Spend less, work longer or get another job, move in with your parents or get a flatmate. But whatever you do, don’t push for a pay rise to compensate for inflation. That’s the advice dispensed by Reserve Bank Governor Philip Lowe in recent months.

To facilitate some of these outcomes, the RBA is close to tipping the economy into recession. Gross domestic product per person was down 0.2 percent in the first three months of the year, the household savings rate is collapsing, and consumption growth is grinding to a halt, according to the Bureau of Statistics.

The bank’s board noted in the minutes to its May monetary policy meeting that the unemployment rate will be pushed up by 1 percentage point by the end of next year, putting more than 100,000 people out of work. How this approach squares with Lowe’s exhortations to work more is unclear. National Australia Bank chief economist Alan Oster says the figure could be 200,000 or more. Time will tell.

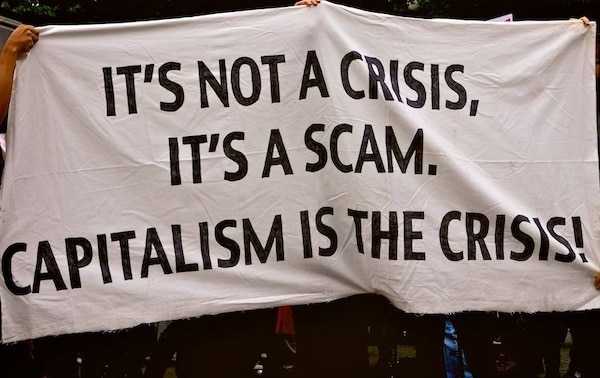

The bottom line is that the RBA is trying to make wage earners poorer to save them from rising prices. That’s the magical logic of capitalism. If this magic appears so dazzling that you can’t figure out how it works, you may just belong to the wrong social class.

How so? Well, take Lowe’s exhortation for people to spend less.

Those on lower incomes are already trying to spend less on electricity by shivering through winter. According to Lowe, this is for the good of “the economy”. But here’s the rub: the Australian Energy Regulator says prices will jump 20 to 25 percent from July, which comes on top of a 15 percent rise over the last year. In these conditions, even when you try to use less, it ends up costing more—it’s the David Copperfield economy, where the more you pay, the more something disappears.

Where does it go? Well, on the back of these surging prices, energy giant AGL is forecasting an underlying profit increase of perhaps 150 percent next year, according to the Financial Review. There’s your magic: one social class’s attempt at frugality is transformed into a financial windfall for another social class.

It’s the same with food: prices increased 8 percent over the year, but the volume purchased declined. “There certainly has been a huge increase in how many dollars we spend on food”, Greg Jericho, policy director at the Centre for Future Work, noted last month in the Guardian.

[But] we are now buying about 5 percent less food than expected before the pandemic. It’s just costing more.

Lowe basically says try disappearing another meal—it’s for your own good, because it’s good for “the economy”. Meanwhile, insatiable supermarkets can’t stop price gouging. Coles recently posted a half-yearly profit of more than $600 million—up more than 11 percent after tax. Woolworths lodged a $900 million profit—up 14 percent.

So we pay more to eat less, and hunger for one class is magically transformed into a shareholder dividend bonanza for another.

It’s similar with housing: Lowe says more people in fewer dwellings will fix the problem. “Higher prices do lead people to economise on housing”, he told a Senate hearing last month.

Kids don’t move out of home, because the rent is too expensive—so you decide to get a flatmate or a housemate because that’s the price mechanism at work.

That’s right kids, it takes high prices to force you to adapt to the high prices that banks and landlords are charging. It’s price mechanism magic. Lowe is helping this mechanism by jacking up interest rates, which he can do in good conscience because mortgage payments, which are up by more than $1,000 per month on an average loan, aren’t counted when measuring consumer price inflation. (More magic.)

The governor of course says nothing about the preponderance of empty homes owned by the wealthy. Nor has he offered to sublet on the cheap any of the five bedrooms in his Randwick home. That’s not how this capitalist magic works—one class’s expanded and expanding living spaces are disappeared in advance from the equation demanding the shrinking of living space for another class.

It’s a Harry Houdini housing market.

And it’s the same again with wages. “We have to make sure that higher inflation doesn’t translate into higher wages for everybody”, Lowe said this month after lifting the cash rate for the twelfth time in fourteen months. In real terms, average wages are down more than 7 percent since their peak three years ago.

Where did all that disappeared wealth from working people go? Magically, a bunch of it turned up in the pockets of the bosses. The latest data, compiled by the Governance Institute, shows average pay rises of 11 percent, 13 percent, 15 percent and 24 percent, depending on the position, for directors and managers at Australia’s biggest companies. General counsel and company secretary bonuses are up 49 percent.

The misery of one class of people turned into more and more money for another class. That’s the magic of Australian capitalism.