Do you think that Recep Tayyip Erdoğan—who has carried out the most massive privatizations in Turkey’s history, banned countless strikes, driven down working-class wages, and turned millions of refugees into providers of cheap labor under slavery-like conditions—could be a socialist?1 I am aware that this question sounds absurd, but unfortunately there is a reality even more absurd: For a significant segment of Turkish youth, the answer to this question is indisputably yes. In their eyes, Erdogan and his Justice and Development Party represent a socialist and even communist regime with Islamic tendencies.

The reasons attributed to Erdogan’s socialist character are wide-ranging: interest rates have been kept low at the expense of rising exchange rates to prevent the unemployment rate from going up before the general election; the minimum wage has been raised, even though it remains below the inflation rate; and the belief that the government excessively taxes capital, a belief completely contrary to reality. But even if the reasons vary, the fact they point to does not change. A part of the Turkish youth condemns and labels as socialist all economic policies that go beyond the neoliberal discourse or have the slightest possibility of benefiting the working class.

How did these young people—whose social practices are limited to the Internet because they have no money for a coffee with peers, who almost all live with their families because of impossible rents, who are either part of the unemployed majority or are exploited for long hours with wages that lose their real value day by day—become convinced that the source of their problems is “socialism” and “socialist policies”? Why do they adopt a market fundamentalism similar to the Austrian School economists who declare that even Milton Friedman is a socialist?

I think that the answer to these questions is less a result of Turkey’s current political, social, and economic structure and more a result of the global phenomenon of crypto currency. The widespread ownership of crypto currencies has created the grounds for a very reactionary economic understanding among broad social segments, especially among young people.

Financialization for Everyone!

The unofficial start of Turkey’s currency crisis in 2018 was a wake-up call from middle-class dreams for some segments of the working class: Consumerism, which was at the center of the artificial identity of the middle class, was becoming difficult to maintain. Not only did the Turkish lira lose its value day by day, reducing real working-class income, but cryptocurrencies, which had been a niche technology, also gained extraordinary value and garnered great interest.

The continuous depreciation of the local currency was leading not only investors, meaning crypto enthusiasts, but also ordinary Turkish citizens to turn to cryptocurrencies in order to preserve the value of their savings.2 In an environment where there was no regulation on cryptocurrencies and where the state supported nationalist-flavored speculative projects like Turkcoin, a new cryptocurrency exchange or project was announced almost every day.3

The crypto world was attractive, especially to young people, for several reasons. (1) Unlike the stock market, these new generation crypto exchanges did not require any bureaucratic procedures or even have an age limit—literally anyone could be a crypto investor! (2) The volatile nature of cryptocurrencies seemed to make it possible to earn considerable profits with low capital, at least in theory. And (3) the rise of exchange rates amid a political crisis between the United States and Turkey created an expectation among the people that the government would impose certain sanctions on foreign exchange and especially dollar accounts, so decentralized cryptocurrencies seemed like suitable alternatives.4

This was the beginning of a process that turned half of Turkey’s population into cryptocurrency owners, inspiring millions of young Turks to take their first steps into the complex world of finance.5 To follow the rise of exchange rates with joy rather than worry, all they had to do was find and invest in the right cryptocurrency whose value would increase tens or even hundreds of times in the future. From this point of view, buying any cryptocurrency was not very different from buying a lottery ticket, and their ideological effect was quite similar. Karl Marx described the ideological function of the lottery like this:

On December 20 Pascal Duprat interpellated the Minister of the Interior concerning the Gold Bars Lottery.… Seven million lottery tickets at a franc-a-piece, the profits ostensibly to be devoted to shipping Parisian vagabonds to California. On the one hand, golden dreams were to supplant the socialist dreams of the Paris proletariat, the seductive prospect of the first prize the doctrinaire right to work.6

Just like the lottery, crypto ownership has also alienated the masses from their class interests and pushed them to trade their current interests with a very low chance of class mobility in the future. In Turkey, where the decline of real wages and the living standards of the working class were felt week by week, a crowd of mostly young people who had no economic security for the future were having heated debates about which cryptocurrency was worth buying.

(Neoclassical) Economics and (Technical) Analysis

Many crypto enthusiasts believe that the value of cryptocurrencies can be understood through the science of the economy and predicted through technical analysis. For them, the science of the economy refers to the neoclassical theory that represents the “mainstream” in economics. This theory, whose seeds were sown in the second half of the nineteenth century, emerged essentially with the aim of vaccinating classical political economy against Marxist criticism. But it had the heavy side effect of completely severing the ties of classical economy with the actually existing capitalist economy, replacing production factors and classes by imaginary “rational, fully informed, and self-interested agents” and abandoning the labor theory of value for the marginal value theory. The pages and pages of text and the immense models they built on absurd assumptions legitimized and rationalized the economic and political interests of the ruling class.

Neoclassical economic theory—which fails to explain the functioning of the economy in the real world, where production depends on a series of material conditions—feels at home in modern financial markets where everything is more or less about prices and speculation:

Financial markets are the least regulated or constrained, the most accessible to instantized calculations and communications, the most “globalized,” competitive, and integrated markets of all; indeed, they alone approximate the ideal of the mainstream economist’s “perfectly competitive market.”7

Cryptocurrency markets can be defined as perfect financial markets safe from reality: The king of the crypto world is not technology or creativity, as is often claimed, but demand and price. Those who start thinking about economics through cryptocurrency markets inevitably develop a deep belief in neoclassical theory, where supply and demand seem to be the only determinants of price. In this context, I think it we could even say that, through popular books, videos, and internet articles, cryptocurrency markets produce more (neoclassical) economists than today’s universities.

When crypto enthusiasts start adapting their assumptions and methods to understand the real economy, they find themselves defending arguments that are completely opposite to their own class interests. For example, in Turkey, young people who work for minimum wage may start to complain about every minimum wage increase, on the grounds that it will raise inflation or unemployment.

Even though it is based on completely irrational assumptions, neoclassical economics has a responsibility to pretend to be a science. Therefore, the tools that allow predictions to be made about the future are very limited and the focus shifts to explaining the existing facts with increasingly complex models. Therefore, when it comes to predicting the future price of cryptocurrencies, the science of the economy fails crypto investors, and help seems to come from a discipline even more detached from reality and more irrational than neoclassical economics: technical analysis.

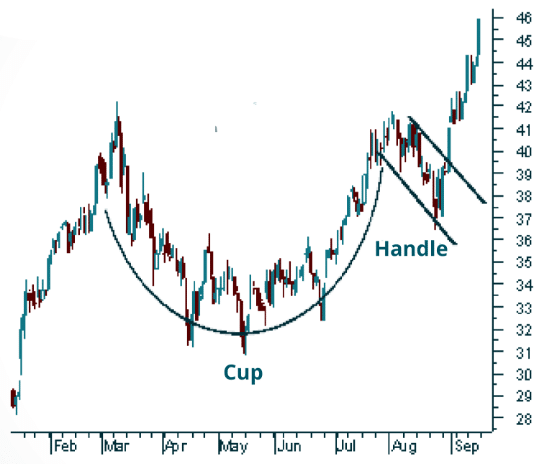

Technical analysis takes the market obsession of neoclassical theory to another level by assuming that past prices are the main determinants of future prices, meaning that supply, demand, and even market agents have disappeared, only the price remains. If you want to predict future price movements, you must undertake a technical analysis of the price chart. This means looking for a series of predefined and self-fulfilling patterns in the graph. Each of these patterns has its own unique name and possible outcome. For example, this graph represents a very popular technical analysis cup and handle, which technical analysts believe is followed by a price increase. The word believe is the key here. In fact, technical analysts do not dwell on which pattern gives rise to which result and for which reason… They only focus on whether the pattern appears on the graph.8

Jennifer C. Bender, Carol L. Osler, and David Simon, “Noise Trading and Illusory Correlations in US Equity Markets,” Review of Finance 17, no, 2 (April 2013): 625–52.

Technical analysis is the result of the exaggeration of the centrality of price in neoclassical theory, and even though it speaks the language of neoclassical theory, it is not taken seriously by it. For those who have been engaging in technical analysis for a long time, it is not that hard to adopt the idea that prices are the main determinant of all economic phenomena and that they should not be interfered with from the outside.

Technical analysis—the image of a stockbroker drawing interesting shapes and lines on a chart—is very popular among crypto investors for several reasons. (1) Technical analysis and its infinite patterns provide a pool of endless reasons for brokerage and financial consulting firms that charge per transaction. (2) These firms and some so-called experts have built a sector consisting of books, online training sets, and courses on technical analysis education. (3) Perhaps most importantly, technical analysis eliminates the randomness and chance factor in the prices of speculative financial instruments such as crypto currencies, at least on the level of perception.

The theoretical framework provided by neoclassical economics and the sense of control provided by technical analysis lead investors to see cryptocurrencies as something different from a purely chance-based lottery or gambling. According to them, cryptocurrency markets are an area that needs to be studied and learned. In this learning process, they are exposed to extremely reactionary economic ideas and adopt them. The bear seasons, when cryptocurrencies stop rising and markets stagnate, cause many investors to switch to other speculative instruments like the stock market or to completely break away from speculative finance due to incurred losses. But even if they leave cryptocurrency markets, they continue to maintain the ideological influence to which they are exposed.

The Crypto Dream

The discussion on the value of cryptocurrencies is beyond the scope of this article, but it would not be wrong to say that, especially in the periods of upward swings, the values of cryptocurrencies are almost entirely speculative and therefore depend on new investors and the money they will bring. What is interesting is that, among all the rhetoric about the virtues of the science of the economy and technical analysis, almost all cryptocurrency investors are instinctively aware of how speculative the whole market is, working like a 1.7 trillion dollar Ponzi scheme. Everyone who has a connection with that market, from huge exchanges to small investors, acts with a single purpose: to attract more investors and money to the market. For this sacred purpose, which is essential for the sustainability of the cryptocurrency markets, the modest efforts of small investors and the marketing budgets of huge exchanges, social media agencies, and influencers who want to benefit from these budgets are all mobilized.

The most obvious way to add new people to the sector is to market what we can call the crypto dream. The crypto dream is the belief that anyone can make considerable money and even become a millionaire by closely following and analyzing the cryptocurrency markets and the crypto world in general.

The crypto dream, adorned with buzzwords such as financial freedom and passive income, is often marketed together with its antithesis: the ordinary worker existence, where rent and bills are a concern, where one wakes up early, works long hours in a tiring pace, and does not have access to the fruits of their labor or any security for the future. Although this existence reflects the reality of the contemporary working class, it is depicted as something that the worker deserves: The worker has chosen this life by avoiding taking risks and not following current trends, such as cryptocurrencies. Of course, changing this and taking control of their own destiny is possible by entering cryptocurrency markets.

This marketing method is nothing but a bad crypto-updated version of the new investor attraction methods used for years by stock market, entrepreneurship, or network marketing circles. In this context, what makes cryptocurrencies different is that they have reached a much younger and wider audience by serving this culture that glorifies the rich and degrades workers. In addition, small investors who hold various cryptoassets become voluntary advertisers of those assets. The crypto bro stereotype, who only talks about cryptocurrencies and the opportunities they offer, is a result of this phenomenon.

The ideology imposed by neoclassical economics and technical analysis, combined with the agitation that spreads from the marketing campaigns of crypto circles, creates a fertile soil for even the most reactionary ideas to easily take root.

Our Question

Even though economic liberalism has been adopted by all actors of the system, from the opposition to the government, it never represented an important independent political line in Turkish political history. Although people who defined themselves as liberals held important positions in the media and politics, their number was very limited and they eventually leaned toward one of the three forms of the right in Turkey, namely, conservatism, Islamism, and Turkism. But today many young people define themselves as liberal and even libertarian. Their early youth years coincided with the period that Korkut Boratav, one of Turkey’s most important Marxist economists, described as the “distributional shock.”9 A significant proportion of this generation, who observed the dramatic decline in the value of labor and the rise in the value of Bitcoin at the same time, turned to cryptocurrencies and then to the stock market. They adopted ideologies and ideas that were hostile to their own existence through the mechanisms I described above.

Some of the current political parties try to include these young people, sarcastically called 2005-born liberals and whose numbers are increasing every day, but Turkey’s unique political conditions largely prevent this line from reflecting on the political scene, at least for now. Unfortunately, the situation is different for Argentina, which ranks second after Turkey in terms of cryptocurrency ownership rate and suffers from currency crises and chronic inflation just like Turkey.10 In December 2023, libertarian economist Javier Milei, who transitioned from the media world to the political world, became the president of Argentina with the support of a predominantly young electorate. Milei often declared his pro-crypto attitude during the election cycle and praised Bitcoin for returning money to its rightful owner, the private sector.11 Naturally, he received wide support from crypto enthusiasts not only in Argentina, but also globally. Milei, who advocates that even human organs should be bought and sold, initiated a bill to legalize the use of Bitcoin in contract settlements and payments as one of his first actions.12

Although the crypto markets have been relatively quiet since 2021, crypto circles are very hopeful that a new active season is on the horizon. This hope is largely propelled by the expectation that the Federal Reserve will lower interest rates and the U.S. Securities and Exchange Commission’s recent approval of Bitcoin exchange-traded funds will drive new cryptocurrency purchases.13 For us, there is a more important question than whether this hope will turn into reality and whether cryptocurrencies will once again make headlines: How can we fight against the mechanism that turns young people, whose futures have been robbed by capitalism, into relentless market fundamentalists? Our capacity to answer this question depends on our understanding and analysis of the fact that this speculative toy of capitalism plays crucial ideological, not only financial, functions.

Notes

1. “AKP Gov’t Has Privatized State-Owned Assets Worth $62.3 Bln in 19 Years: Report,” Turkish Minute, April 30, 2021; “Turkey Is Becoming a Country of Minimum Wage Earners,” Bianet English, December 2, 2021; Safak Tartanoglu Bennett, “Syrian Garment Workers in Turkey: Modern Slavery?“ Futures of Work 11, February 3, 2020.

2. Cindy Huynh, “As Turkey’s Lira Falls, Bitcoin’s Popularity Soars,” Blokt, August 16, 2018.

3. “Turkey Proposes State Cryptocurrency ‘Turkcoin’ After Iran, Venezuela,” RTTNews, February 23, 2018.

4. Alex Ward, “Turkey Releases US Pastor Andrew Brunson in a Big Win for Trump,” Vox, October 12, 2018.

5. Alyssa Herting, “Half of the People in Turkey Now Own Crypto: Report,” Decrypt, September 2, 2023.

6. Karl Marx, “The Eighteenth Brumaire of Louis Bonaparte,” chap. 5, 1852, marxists.org.

7. Douglas Fitzgerald Dowd, Capitalism and Its Economics (London: Pluto Press, 2000), 185.

8. Jennifer C. Bender, Carol L. Osler, and David Simon, “Noise Trading and Illusory Correlations in US Equity Markets,” Review of Finance 17, no, 2 (April 2013): 625–52.

9. With this term, Boratav describes a radical decline in the share of wages in GNI. Dora Mengüç, “Profesör Boratav: Türkiye’de kriz değil çok ciddi bir bölüşüm şoku var,” Independent Turkish, June 14, 2023.

10. Medha Singh and Lisa Pauline Mattackal, “Cryptoverse: Digital Coins Lure Inflation-Weary Argentines and Turks,” Reuters, May 2, 2023.

11. Macauley Peterson, “Argentina Elects Pro-Bitcoin President Javier Milei,” Blockworks, November 20, 2023.

12. “President Javier Milei’s Move: Argentina Legalizes Crypto Amid Economic Challenges,” Finance Magnates, December 22, 2023.

13. Hannah Lang and Suzanne McGee, “US SEC Approves Bitcoin ETFs in Watershed for Crypto Market,” Reuters, January 11, 2024.