What impact will the war in Ukraine have on India’s economy? To understand this, we need to look at the state of the economy before the war.

It is already clear that India’s rulers will ascribe all the adverse developments of the coming period to the Ukraine war, an “act of God”, as it were. That provides them a ready alibi, and diverts from the already alarming condition of the people before the impact of the war. Indeed, as we shall see in an article to appear later on this blog, a sort of economic war has been underway in India, with countless victims, yet it is shrouded by a remarkable silence. The principal responsibility for the suffering of the people thus cannot be shoved onto world events; it lies principally with India’s rulers themselves, who have led the country into the present abyss.

Further, the rulers have started imposing burdens on the people in the name of the fall-outs of the war (now that the elections to five state assemblies are over). The Finance Minister declared in Parliament: “People have been asking, how can you raise the fuel price?… [The timing of the price hikes] has nothing to do with elections… This war which is happening in Ukraine, the impact of that is on all countries, supply chains are disrupted, particularly of crude oil.”1

Here we argue the following:

1. People had already suffered a steep rise in the prices of petroleum products in the last two years, in part because the Government raised excise taxes on them in 2020. This the Government did in order to compensate for its sharp reduction of corporate taxes in 2019, thus shifting the burden from the corporate sector to the common people.

2. Current inflation is not being driven by excess demand; quite the reverse, demand is depressed. Nor is inflation being driven by a cost-push from wages or from most agricultural prices. In fact, real wages of rural workers (and probably most other workers as well) have gone down in the past year, and terms of trade for most farmers have been deteriorating. Meanwhile the large corporate sector, taking advantage of reduced competition from a now-devastated small and medium sector, is able to pass on increased costs to customers.

In these conditions, trying to control prices by depressing demand will only further depress employment without tackling prices. In order to check the current price rise, people should struggle for a drastic reduction in petroleum taxes, as well as for other direct measures of price control and public provisioning.

3. International fertiliser prices too have been rising over the last year. But the Government failed to act in time to ensure adequate supplies. Farmers were driven to buy fertiliser at exorbitant prices on the black market. This year, despite knowing that domestic stocks are low and that the price of imported fertilisers is set to rise, the Government has cut the provision for fertiliser subsidy in the Budget. The mismanagement of fertiliser supplies may already have had a negative effect on the current wheat crop, and portends graver effects in the coming year.

4. Edible oil prices too have risen over the last year. Due to State policy, India has developed a heavy dependence on imports of edible oil over the post-liberalisation years, which leaves it helpless when external developments raise import prices of edible oils. What is required is a system of promotion and large-scale public procurement of edible oilseeds, and distribution of edible oil through the public distribution system (PDS). While the former will take time to implement, people should immediately struggle for the latter, i.e., provision of edible oil at controlled prices through the PDS.

5. Using the excuse of ‘excess’ buffer stocks and high international prices of wheat, the Government is reducing its wheat procurement target and pushing for large-scale exports. But India is not a land of surplus foodgrain. On the contrary, India has the largest number of undernourished people in the world. The Food Corporation of India and the PDS were the sole barrier that prevented an even greater catastrophe during the Covid-19 lockdowns. The current so-called ‘excess’ supply is due to a lack of purchasing power with large masses of people, and the failure to distribute more grain where it is nutritionally needed. Moreover, the ‘excess’ stock is falling, and wheat prices have been rising as wheat exports have risen in the past six months. The export of wheat must be opposed.

6. The gravest impact may be triggered by the developments in the external sector. India has built up massive foreign exchange reserves as a defence against an external crisis, but it has done so by building up even larger external liabilities, a large part of which can be withdrawn at will by foreigners. The deficit on the current account (the broadest measure of external earnings and payments) is growing, and may cause foreign investors to become more cautious. Any withdrawal may cause the rupee to weaken, which will raise import costs and thus further fuel price rise; and it may also cause financial instability. In order to prevent such a withdrawal, the Government has already announced its intention to hike interest rates. But this will further depress the already depressed economic activity in the country. This vulnerability to volatile capital flows has been built up by successive regimes, including the current ‘Atmanirbhar’ regime.

There has already been a depression in India, the scale of which is hidden only by the fact that it is concentrated in the informal sector, about which scant data are gathered. The cumulative effect of rising prices and attempts by the Government to prevent capital outflows would be an even deeper depression.

Two main channels

The International Monetary Fund (IMF) blog warned2 in March that the Ukraine war may affect countries worldwide through two main channels, namely, price rise and capital outflows:

(1) “One, higher prices for commodities like food and energy will push up inflation further, in turn eroding the value of incomes and weighing on demand.” As people restrict their consumption to essentials, demand for a whole range of goods gets curtailed–much as we saw in India during the Covid-19 lockdown. In turn, workers producing those goods receive less income or lose their employment altogether. All this can make economies spiral downward into a recession.

(2) Secondly, “reduced business confidence and higher investor uncertainty will weigh on asset prices, tightening financial conditions and potentially spurring capital outflows from emerging markets…” In conditions of greater uncertainty, global financial investors tend to return to so-called ‘safe havens’, i.e., the world’s dominant countries, in particular the U.S.. As they pull out their investments, the rupee’s value falls, interest rates are raised, funds become scarce, and a whole series of other consequences are triggered.

However, both these developments–price rise and increased volatility of capital flows–were under way in India well before the Ukraine war, for reasons that can be traced to the Indian government’s policies. And to the extent these problems intensify in the coming period, the main responsibility cannot be placed on a distant war: rather, it lies at the door of those existing policies. Let us look at these questions in turn.

Petroleum products

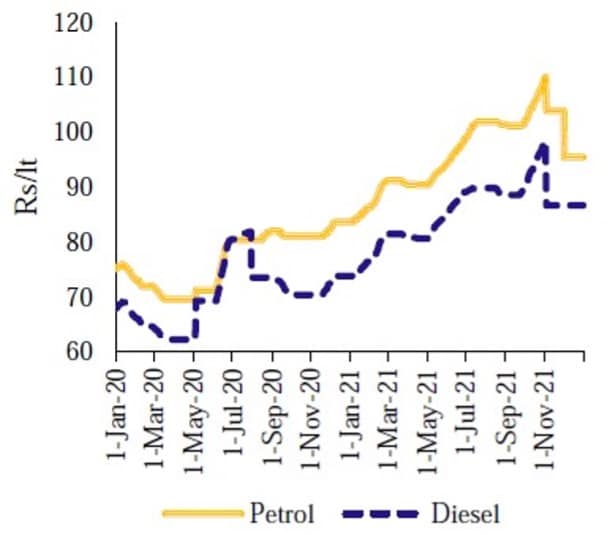

The rise in the international prices of crude oil and natural gas did not start with the Ukraine war; rather, after hitting a low of $21/barrel in April 2020, these prices rose steadily, to hit $81/barrel in October 2021. But what is particularly relevant to us is that, in 2020, the Indian government steeply increased the taxes on petroleum products, and kept them high even as international prices rose. As can be seen from the chart below, the price rise in petrol and diesel was raging long before most people in India had heard of Ukraine.

Retail Selling Price of Petrol and Diesel in Delhi

In the last quarter of 2021, in preparation for state assembly elections, excise duties on petroleum products were reduced. This is reflected in the dip in the chart above. Nevertheless they remain very large (Rs 27.90/litre on petrol, and Rs 21.80/litre on diesel as on April 1, 2022). At present taxes make up more than 47 per cent of the price of petrol in Delhi, and more than 41 per cent of the price of diesel.3 The burden of these taxes is particularly heavy for Indians, as incomes here are so low. Petroleum products in India are thus among the most unaffordable in the world (i.e., they take a larger bite out of the income of most people), and certainly among all G-20 countries.4

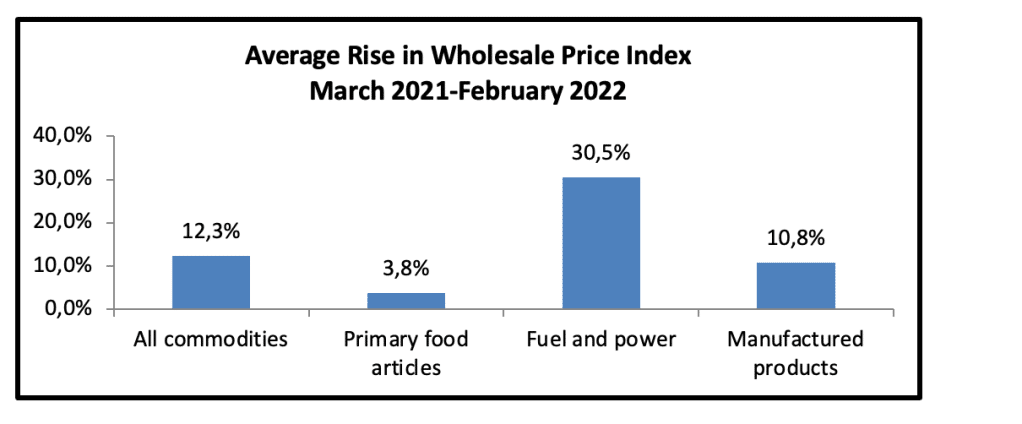

The taxes on petroleum products are an extraordinary extraction from the poorest sections of the people, since they raise the prices of all goods. In 2021-22, retail inflation was driven by two groups of commodities, ‘fuel and light’ and ‘miscellaneous’. And inflation in the ‘miscellaneous’ group of commodities, as the Economic Survey 2021-22 notes, was largely on account of high inflation in the subgroup ‘transport and communication’, which in turn was partly driven by rising fuel prices. Moreover, the higher prices of fuel add to the production and transport costs of all other goods. In other words, inflation in 2021-22 could have been checked by simply reducing excise on petroleum products.

Class nature of current inflation

The Reserve Bank’s recent Monetary Policy Report (April 8) says that the inflationary pressures in the second half of the year “can be attributed mainly to adverse cost-push factors, coming from supply-side shocks in food and fuel prices, even as weak aggregate demand conditions continued to exert downward pressure on inflation”.5 What does this mean, in plain English? We can think of inflation as caused by either a rise in demand (pulling up prices), or a rise in production costs (pushing up prices). What do the data indicate?

— In the past year, there was no demand-pull. Consumer demand remained depressed: per capita private consumption expenditure in 2021-22 is estimated to be 5 per cent below the level of two years earlier.

— At the same time, there was no cost-push from wages. Real wage levels of rural labourers actually fell, according to Government surveys; since construction and other manual workers in the informal sector are drawn from this rural pool, their wages too would have stagnated at best. In the organised sector, labour’s share in total production costs have been falling in recent months, for both manufacturing and services. In manufacturing, they are now 5.3 per cent of production costs, well below any time in the last three years.6

— Further, there was no cost-push from most crop prices. Wholesale agricultural prices were depressed, even as prices of fuel and manufactured goods rose steeply.

— Meanwhile, the corporate sector as a whole was largely able to pass on its increased costs to consumers. In the quarter ending December 2021, the value of sales by non-financial listed companies grew 30.9 per cent over the corresponding quarter of the previous year. But real sales, i.e., after adjusting for increased prices, grew by only 7.1 per cent.7

— The corporate sector found it easier to pass on its costs to consumers because small and medium-sized competitors have been devastated by a series of blows: the pre-lockdown depression, the lockdowns, the deeper post-lockdown depression, and the current rise in input prices. The market research firm Nielsen reports that 14 per cent of small manufacturers in the fast-moving consumer goods (FMCG) category exited the business between September 2020 and September 2021, continuing a trend witnessed over the past few years. Almost all the growth in the market was captured by large firms.8

These facts bring out the class nature of the current inflation. We will return to this question in a later piece

Given that the Central Government has extracted huge revenues through taxes on crude oil and petroleum products (Rs 4.2 lakh crore in 2020-21 alone), and given that the corporate sector has earned a bonanza in profits in the last year, it can certainly absorb the recent rise in international prices without hiking domestic prices. But instead, on the excuse of the Ukraine war, the Indian government is continuing to impose burdens on the people: a sharp hike in diesel for bulk buyers (e.g., public transport), nearly daily hikes in petrol and diesel prices, steep hikes in natural gas prices.

The Indian government may instead decide to absorb part of the international price increase. But in that case, it is likely to slash other expenditures in its Budget for 2022-23, so as to remain within its fiscal deficit target. Which expenditures might it choose for the axe?

The Budget for 2022-23 gives us an idea of the Government’s priorities. It reduced real expenditure on a range of welfare and employment expenditures such as rural employment (MGNREGS), food subsidy (PDS), rural development, and public health. All this was done in order to spend more on infrastructure, with the visible aim of boosting corporate growth, or at least corporate profits.

2. Fertiliser:

The war in Ukraine directly affects fertiliser supplies. India imports phosphatic fertiliser from Russia and the Belarus. Natural gas is a feedstock for production of urea fertilisers, and Russia is a major supplier of natural gas. India is the world’s biggest buyer of urea and diammonium phosphate (DAP), and depends on imports for a third of its fertiliser supplies. In the liberalisation era, India has grown increasingly dependent on imports of fertiliser, even for urea (for which we have the raw materials, unlike in the case of phosphatic and potassium-based fertilisers). Thus a prolonged war in Ukraine will certainly create a shortage of fertiliser here.

However, the problem predates the Ukraine war: fertiliser prices had already nearly doubled on the international market over the past year. As economies recovered from the Covid-period downturn, the prices of a range of commodities, including coal, natural gas, and phosphates, rose. Fertiliser-producing countries prioritised domestic requirements over export, with China and Russia banning the export of fertilisers.

Table: Fertiliser Prices on the International Market ($/metric tonne)

| Jan-Mar 2021 (avge) | Oct-Dec 2021 (avge) | Feb 2022 | |

| DAP | 494.8 | 714.9 | 747.1 |

| Phosphate rock | 89.8 | 159.1 | 172.5 |

| Potassium chloride | 202.5 | 221 | 391.8 |

| Triple Super Phosphate | 416.5 | 656.6 | 687.5 |

| Urea, E. Europe | 317.6 | 828.5 | 744.2 |

Source: World Bank Commodities Price Data, March 2, 2022

While fertilisers are officially subsidised in India, only the prices of urea fertilisers are fixed by the Government. Non-urea fertilisers receive a fixed amount of subsidy per tonne (of the specific nutrient), but the price is set by companies by ensuring a profitable mark-up over their costs; when their import costs rise, they pass on the higher costs to consumers. If the Government wishes the retail price of non-urea fertilisers to remain the same, it has to increase the subsidy per tonne.

In the second half of 2021, as fertiliser prices rose, the Government, anxious about the upcoming assembly elections in several states, appears to have pressurised fertiliser companies not to raise the prices of non-urea fertilisers. However, it failed to raise the subsidy amount. As a result, firms did not find it profitable to make imports in time for the rabi crop (DAP application for the rabi crop starts at the time of sowing, in October), and then raised retail prices of fertiliser sharply.

When the Government finally (on October 12) raised the subsidy on non-urea fertilisers, it was too late, and a massive shortage emerged. The Indian Express reported that “all-India stocks of DAP and muriate of potash on September 30 [2021] were less than half the year-ago levels, even as international prices of fertilisers and inputs have surged to their highest since 2008-09.”9

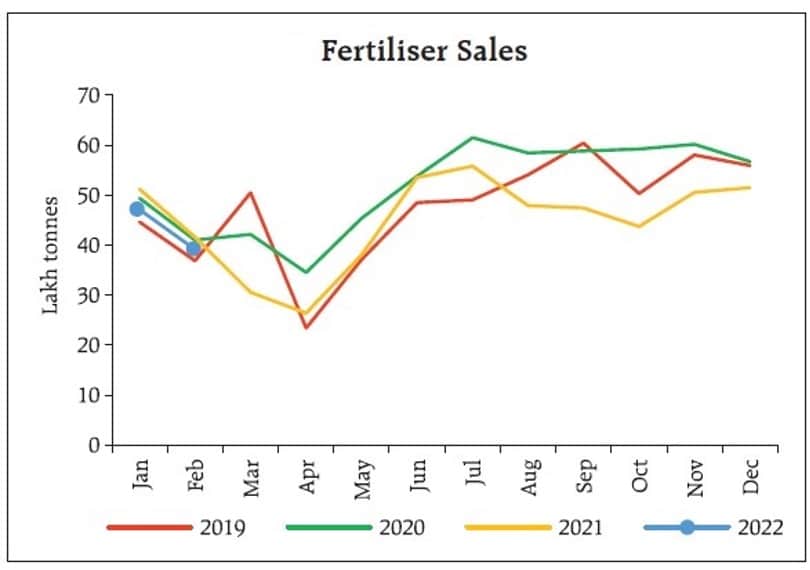

Desperate Indian farmers ran from pillar to post to obtain supplies, and at many places near-riots took place. They were compelled to buy fertilisers at exorbitant prices on the black market, where the premium was reportedly 25 per cent on DAP and 50 per cent on urea.10 This took place even as the prices of other inputs, in particular diesel, rose sharply. Farmers, particularly small and marginal farmers, were compelled to cut back on fertiliser use.

Thus, as we can see from the chart below, fertiliser sales were considerably below the figures for the previous two years, and this trend continued into January-February 2022, as fertiliser traders reduced their stocks and imports fell.11 The Government bears the responsibility for this setback.

Moreover, India’s own urea production will also be affected by the rising prices of natural gas. India depends on imports of liquefied natural gas (LNG) for most of its feedstock requirements for urea production, and it buys about half of this, not on long-term contracts, but at spot market prices. LNG prices have risen steeply over the last year. This means that, in order to keep consumer prices of urea at the same level, the subsidy from the Government to the manufacturers would have to rise.

Despite this background, the 2022-23 Budget cut the provision for fertiliser subsidy by 25 per cent over the Revised Estimates of the previous year.

Fertiliser Subsidy, 2021-22 and 2022-23

| 2021-22 (RE) | 2022-23 (BE) | |

| Urea subsidy | 75930 | 63222 |

| Nutrient-based subsidy | 64192 | 42000 |

| Total | 140122 | 105222 |

RE = Revised Estimates. BE = Budget Estimates

Source: Union Budget 2022-23.

If the Government chooses now to increase subsidies on fertiliser in order to keep domestic prices from rising, it would very likely cut some head of welfare expenditure, for the reason mentioned above.

3. Edible oil:

Ukraine is the main source of India’s imports of sunflower oil, so the war will hit supplies. India is the world’s number one importer of edible oils, and is dependent on imports for 60 per cent of its consumption (with palm oils constituting 60 per cent of edible oil imports). Hence it is particularly vulnerable to international price fluctuations due to developments outside its control, such as Indonesia’s decision last year to reduce its palm oil exports.

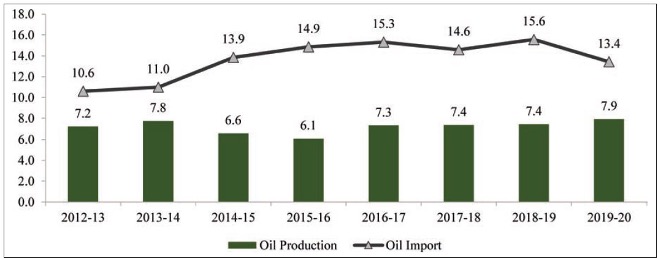

India’s Production and Import of Edible Oil (million tonnes)

Over the last two years, prices of ‘oils and fats’ have risen steeply in India; in 2020-21, they rose 16 per cent, and in April-December 2021, 31 per cent over the corresponding period of the previous year. Oil and fats accounted for around 60 per cent of inflation in ‘food and beverages’. Evidently, India is paying a steep price for its import dependence in edible oils, which got entrenched in the post-1994 period (i.e. after it joined the World Trade Organisation and dismantled a successful programme for promotion of domestic oilseed production).

The Government has attempted to keep edible oil prices under control by reducing import duties: from October 2021 to February 2022, the effective import duty on three major imported crude edible oils, namely, palm oil, soyabean oil and sunflower oil, was reduced by 19.25 percentage points. However, given that the problem is the large gap between demand and domestic supply of edible oilseeds, the solution to the problem is not reduction in import duties. Rather, the solution is a comprehensive programme of promotion of oilseeds, including through assured public procurement at remunerative prices, and supply of edible oil in the public distribution system.

The Government no doubt has made some attempts to promote improved seeds, and it does announce a Minimum Support Price (MSP) for various oilseeds, but its procurement operations are small, and oilseeds are routinely sold at much below MSP (as acknowledged in official reports). When market prices of edible oil rise sharply, as they have done in the last two years, the market prices of oilseeds too rise, and farmers bring more acreage under oilseeds for a short while, but they frequently experience sharp drops in price by the time the crop is marketed. At any rate, growth is too slow to meet demand: oilseed production grew just 10 per cent between 2013-14 and 2020-21.

Note that, compared to edible oil, the market prices of rice and wheat have been relatively steady, since producers have benefited from public procurement and consumers have benefited from public distribution. If India is to overcome its massive dependence on imports for this essential item of mass consumption, it must expand, not dismantle, its public procurement and distribution system beyond rice and wheat.

4. Wheat exports: On one count, however, the authorities and the media are celebrating the Ukraine war: They believe it will open up a grand opportunity for India to make wheat exports.

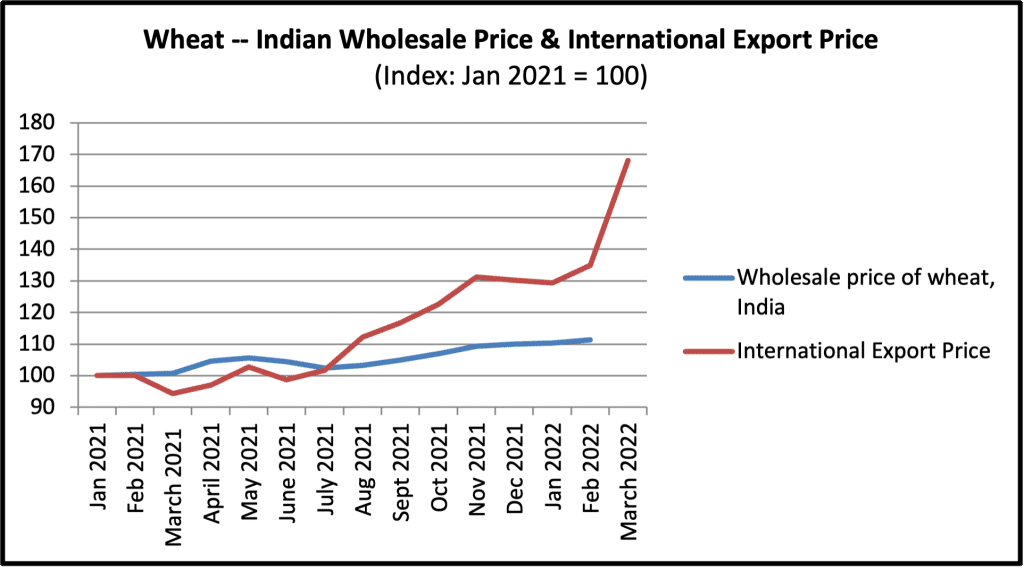

Russia and Ukraine are both major wheat exporters, accounting for a quarter of international trade in wheat. As a result the war there has already led to a steep hike in international wheat prices. And this, on the back of a rise in wheat prices in the second half of 2021.

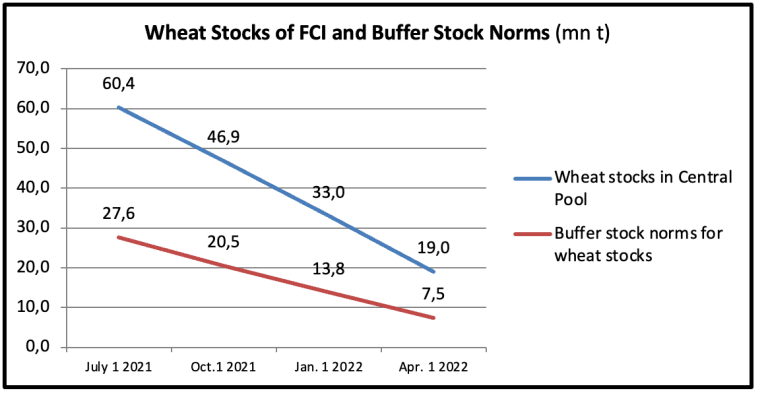

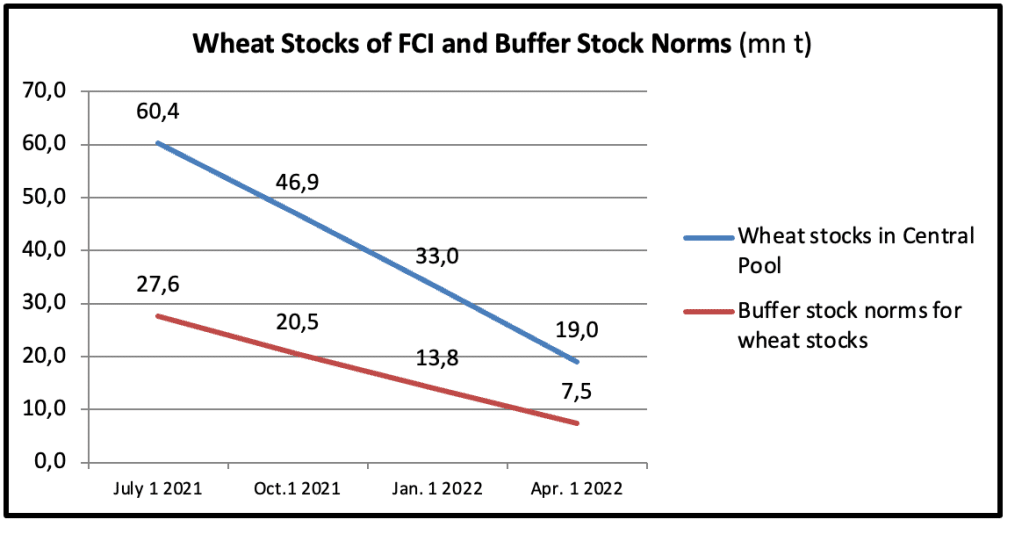

India, on the other hand, has large public stocks with the Food Corporation of India (FCI): the FCI held 19 million tonnes (mt) of wheat on April 1, 2022, or 255 per cent of the norm for buffer stocks on that date.12 Moreover, the Government announced a wheat procurement target of 44.4 mt in the current season.

As international wheat prices began to rise in the latter part of 2021, private traders in India seized the opportunity. Wheat exports reached 7.85 mt in 2021-22, a record for India. Demand in the coming year appears even more promising: the target of 10 mt may be outstripped by 5mt. Private traders are reportedly buying up wheat from farmers in Madhya Pradesh at above the Minimum Support Price.

The FCI is not allowed to directly export wheat from its stocks, as that would come up against opposition from other wheat exporters in the World Trade Organisation (who would claim that India is subsidising its exports). Instead, the Government is simply procuring less, and allowing private traders to purchase the remainder. At present the Government has reduced its procurement target by 10 mt, but it may go even lower. The Government welcomes the surge in wheat exports. The media too have embraced it, with headlines such as “India acts to seize gap in wheat export market”, “India looks to fill wheat granaries depleted by Ukraine war in many countries”, “MP might lower mandi tax to facilitate wheat exports from the state”, and so on.

The assumption behind this policy is that India is a ‘foodgrain-surplus’ country, similar to the U.S. or Australia. This is false. In fact, India has, according to the UN’s Food and Agricultural Organization (FAO), the largest number of undernourished people in the world.13 Within India, official sample surveys14 show a wide range of calorie intake. The poorest 5 per cent in the rural and urban areas consume a little over 1600 calories per day, on the average; calorie consumption rises steadily with each income group–with the richest 5 per cent in both rural and urban areas consuming over 3200 calories per day. About three-fourths of the rural population and half the urban population do not meet the minimum norms for calorie intake used by the erstwhile Planning Commission in the Eleventh Five-Year Plan (2007-12) for rural and urban areas (2400 and 2100 calories, respectively, per person per day).

The importance of cereals in the diets of the great majority of working people can be seen from a few facts. First, food accounts for 53 per cent of consumer expenditure in the rural areas, and 43 per cent in the urban areas. Cereals account for only 11 per cent (rural) and 7 per cent (urban) of consumer expenditure, but provide 57 per cent and 48 per cent of calories, respectively. The poorer the consumer, the higher the share of calories provided by cereals: thus the poorest garner 70 per cent (rural) and 66 per cent (urban) of their calories from cereals.

Moreover, protein intake is heavily dependent on cereal intake. Cereals account for 58 per cent (rural) and 49 per cent (urban) of protein intake, and here, too, the poor derive a much higher proportion of their meagre proteins from cereals.

Even though the better-off consume more of other foods, they also consume more cereals than the poor do. If the poor were better-off, they would not only consume more pulses, vegetables, milk, eggs, fish and meat, but also more cereals. The reason that stocks of cereal with the Food Corporation of India are so large is not because they are ‘surplus’ in terms of people’s nutritional needs, but because people lack the purchasing power to obtain them.

The critical role of the cereal stocks with the FCI was underlined during the pandemic lockdown. Dreze and Somanchi15 conclude from a careful study of 76 household surveys that “there is overwhelming evidence that the national lockdown of April-May 2020 was associated with a tremendous food crisis. Large numbers of people struggled to feed their families, and food intake dipped in both qualitative and quantitative terms for a majority of the population.” Where other relief measures by the Government were patchy and inadequate, “A large majority of the population had access to the PDS in 2020 (with enhanced monthly rations for 8 months), and this played a critical role in averting the worst.”

Under the Pradhan Mantri Garib Kalyan Anna Yojana (PMGKAY), existing ration card holders could obtain an extra 5 kg grain per person per month, free of cost–in other words, the barrier of purchasing power was removed. As a result, total wheat offtake rose from 27 mn t in 2020-21 to 36 mn t in 2020-21 and further to 47 mn t in the first 11 months of 2021-22.16 With this, excess wheat stocks with the FCI have steadily fallen through the year; from 33 mn t in July 2021, they have fallen to 12 mn t in April 2022.17 Further, the Government has extended the PMGKAY for another six months, till September 2022.

The RBI notes that the sudden sharp rise in wheat exports since September 2021 has already led to a sharp rise in domestic wheat prices (albeit much less steep than international prices). Significantly, it fears that “international prices could set a floor for domestic wheat prices through the export channel”.18 Fast-moving consumer goods (FMCG) companies have been repeatedly marking up their processed foods prices. Despite the FCI’s grain stocks and a bumper crop, wheat prices may rise further in coming days. Given that other commodities too are witnessing price rise at present, the export-fueled rise in wheat prices will impose an unbearable burden on consumers, who have already reduced their consumption.

It is most important to be alert to a possible plan on the Government’s part to kill two birds with a single stone. The recent peasant struggle against the Farm Acts forced the Government to temporarily retreat from dismantling the entire regime of public procurement and distribution. Peasants recognised that they would lose under a regime where giant agribusinesses would call the shots, and preferred the security of public procurement at the official Minimum Support Price (MSP). Now international prices have risen steeply, and private traders are buying up the wheat crop at above MSP. This provides an opportunity to the Government to proclaim that the ‘free market’, including free external trade, benefits farmers. Simultaneously, it has a chance to reduce public procurement. Thus, the very system which prevented an even greater catastrophe during the recent pandemic lockdowns and consequent depression may be surreptitiously brought under attack once again.

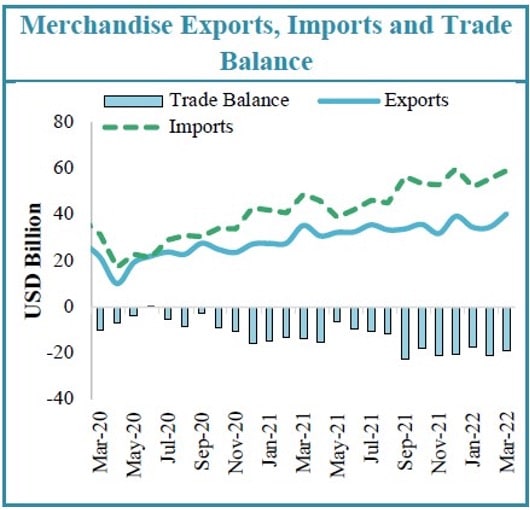

5. Trade deficit and current account deficit: As the world economy slows–due to various disruptions, price rise and uncertainties–demand for India’s exports too will slow. India’s merchandise exports have grown rapidly during 2021-22, after a decade of stagnating at the same level. However, export growth had already started slowing in recent months.

Even as India’s exports have grown, its imports have been growing more rapidly, leading to a growing merchandise trade deficit. (Among the factors contributing to this is a surge in gold imports, to $33 billion in April-November 2021.) All this happened long before the Ukraine crisis. The trade deficit jumped $90 billion, from $102 billion in 2020-21 to $192 billion in 2021-22–a record high.

The deficit on the current account–a broader measure, which includes earnings and expenditures on not only merchandise but also services and investments–has been growing rapidly. The current account balance has deteriorated in 2021-22 from a surplus of over $6 billion in the first quarter to a deficit of $23 billion, or 2.7 per cent of GDP, in the third quarter. The deficit is likely to grow further in coming months. The U.S. investment bank Morgan Stanley forecasts that India’s current account deficit (CAD) will be 3 per cent in 2022-23.

When a country runs a deficit on the current account, it must balance it with a surplus on the capital account. In other words, when it spends more than it earns, it must balance this with inflows of capital–that is, foreign investment, foreign loans, or foreign grants, or a drawing down of its foreign exchange reserves. Among such flows of foreign investment are foreign investment in India’s share markets.

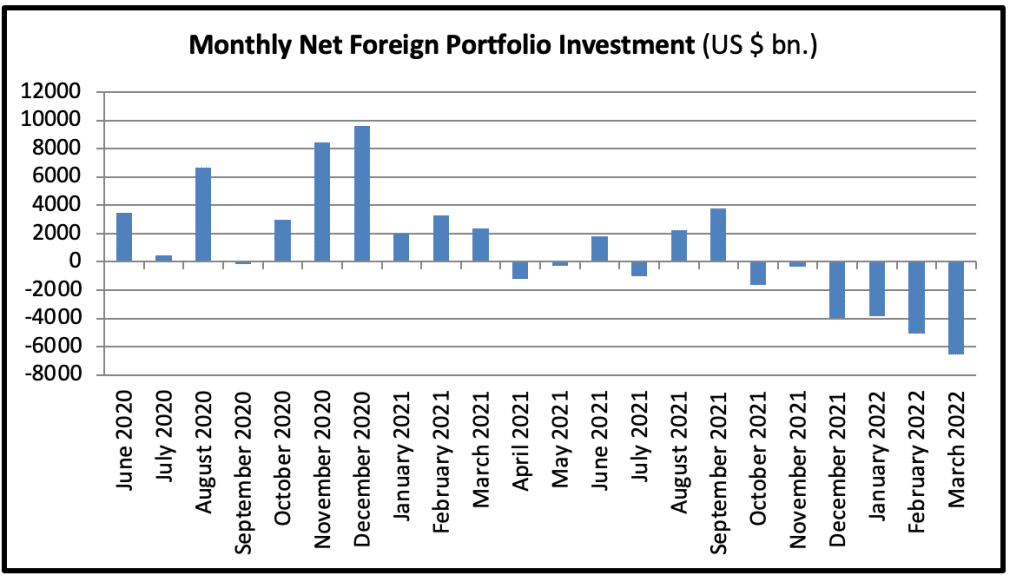

6. Outflow of foreign investment: Between October 2021 and March-end 2022, foreign portfolio investors (FPIs) in India’s stockmarket kept pulling out investments. This was not on account of any imminent crisis in India. Rather, they anticipated that the U.S. central bank (the Federal Reserve) would hike interest rates in the U.S., and also tighten the supply of funds.

Much foreign portfolio investment had come to India precisely because interest rates in the U.S. were near-zero, and in addition the U.S. Federal Reserve had taken special measures to ensure an overabundance of funds available for borrowing. Provided such a sea of money, international speculators pumped a portion into ‘risky’ Third World markets like India. From June 2020, there was a flood of foreign investment in the share market, and share prices soared.

The Indian authorities and the media touted this as foreigners’ vote of confidence in the long-term prospects of the Indian economy. The Economic Survey 2020-21 termed it “an endorsement of India’s status as a preferred investment destination among the global investors”.19 However, as soon as it was clear U.S. interest rates would start inching up again, foreign investors started withdrawing a portion of their funds. Since October 2021, FPIs have withdrawn a larger sum from Indian stocks than during the Global Financial Crisis of 2008. (At that time the stock market plunged by nearly 70 per cent; this time, it has not done so as yet, largely because Indian investors have been buying up the shares foreign investors sold off.)20

Indeed, the rupee’s exchange rate could slide if foreign investment in the stock market leaves, and the trade deficit widens. This downward pressure has already been visible for some time: the rupee’s value dropped nearly 4 per cent over the course of the year, and at one point touched Rs 77.06/$. Any drop adds to the rupee price of imports, and thereby to price rise in general.

As we noted earlier, it is projected by some that India’s current account deficit may rise to 3 per cent in 2022-23. Foreign investors appear to consider a CAD above 3 per cent of GDP as a danger mark, and the Indian authorities themselves consider 2.4-2.8 per cent as the maximum ‘sustainable’ (by implication, a level higher than that is un sustainable).21 Since it is possible that these levels will be breached in the coming period, there may be greater uncertainty about foreign capital flows.

Why should this matter? One could argue that the CAD can be paid for by drawing down the foreign exchange reserves–that is what the reserves are for. And India has giant foreign exchange reserves: over $606 billion on April 1, 2022, which would cover our merchandise imports for a year. Even if no foreign investment were to come into India in the coming year, it would seem that the RBI could easily take care of the gap. Particularly after the 1997-98 Southeast Asian crisis, Third World governments have tried to accumulate large foreign exchange reserves, as a sort of dam against any crisis.

The reason it matters is that India’s foreign exchange reserves themselves are not built out of trade surpluses accumulated over time (as is the case with, for example, China). Rather, they have been accumulated out of foreign liabilities–debts owed to foreigners and investments in India by foreigners. India’s Net International Investment Position–i.e., the foreign assets owned by Indians (mainly the RBI’s foreign exchange reserves) minus India’s liabilities to foreigners–was -$358 billion at the end of December 2021. In fact, sizeable parts of India’s liabilities can be withdrawn by foreigners at short notice.

Imagine, if you will, enjoying a large bank balance, but an even larger debt, much of which might have to be repaid suddenly if the creditors get nervous. Naturally, all one’s behaviour would be conditioned by the need to reassure one’s creditors. This vulnerability has been created by successive governments of India, each adding further net liabilities to the legacy it received.

In a strange pathology, the larger the liabilities, the greater the need to accumulate reserves to reassure foreign investors–thereby further increasing the liabilities. The foreign exchange reserves are invested in ‘safe haven’ assets in the developed countries, on which the returns are very low. On the other hand, foreign investments in India yield a much higher income–to foreign investors. Moreover, the present value of foreign investments is multiples of the values at which they came in. As we have pointed out in an earlier article (“A Regime of Drain, External Control, and Impoverishment”, November 16, 2021), this results in a net drain from India, recalling the drain during colonial rule.

Further, these net liabilities, and the constant fear of the exit of foreign investment, act as a constant pressure on the country to adhere to the policies demanded by international investors and international institutions. These policies are continuously monitored by international credit rating agencies. Even if India were not to defy their strictures, some external event–such as instability in another Third World country, or a crisis in the developed world–can lead international investors to shift to ‘safe havens’, principally the U.S..

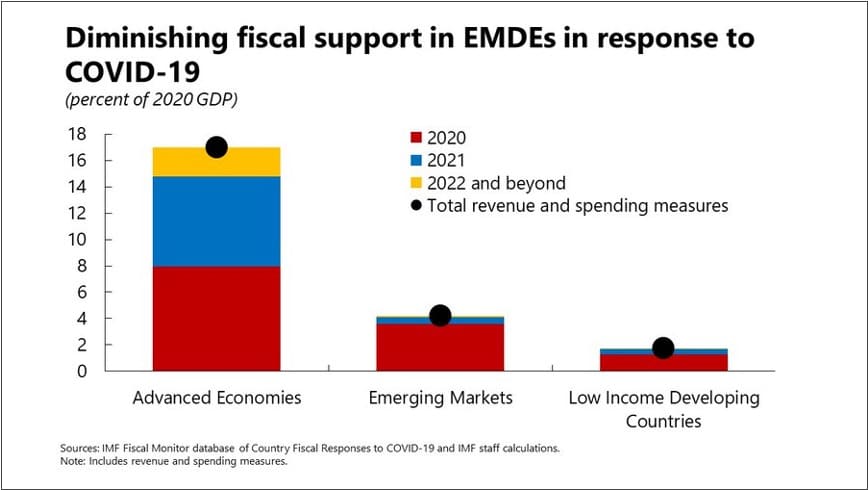

A recent UNCTAD report, Tapering in a Time of Conflict (March 24, 2022), provides a grim analysis of the present international situation. It points out that developed countries such as the U.S., which had, in 2020, reduced interest rates and expanded money supply in order to revive growth in their own economies, are now poised to “taper”–that is, they will increase their interest rates and tighten their money supply in order to curb inflation. As they do so, “it may have disastrous repercussions for developing countries.” Money may exit ‘developing’ countries and head for the U.S., making it difficult for developing countries to service their foreign debt and obtain fresh debt in order to make critical imports. The exchange rates of their currencies might drop precipitously, which would make imported goods expensive, and further push up inflation in such countries (already high due to the rise in the international prices of oil and other commodities).

In order to prevent capital exiting their economies, and to check domestic price rise, the developing countries may resort to hiking interest rates (since a higher interest rate would mean higher returns for a foreign investor in that country’s debt, making it more attractive). This in turn would make it difficult for domestic businesses and consumers to borrow, further pushing down domestic demand–already depressed by high prices. Keep in mind that the economies of the developing countries were already dealt a massive blow by the pandemic and its associated lockdowns. Further, in contrast to the developed world’s massive expansions of Government spending in order to counteract the effects of the lockdowns, the developing countries only made meagre increases in Government spending, for fear that foreign investors would exit their economies. As a result, they remain in depression. Now, this depression is set to deepen.

The case of India seems on the surface to be different. After all, India’s external debt indicators look healthy, and there seems to be no imminent crisis (see Table below).

India–External Debt Indicators

| End-March | External Debt (U.S.$ billion) | Ratio of External Debt to GDP (%) | Debt Service Ratio (%) | Ratio of Foreign Exchange Reserves to Total Debt (%) |

| 2014 | 446.2 | 23.9 | 5.9 | 68.2 |

| 2015 | 474.7 | 23.8 | 7.6 | 72 |

| 2016 | 484.8 | 23.4 | 8.8 | 74.3 |

| 2017 | 471 | 19.8 | 8.3 | 78.5 |

| 2018 | 529.3 | 20.1 | 7.5 | 80.2 |

| 2019 | 543.1 | 19.9 | 6.4 | 76 |

| 2020 | 558.4 | 20.6 | 6.5 | 85.6 |

| 2021 | 569.7 | 21.1 | 8.2 | 101.3 |

| End-June 2021 | 571.3 | 20.2 | 4.1 | 107 |

Source: RBI

However, UNCTAD paints a less rosy picture. It notes that, among Asian economies, “India in particular will face restraints on several fronts: energy access and prices, primary commodity bottlenecks, reflexes from trade sanctions, food inflation, tightening policies and financial instability.” It is the last–financial instability–that is most significant. What UNCTAD argues is that, irrespective of their seeming mountains of foreign exchange reserves, the more integrated developing economies are with global finance, the more vulnerable they are.

Their vulnerability was vividly demonstrated in 2013, when the chairman of the U.S. central bank (the ‘U.S. Fed’) said that the Fed would start to taper off its expansion of money supply. As the fresh supply of dollars would now slow down, the statement led to an immediate rise in the effective interest rates on U.S. Treasury bonds. In turn, it led to a drop in capital flows to developing countries, and a fall in the exchange rates of their currencies–what is known as the “taper tantrum”.

At the time, India had $292 billion in foreign exchange reserves, a current account deficit of $88 billion and capital inflows of $92 billion in 2012-13. There was no need for any panic. Yet it was seen as vulnerable; an analyst at the investment bank Morgan Stanley coined the phrase the “Fragile Five”, and included India in the list (others being Brazil, Indonesia, South Africa and Turkey). The Indian economy suddenly was thrown into a panic and the RBI had to mount a rescue operation.

In March 2020, with the Covid pandemic, international investors fled developing countries to the safety of the U.S., even at the cost of accepting lower interest rates there: “Portfolio investors withdrew funds from developing countries’ equities and bonds on a scale and with a speed without recent historical precedent. These funds were redirected to the safety of developed country government securities, the chief beneficiary being the United States government.” During 2020 the U.S. government increased its borrowings by $4 trillion (keep in mind that India’s GDP is less than $3 trillion), but so much capital from across the globe rushed to invest in U.S. government bonds that the returns on the bonds actually fell.

After the 2013 taper tantrum, did developing countries such as India try to reduce their vulnerability to international capital flows by reducing their financial openness? On the contrary, UNCTAD points out.

Today in many countries, current account deficits are smaller than in 2013, and thus external capital inflows, including volatile portfolio inflows, appear to pose lower immediate risks. In several large developing economies, stocks of foreign exchange reserves have increased. Yet indicators such as current account positions and foreign reserves are limited in predicting vulnerability to short-run liquidity movements. Measures of financial integration provide a better gauge of potential exposures. On this measure, the picture is not substantially changed from 2013–many large developing economies remain financially open and thus vulnerable to sudden reversals in financial flows.

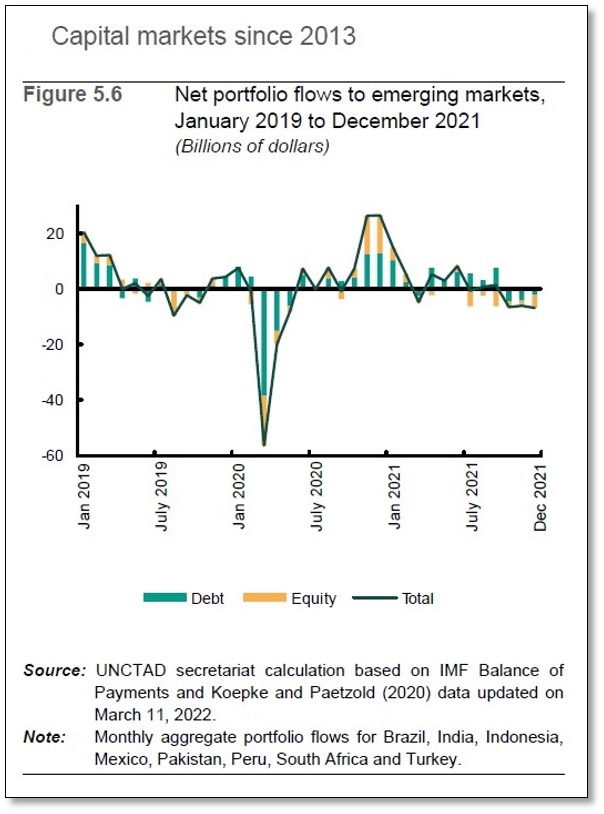

They have had large inflows of volatile foreign capital into their equity and debt markets. And so “At least some of the ‘fragile five’ remain exposed to monetary tightening in the the United States.” The chart below, from the UNCTAD report, shows the net flows of such capital to eight such countries, including India.

For all the present Government’s talk of “self-reliance”, it has systematically increased India’s financial openness to global capital flows. And it is through this channel that India faces the gravest risks in the present situation.

Notes:

- ↩ “War has forced fuel price hikes: Nirmala Sitharaman”, Times of India, March 26, 2022, timesofindia.indiatimes.com

- ↩ “How war in Ukraine is reverberating across world’s regions”, IMF Blog, March 15, 2022, blogs.imf.org

- ↩ Website of Indian Oil Corporation, April 1, 2022.

- ↩ Alternatively, the price of a litre of diesel (Rs 92.72/litre, average of four major metropolitan cities of India) on March 31, 2021 was 23 per cent of one day’s per capita income in 2020-21 (Rs 399).

- ↩ RBI, Monetary Policy Report, April 8, 2022, p. 19.

- ↩ Ibid., p. 33.

- ↩ CMIE, “Inflation drives corporate sales”, February 28, 2022, www.cmie.com

- ↩ NielsenIQ, “Metros and pricing buoy India’s FMCG industry in Q3 2021”, January 5, 2022; Sagar Malviya and Ratna Bhushan, “FMCG likely to grow 9-10 per cent in 2020”, Economic Times, January 22, 2020.

- ↩ Harish Damodaran, “Government sets up ‘war room’ on movement of fertilisers”, Indian Express, October 22, 2021.

- ↩ “Black market for fertilizers is booming in India as prices soar,” Bloomberg, November 29, 2021.

- ↩ RBI, Monetary Policy Report, says that low fertiliser sales in January-February 2022 reflected “inventory de-stocking and lower imports amidst rising international prices”. (p. 40)

- ↩ Website of the Food Corporation of India.

- ↩ FAO, The State of Food Security and Nutrition in the World 2021.

- ↩ National Sample Survey, Nutritional Intake in India 2011-12, NSS 68th Round.

- ↩ Jean Drèze and Anmol Somanchi, “The Covid-19 Crisis and People’s Right to Food”, May 13, 2021, osf.io

- ↩ Harish Damodaran, “Wheat stocks at three-year-low, but comfortable”, Indian Express, April 13, 2022.

- ↩ As far as possible, all figures in this article have been rounded off.

- ↩ RBI, Monetary Policy Report.

- ↩ vol. II, p. 105.

- ↩ Akash Prakash, “Fed hiking cycle: What next?”, Business Standard, March 28, 2022.

- ↩ Rajan Goyal, “Sustainable Level of India’s Current Account Deficit”, Reserve Bank of India Working Paper Series no. 16, August 2012. Similarly, in India’s November 25, 2019 Article IV Consultation with the IMF, the sustainable level is defined as -2.5 per cent of GDP.