Falling energy prices pushed down the consumer price index 0.1 percent in the month of April. After rising 2.7 percent from January of 2009 to January of 2010, consumer prices were unchanged over the first three months of this year. Core prices were unchanged in April. Inflation in the core index has risen at a 0.6 percent annual rate over the last three months and 0.3 percent over the last six.

After falling sharply in the second half of 2008, consumer prices rose at a 4.8 percent annualized rate from May to August of 2009. Since then, the three-month rate of inflation has declined to zero. Energy prices had been a strong driver of inflation; the three-month annualized rate reached 57 percent in the three months ending last August before falling at a 7.6 percent rate since January.

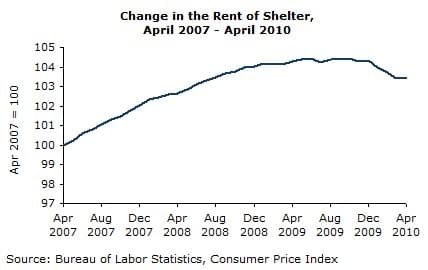

Falling rents also continue to hold down core inflation. Rent of primary residence was essentially unchanged in April and, despite a 0.1 percent increase in March, has remained flat over the last six months. Owners’ equivalent rent (OER) of primary residences — which accounts for nearly four times as much of the CPI — fell less than 0.1 percent in April. This was the sixth consecutive month of small decline in OER, and over that time it has fallen at a 0.7 percent annualized rate.

Falling energy prices helped push down transportation prices, which fell 0.5 percent in April. Transportation prices have fallen at a 2.8 percent annualized rate over the last three months, after rising at a 14.2 percent rate over the previous three. The previously-reported disinflation in the used-car market continued in April as prices rose only 0.2 percent in the month. The cash-for-clunkers program drove the three-month rate of inflation in the price of used cars to an annualized rate of over 30 percent for the quarter ending in October, but has declined steadily since then. Used car prices have risen at a 5.6 percent rate since January.

Apparel prices fell again in April. Though apparel accounts for less than 4 percent of the overall CPI, prices have fallen at a 7.0 percent annualized rate over the last three months and 3.4 percent over the last six.

Elsewhere in the core index, medical care continues to be a source of price pressure — rising 0.2 percent in the month. Among medical care costs, hospital and related services were again the fastest growing in April, though not as fast as the previous two months. The price of hospital services rose 0.4 percent in the month — a 4.3 percent annualized rate of growth. By contrast, those prices rose 1.1 and 1.0 percent in February and March, respectively.

Education prices rose another 0.5 percent in April. Tuition, fees, and child-care prices have seen a 1.7 percent increase in the last three months — a 7.0 percent annualized rate of growth. Tuition prices have averaged 5.9 percent annual inflation over the last ten years — more than twice as fast as the 2.4 percent inflation overall.

Non-agricultural export prices rose 1.4 percent in April, and have risen 6.0 percent over the last year. At the same time, nonfuel import prices rose 0.5 percent. The rise in both import and export prices has been concentrated in industrial supplies rather than consumer or capital goods. The producer price indices largely tell the same story, as the price of core finished goods have risen at a 1.4 percent annualized rate over the last three months.

Non-food, non-energy crude prices have risen at a 43 percent rate over the last year, but this is in large part a recovery from the rapid fall in the second half of 2008. Over the last three years, prices have risen at a 5.1 percent annualized rate. Intermediate core goods show the same pattern. Despite a sharp run-up and fall in 2008, and a current three-month rate of inflation over 11 percent, intermediate prices have risen a cumulative 8.2 percent over the last three years.

Overall, the inflation picture is not much changed since last month. The pressures at earlier stages of production are confined to supplies and materials, which have experienced large price booms and busts over the last few years, but producers have largely not passed these price changes on to consumers. As a result, deflation is present in much of the core index and energy prices have begun to fall once again — leaving little threat of inflation.

David Rosnick is an economist at the Center for Economic and Policy Research in Washington, DC. This article was published by CEPR under a Creative Commons license on 19 May 2010.

| Print