During the evolution of the pandemic in Europe, the financial system has received little attention in the media. It was only at the end of February/beginning of March that a very sharp fall in the stock markets made the front page of newspapers and television broadcasts. Indeed, between February 20 and March 9 we saw a collapse in prices of between 23 per cent and 30 per cent, depending on the financial centres. We now know that it is thanks to the intervention of the Fed (Federal Reserve, the central bank of the United States). Today, the support it provides to financial investors is without fail.

On June 12, the Fed lowered the key rates on its loans to 0 per cent and announced the unlimited purchase of treasury bills (1). On June 18, the ECB (European Central Bank) immediately announced that it was lending to eurozone banks1.310 billion euros at a rate of one per cent. In April 2019 I concluded an article for (A l’Encontre thus:

The political question which may arise in one or more European countries, depending on the circumstances, is a new rescue of the banks by the state and the “socialization of losses” at the expense of the workers which goes with it in such cases. (2)

That is where we are now. The economic newspaper Les Echos stresses that for the ECB the amount is a record for a programme called TLTRO (Targeted Long-Term Refinancing Operation):

The offer is particularly incentive. Institutions that have taken out these loans will be charged a negative interest rate. In other words, the ECB will pay the banks to lend to their customers. And the level of this remuneration, -one per cent, is completely unprecedented. For this, banks must maintain their credits to the economy at their level before the explosion of the pandemic. A condition which should be easily fulfilled thanks to the guarantees provided by governments to enable businesses to withstand the crisis.

The stated objective is to strengthen the lending capacity of banks, in particular to SMEs (small and medium sized enterprises), but “several establishments could choose to partially invest these funds borrowed at one per cent in government bonds that offer a positive return, including those of Italy (3). In short, it is a question of restoring the banks’ profitability and their ability to pay dividends to their shareholders.

But things are not that simple. The IMF’s quarterly report on global financial stability, the Global Financial Stability Report , of April 2020 and the article posted online on the blog by IMF economists give on the contrary the idea of an unprecedented situation revealed by the pandemic, of institutions – central banks and the IMF – faced with a new situation of ungovernability and decoupling between the markets and the “ real economy ”, starting with the stock markets . The two major long-term systemic trends discussed in previous articles will help to understand their roots.

The long- term context: an endless financial accumulation and a continuous fall in interest rates

The first is the global movement which has seen global financial assets grow at a rate well above that of global GDP. I have spoken about this in many articles published by A l’Encontre. It results from the specific mechanism of accumulation of money capital/loan capital as opposed to the “real accumulation of capital” which Marx studies in the three chapters (30,31,32) entitled “money-capital and real capital” of Part 5 of Book III of Capital. At the time when Marx studied it, the movement was linked to the economic cycle: part of the capital accumulated by industrial capitalists in the phase of expansion sought during the period of crisis and recession to be valorised as loan capital. He adds somewhat laconically that the accumulation of money capital may be “partly the result of circumstances which accompany it but are quite different from it”. (4)

What was in the nineteenth century a conjunctural fact has become in the case of contemporary capitalism a systemic process, born first of “North-South” imperialist relations, then of institutional mechanisms of transformation of wages into money capital by means of pension systems by capitalization and then fuelled by the issue of securities of private debt, and more and more massively of public debt, in the central capitalist countries. We are in the presence of virtual drawing rights on present and future surplus-value, direct in the case of shares and bonds issued by companies, indirect in the case of public debt securities. They represent capital for those who hold them and expect a return, but are fictitious capital in terms of the movement of capital as a whole. (5)

The McKinsey Global Institute has calculated that stocks measured by market capitalization, private and public debt securities and bank deposits increased from 100 per cent to 200 per cent of global GDP between 1990 and the global economic and financial crisis of 2007-2009.

Figure 1. Growth of global financial assets and world GDP 1990-2010 (left axis and in red global financial assets as a percentage of world GDP; right axis their amount in trillions of dollars at 2011 exchange rates)

Source: McKinsey Global Institute, Financial Globalization, Retreat or Reset? 2013

The McKinsey Global Institute has stopped publishing its estimates. On the other hand, the Visual Capitalist site published figures in May which show that the movement has continued. (6)

Shares, measured by their market capitalization (89.5 trillion dollars) and titles of public and private debt (253.0 trillion dollars, of which 27.4 per cent is state debt) reach a total of 342, 5 trillion dollars, 95.5 thousand in bank deposits (not counting the 35.2 trillion in tight monetary aggregates), that is, a total of 438.2 trillion dollars as against 225 trillion dollars in 2012, an increase of 98 per cent. In addition, 280.6 trillion dollars in real estate assets are to be added.

• The second long-term trend is the continuing fall in interest rates.

Figure 2. United States: Interest rates on ten-year treasury bills at constant prices

Source: Federal Reserve Bank of Saint-Louis Economic Research

The policies (the term ” unorthodox ” which was used for a long time has gradually disappeared from comments) of massive monetary creation and permanent support from banks followed by the Fed and other central banks have contributed to this fall in rates. The studies department of the Natixis group even estimated that they explain two-thirds of the fall in rates from 2009. (7) But the economists of the BIS in Basle insisted that this was not enough to explain the fall, since it had started in 1995. As regards these falling interest rates, it is impossible, they say, to “disentangle what is structural and what is cyclical, and in what is cyclical, the respective importance of monetary and non-monetary factors ” (8) Indeed, the major causes of the long fall in rates on the debt securities markets are to be found in the sharing of productivity gains controlled by the relationship between capital and labour, the skewed effects of technological change and the blocking of the mechanisms of accumulation that they create. The growth of the current and future surplus value of the virtual drawing rights constituting fictitious capital is slowing down. The lack of profitable investment opportunities means that the supply of capital exceeds demand. (9) In response, investors have increased year by year what has been called from the early 2010s their craving for risk (“risk appetite”) and have turned towards the opportunities for micro-profits offered by artificial intelligence.

The advent of big data and algorithms

High frequency transactions (HFT) were the first form of ” automatic trading ” based on statistical decisions managing big data in the financial sphere. These virtual market operators use complex algorithms to analyse several markets simultaneously and execute orders according to their condition. Whereas the HFT transaction speed was still 20 milliseconds in the early 2010s , it increased to 113 microseconds in 2011.

Non-specialists in the financial markets discovered HFT on May 6, 2010. While the European markets had opened slightly down due to concerns coming from Greece, on Wall Street, without warning or apparent reason, the Dow Jones index lost almost 10 per cent in a few minutes. (10) After an investigation, the American regulatory authorities (SEC and CFTC) questioned the technique of buying and selling assets based on algorithms. By studying the so-called “e-mini” contracts of the S&P 500, researchers found that HFT traders made an average profit of 1.92 dollars for each transaction made for large institutional investors and an average of 3.49 dollars for those made by retail investors. (11)

HFT was followed by what is called “robo-investing”, which represented in 2019 according to The Economist (12) 35 per cent of market capitalization on Wall Street, 60 per cent of assets of institutional investors and 60 per cent of purchases and sales of securities on the American markets. This management takes different forms. On the equity markets, the most common is that of the ETF (Exchange Traded Fund). Being programmed to follow the fluctuations of a benchmark index, without seeking to obtain a better performance than the market average, they are called “passive management”. It is in particular in the management of private portfolios that we find fully automated online investment platforms called “robot-advisers”. Funds traded on the Stock Exchange (Exchange Traded Funds) automatically track indices of shares and bonds. In October 2019, these vehicles were managing 4,300 billion dollars of U.S. stocks, exceeding for the first time those managed by human beings. Software called “smart beta” isolates a statistical characteristic – volatility, for example – and focuses on the stocks that present it. As algorithms have proved themselves for stocks and derived products, they are also developing on the debt markets.

Fund managers read reports and meet with companies under strict insider trading and disclosure laws designed to control what is in the public domain and ensure that everyone has equal access. Today, an almost infinite accumulation of new data and the constant rise of algorithms are creating new ways of evaluating investments. They have more up-to-date information on companies than those available to their boards of directors. So far, the rise of computers has democratized finance by reducing costs. A typical ETF charges 0.1 per cent per year, compared to perhaps one per cent for an active fund. You can buy ETFs on your phone. An ongoing price war means that the cost of transactions has collapsed and that markets are on the whole more liquid than ever before. (13)

The Economist wonders whether ETFs are a threat to financial sustainability. (14)

Computers can distort the prices of assets, since many algorithms target at the same time titles having a given characteristic, then suddenly abandon them. Regulators fear that liquidity will evaporate as the markets fall. That is to forget that humans are perfectly capable of causing damage themselves and that computers can help manage risks. Nevertheless, a series of “flash-crashes” and bizarre incidents have occurred, including a crash of the British pound in October 2016 and a fall in debt prices in December 2018. These incidents could become more serious and frequent as computers become more powerful.

The current state of the global financial system

In April, the IMF published its first quarterly report, the Global Financial Stability Report of 2020. The director of the Department of Money and Capital Markets published the main lines of the June report on his blog prior to its publication. (15) It recalls that although the financial system came to the attention of the general public only at the beginning of March, the situation was very tense for weeks. Thus:

In mid-February, when investors began to fear that the epidemic would turn into a global pandemic, stock prices fell sharply from the excessive levels they had reached. In credit markets, credit spreads soared, particularly in risky segments such as high-yield bonds, leveraged loans and private debt, issuance of which practically stopped. Oil prices plummeted due to weaker global demand and the lack of agreement among OPEC + countries on production cuts, further reducing the appetite for risk. Volatility in the markets led to a flight to quality assets and the yield on bonds where investors had taken refuge dropped abruptly. (16)

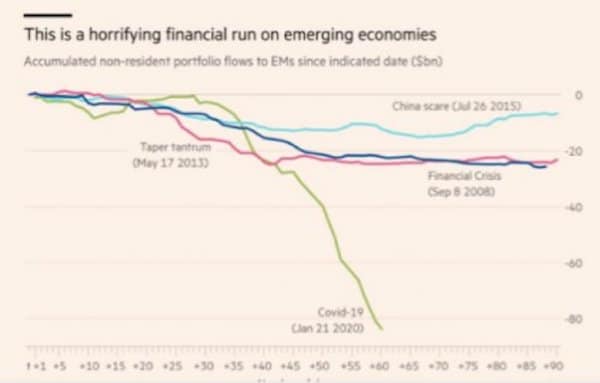

The emerging countries have experienced enormous capital flight.

Figure 3. Emerging countries: an enormous flight of capital

Source: Financial Times

This involved mainly very vulnerable African countries, which experienced the largest reversal of portfolio investment flows ever recorded by emerging countries, both in dollar amounts and as a percentage of their GDP. The speed with which speculative capital moved reflected the fear of speculative funds confronted with the situation.

The FMI is pleased that “the central banks, on the whole, have mobilized to prevent the health crisis from turning into a financial hurricane. Whether by lowering their interest rates, by extending their programme of buying financial assets, by setting up currency swap lines between them or by granting credit facilities and liquidity”. The configuration that mainstream economists describe by the counter-intuitive term “moral hazard “when an entity (in this case a bank or a pension fund) is induced to increase its exposure to risk because it knows that it will not bear all the costs goes back to the doctrine of “too big to fail”. This doctrine was applied to the rescue of the Continental Illinois National Bank in 1983 (17) and has not stopped expanding since, the Lehmann Brothers bank being the only exception in September 2008. The IMF recognizes that in 2020 moral hazard was widespread and warned:

The unprecedented use of unconventional tools has undoubtedly cushioned the blow to the world economy by the pandemic and reduces the immediate danger to the global financial system, its intended goal. However, policymakers should be alert to unintended consequences, such as the continued increase in financial vulnerabilities in an environment of easy financial conditions. The fact of expecting continued support from central banks could turn the valuations of already stretched assets into vulnerabilities, particularly in a context where financial systems and the private sector exhausted their reserves during the pandemic.

Central banks have come to the aid of banks, pension funds and other investors to such an extent that, since the fall in late February, the price of risk assets has rebounded, starting with that of shares. The stock markets are experiencing an unprecedented decoupling between price developments and the reality of economic activity, marked by the fall in GDP and the rapid rise in unemployment. Witness the surge in U.S. stock market indices and the fall in consumer confidence, two indicators that have historically evolved together,

which raises questions about the sustainability of the rebound if not for the boost from the central bank. (18)

Figure 4. United States: The paths separate, the stock markets and the state of trust are no longer synchronized

The decoupling between the economic situation and the level of shares applies to other countries. Thus, in France, while GDP has already fallen by 8 per cent and unemployment has reached its highest level since 1996, with the destruction of 500,000 jobs in May, the CAC 40 rebounded by 3,755 points on March 18 to 5,198 points on June 6, a recovery of 864 points compared to February 20.

The IMF’s treatment of climate change

There is a chapter in the April report that has nothing to do with the pandemic. It is devoted to climate change. (19) Written at the request of the Network for Greening the Financial System. (20) It dramatically shows the IMF’s concern for investors. I will therefore quote it at length. The IMF notes that, in light of “climate trends, the financial stability authorities fear that the financial system is not prepared to face this potentially significant increase in physical risk, as well as the risk of transition due to political, technological, legal and market changes that will occur during the transition to a low carbon economy”. And to continue, “first of all, a climate risk can turn into a disaster if it occurs in an area where exposure is great and vulnerability is high. Such a disaster affects households, non-financial businesses and the public sector through the loss of physical and human capital, thereby causing economic disruption which can be significant. Companies in the financial sector are exposed to these shocks through their underwriting activities (insurers), their lending activities (mainly banks) and the portfolios of affected securities (all financial companies).

For their part, financial institutions could also be exposed to operational risks (where their structures, systems and staff are directly affected by an event) or a liquidity risk (if disaster triggers a significant withdrawal of customer deposits). Insurers play a special role in absorbing shocks. The provision of insurance concentrates the impact of the shock on the insurance sector and reduces the impact on other economic agents. Governments generally play an important cushioning role by providing certain forms of insurance, as well as disaster relief and support. The pressure on government balance sheets after a disaster could have an impact on financial stability, given the close links between governments and banks in many economies. (….) Large-scale disasters could expose financial institutions to market risk if they lead to a sharp drop in share prices due to the widespread destruction of assets and the production capacity of companies or a fall in the demand for their products”.

Ungovernability of part of the global financial system and markets “uncorrelated”

The article posted on the IMF blog makes the admission, surprising by its frankness, of a “governance system entangled in its contradictions”. Indeed, if “the banks have had imposed on them through the international agreement known as Basel III liquidity ratios , capital requirements and even a start to control over their leveraged loans, this has moved the market for leveraged loans to the unregulated sector, made CLOs (Collateralized loan obligations) flourish and boosted the turnover of highly speculative investment funds. The boundaries of the parallel financial system (that of shadow banking) are even more difficult to trace today than in 2008.

Chapter 2 of the Global Financial Report describes as well as it can “the financial ecosystem of high-risk credit markets lending to companies where the role of non-bank financial institutions has increased and the system has become more complex and opaquer. To give a flavour of the report, here is the first subtitle: “Rapid Growth of Risky Credit has Raised Red Flags”. Potential vulnerabilities include “lower credit quality of borrowers, more flexible underwriting standards, liquidity risks in investment funds and increased interconnection”. If banks have become safer, we do not know the links that institutional investors maintain with the banking sector and could inflict losses on it in the event of market disruptions. Central banks have “few instruments to deal with credit and liquidity risks in global capital markets”, while “risk appetite has even spread to emerging markets. Aggregate portfolio outflows have stabilized and some countries have again experienced modest inflows”.

The conclusion belongs to the World Economic Outlook (WEO) published in early July. We can read there that “according to new projections, world GDP should contract by 4.9 per cent in 2020, that is to say by 1.9 percentage points more than what was forecast in the WEOs of April 2020. The COVID-19 pandemic had a greater than expected negative impact on activity in the first half of 2020, and the recovery is expected to be slower than expected. In 2021, global growth is expected to reach 5.4 per cent. Overall, 2021 GDP should therefore be around 6.5 percentage points below the level envisaged by the projections established in January 2020, before the COVID-19 pandemic. The negative impact on low-income households is particularly severe, and could undermine the considerable progress that has been made in reducing extreme poverty in the world since the 1990s”. And to drive the point home:

The scale of the recent upturn in the financial markets seems uncorrelated with the evolution of economic perspectives, as indicated in the update of the Report on financial stability in the world (RFSW). (21)

Notes:

- www.federalreserve.gov

- alencontre.org

- www.lesechos.fr

- Capital Vol. III Part V Division of Profit into Interest and Profit of Enterprise. Interest-Bearing Capital Chapter 32. Money Capital and Real Capital. III.

- For a longer presentation, I refer to my article of April 26, 2019. alencontre.org

- www.visualcapitalist.com

- www.capital.fr

- Peter Hördahl , Jhuvesh Sobrun and Philip Turner, Low long-term interest rates as a global phenomenon, BIS Working paper n ° 574, August 2016.

- This use of supply and demand is theoretically legitimate. Capital Vol. III Part V Division of Profit into Interest and Profit of Enterprise. Interest-Bearing Capital Chapter 22. Division of Profit. Rate of Interest. Natural Rate of Interest., Marx writes that “We have seen that interest-bearing capital, although a category which differs absolutely from a commodity, becomes a commodity sui generis, so that interest becomes its price, fixed at all times by supply and demand like the market-price of an ordinary commodity. The market rate of interest, while fluctuating continually, appears therefore at any given moment just as constantly fixed and uniform as the market-price of a commodity prevailing in each individual case.(… ..) The general rate of profit, therefore, derives actually from causes far different and far more complicated than the market rate of interest, which is directly and immediately determined by the proportion between supply and demand”. Rates can only go down.

- en.wikipedia.org

- sevenpillarsinstitute.org March 13, 2020.

- www.economist.com

- See investorjunkie.com and the list of best rated: www.investopedia.com

- www.economist.com

- blogs.imf.org

- Executive summary www.imf.org

- en.wikipedia.org

- blogs.imf.org

- www.imf.org, chapter 5.

- The Network for Greening the Financial System is a group of central banks and supervisory authorities. By consulting the Internet, one realizes that the Bundesbank and the Banque de France present it in a very different way. For the former, the group has expressed concern that the financial risks linked to climate change are not fully reflected in asset valuations and has called for integrating these risks into the monitoring of financial stability (www.bundesbank.de). For the latter, the group’s objective is to help strengthen the global response necessary to achieve the objectives of the Paris Agreement and to strengthen the role of the financial system to manage risks and mobilize capital for green investments and to low carbon emission in the wider context of ecologically sustainable development. (www.banque-france.fr).

- www.imf.org