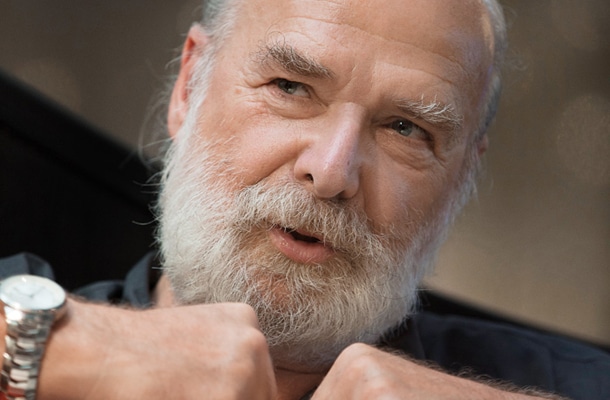

Eric Toussaint (Namur, Belgium, 1954) is co-founder and spokesperson for the Committee for the Abolition of Illegitimate Debt (CADTM), an international network which includes local committees in more than 30 countries and fights to elaborate radical alternatives to illegitimate debt, whether public or private. Eric Toussaint holds a doctorate in Political Science from the Universities of Liège and Paris VIII, and is a member of the Scientific Council of ATTAC France. He has authored about fifteen reference books on debt and the financial crisis, and hundreds of articles on these topics. He has also served as a consultant to the governments of Ecuador, Paraguay, Venezuela and certain Spanish town councils. He was the Scientific Coordinator of the Committee for Truth on Greek Public Debt.

Looking back over your career as a militant, we see that you have been active in numerous political and social movements. When did you decide to make the struggle against repayment of debt your main cause?

Quite early on. In 1983, in Liege, my home-town of over 200,000 inhabitants, we had to fight a drastic austerity programme served on the pretext that there was an enormous public debt to be paid off. We carried out a militant audit of the debt, and it was the first time we realized that we could challenge its legitimacy. In 1986, a campaign was launched in Liege to demand that illegitimate debt should not be paid. Moreover in 1982, many Third World countries, as they are dubbed, had already suffered debt crises and our struggle was inspired by the examples of two major international political figures: that of Fidel Castro who in 1985 had called for the creation of a common front of Southern countries against paying off debt (see http://www.cadtm.org/Fidel-Castro-The-debt-is-unpayable), and that of an African leader who followed the same path as Cuba the same year: Thomas Sankara of Burkina Faso. In 1989, my analysis of the situation convinced me of the need to struggle to abolish debt in the North too, even if the South remained the priority. For all these reasons I took part in founding the Committee for the Abolition of Third World Debt in 1990, the CADTM, which changed its name in 2016 to Committee for the Abolition of Illegitimate Debt.

What do you mean by illegitimate debt?

It means any debt which was contracted to serve the particular interests of a privileged minority against the general interest of the population. Minorities, for example, such as the ruling elite or bankers who are responsible for the financial crisis yet have been bailed out. Those bail-outs have triggered an explosion of public debt as was the case in Spain, Portugal, Belgium and other countries a few years ago. Illegitimate debt may also be illegal, in the context of colossal contracts where creditors make abusively huge profits, or when the interest rates or certain conditions of the contract render it null and void in law.

As well as public debt, the CADTM has recently been focusing on another problem. You talk about the effects of private debt: microcredit, mortgages, student loans… How do these types of debt work?

Over the last ten years we have noticed that there has been a general increase in illegitimate private household debt. This is what happened in the USA with the subprimes bubble – mortgages which were granted to people carrying a high risk of non-payment. More than 500,000 abusive mortgage contracts were identified (http://www.cadtm.org/Bank-abuses-in-the-real-estate). For some, there was not even the signature of the contracting parties, as they were “agreed” over the telephone and thus without the contract having been read. Because of bankers’ misconduct, nearly 14 million families have been evicted from their homes between 2007 and today in the United States. In Spain, nearly 300,000 families have been evicted. Student debt is another form of the explosion of private illegitimate debt, especially in the United States, the United Kingdom, Canada and Japan. It is surely no coincidence that these are the countries that have undergone extreme neoliberal reforms in the domain of education with budget cuts and the removal of grants, obliging many students to get into debt to pay for their studies. In the United States, two students out of three have an average debt of 27,000 US dollars and in Japan, one in two is indebted to the tune of 30,000 US dollars (see http://www.cadtm.org/Breaking-the-Vicious-Cycle-of,14751). Yet another example of expanding illegitimate private debt is microcredit. Since 2005 an international campaign has been under way to sell microcredit. The United Nations declared 2005 “International Year of Microcredit”. The Bengali economist Muhammad Yunus, promoter of microcredit and founder of Grameen Bank, won the Nobel Peace Prize in 2006. Presidents like Zapatero of Spain, Lula of Brazil or Chirac of France have given public support to the initiative. It is now clear that it was a trap, another mechanism for reproducing poverty (see http://www.cadtm.org/Breaking-the-Vicious-Cycle-of,14751, and also http://www.cadtm.org/Bangladesh-Harsh-effects-of-the).

How does microcredit work?

It generally takes the form of loans of 100 to 300 US dollars. At first, in the case of Grameen Bank (the first one to grant microcredit in Bangladesh), you needed the backing of 5 to 25 people to obtain microcredit. In other words, if the borrower was unable to repay the loan, the guarantors would pay in his or her place. And now, someone asking for a loan of 100 US dollars must make a down-payment of 30 dollars as a guarantee to the bank, and will only be lent 70 dollars net. At the same time, they must pay interest at a rate of between 30 and 50% on the full amount of 100 dollars. If the borrower defaults, the bank keeps the 30 dollars guarantee. This is fraud on a grand scale. At present, in Bangladesh, of the country’s 160 million inhabitants, 20 million use microcredit. When you think about it, it is a sly strategic move on the part of finance capital to extract profit from the 2 billion adults in the world who live without any bank account. At the time of writing, nearly 100 million people use microcredit. For capital, loans of 200 or 300 euros contracted to poor people are chickenfeed, but in the end what counts is making a profit. In the case of microcredit, this is somewhere between 20 and 25% of the investment. Excellent figures for a capitalist.

Before someone asks for microcredit, they must have been having problems…

Of course. There is a world-wide degradation of public services. In many regions, peasants have access to public agricultural credit banks. In the context of World Bank and IMF recommendations, along with the shift to the right of many developing countries, these banks have been replaced by microcredit agencies. With the Green Revolution, peasants get into debt to be able to buy seeds and pesticides from TNC such as Bayer-Monsanto. When the harvest is poor and they cannot repay, they get even deeper into debt. Let us not forget that it is mainly women who take out microcredit loans (81% according to statistics). And finally, they are the ones who suffer the most from poverty.

In some of your articles, you emphasize the strategy of staggered structural adjustment— the application of austerity measures in one sector but not in others, to avoid unification of struggles. The OECD has even endorsed the strategy by publishing a guide telling governments how to apply it (see http://www.cadtm.org/How-to-apply-unpopular-austerity). Can it be that capitalism is no longer afraid to show its hand?

So it seems. For years, the World Bank has been regularly publishing a report, Doing Business, which includes a classification of countries where those whose conditions are most favorable for mass lay-offs or who have the worst working-conditions get the most points. It is very important that workers should understand that the employers’ offensive relies on governments’ arguments concerning public debt reduction. The spokespersons for big capital show arrogance of a kind never displayed before Margaret Thatcher came to power. Today they are ever more shameless in expressing their desires and expectations.

The Trans-Atlantic Free Trade Agreement (TAFTA) between the United States and the European Union (also known as the TTIP, Trans-Atlantic Trade and Investment Partnership) is on hold but the CETA (Comprehensive Economic Trade Agreement between Canada and the European Union) is going ahead and has reached the stage of ratification. Is this an example of the desires and expectations of capitalism?

Yes indeed, and it is a very significant challenge. We have to fight these agreements because once they have been ratified and are added to the other internal agreements and conventions of the EU already in existence, we will lose all our rights. These agreements run counter to the interests of people and common goods.

You sat on the Committee for the Truth on Greek Public Debt in 2015. What did you conclude from the audit?

We advised the Tsipras government to suspend debt payments and to confront the creditors with a unilateral act of debt suspension. However, under pressure from the creditors, Tsipras chose to capitulate, which was quite traumatic for the population. I was staying in a working-class neighbourhood in Athens where the expectations of the people were palpable. They were ready to support a break-away government, as they clearly indicated in the referendum. Despite those results, the Tsipras government wanted to capitulate; they were not ready to make use of the victory of the no-vote in the referendum held on 5 July 2015 (http://www.cadtm.org/The-Work-and-Lessons-of-the-Truth). The effects of that capitulation on the Greek population can still be felt.

What is wrong with the European Left? Why can’t it manage to connect with the population?

I think they lack the courage to commit to the application of radical policies and to disobey unjust laws and agreements. SYRIZA won the elections by promising to break away from austerity. And in many countries, there is a fairly significant section of the population who are favourable to the political solutions of the radical left. That is how I interpret the good results obtained by Bernie Sanders in the United States, Jeremy Corbyn in the United Kingdom, SYRIZA, Podemos and Jean-Luc Mélenchon. In the latter case, he had only two points less than Marine Le Pen and was thus a hair’s breadth away from being in the second round in the presidential of May 2017. He did that using a radical leftwing discourse which had certain media up in arms. The radical Left has a window of opportunity that was not there ten years ago. If the Left was more offensive, more combative and more radical, we would have every chance of winning elections and above all applying policies that would break away from capitalism and its neoliberal policies.

Are left-wing parties self-limiting?

Definitely. Many leaders and parties of the radical Left, when they see that they have a chance of getting into government, think that they themselves have to limit their programme and they try to adapt their discourse to Realpolitik. There is still an opportunity to get out of the crisis situation and bring about social justice and structural changes that would favour the majority of the population. However if the radical majorities do not seize that opportunity, be sure that the far right will.

You have advised the governments of Correa in Ecuador and Chávez in Venezuela, among others. Do you think that these Latin-American governments have had more political will to confront power?

At the start of their mandates, yes. In the case of Venezuela, during the first ten years under Chávez, very positive measures were taken. It was the same with Evo Morales in Bolivia and Rafael Correa in Ecuador. Then later on, the measures they took were Realpolitik, more moderate and disappointing. The lesson I learn from all this is that, while it is possible to resist and apply breakaway policies in the first years of a mandate, as the three examples show, it is fundamental for the population to self-organize and to put pressure on governments to keep them to the line of profound change. I would like to say that when I advised these governments, |1| I always maintained my independence. I was not paid a cent by any of the States and I never signed any contracts with their ministers or presidents. This is a rule that I never break or bend, in order to preserve my right to total criticism at all times.

In recent years you have advised certain municipalities in the“Open Cities”network in Spain on debt themes. If you were to analyse their dynamics two years after the general election, how would you evaluate the potential of the initiatives?

It all depends how willing the administrations really are to constitute a municipal front against illegitimate debt and austerity. If such a front is constituted, it could take serious actions to disobey the Montoro Law and Article 135 of the Spanish Constitution, and so on (see http://www.cadtm.org/Spain-The-Municipal-Network and

http://www.cadtm.org/Espagne-L-enjeu-de-l-audit-de-la (in French, Spanish or Portuguese only)). If no action is taken, even if the country has enormous potential, with high hopes and many well-meaning people from all the citizens’ movements, nothing concrete will change. It is not enough for municipalist councils that want change merely to make pleasing declarations and improve transparency of public budgets; unless they unite to fight austerity, they will only bring disappointment and discouragement.

For example, I have not seen many cases of remunicipalization of public services, one of the most important commitments of these bodies. I know it is not easy, but without direct confrontation of the government using the Constitution and the action of a broad front, there will be no progress.

Let us talk now about instruments of struggle against debt and alternatives. One of the mechanisms you put to great use is auditing. How far can it actually bring about change, beyond the desire for transparency?

It has enormous potential because it involves citizens, people who until now had never questioned the legitimacy of debt. The audit leads people to question the legitimacy of actions and policies of their government when they are unjust. Once you have begun to question the logic of indebtedness, you have attained a higher level of awareness. As long as citizens do not control and pressurize their governments, thinking of them as friendly and safe, there will not be any real change. There need to be political forces with the courage and the strength to apply radical policies, but even more importantly, the population needs to be mobilized, critical, ready to revolt when the government does not fulfil its promises. Without those two conditions, there will be no profound structural change.

In your writings, you point out different radical leftwing measures which have to go through State control, such as the nationalization of banks. But do you think a social and solidarity-based economy is an alternative?

It is fundamental for local, solidarity-based initiatives to develop, from creating a local currency to organizing consumer or work cooperatives. But even if you develop a social and solidarity-based economy, it would not be contagious enough to trigger a real change in society. What is also needed is a government ready to take measures, change laws, change the constitution, oppose international agreements and so on. That is why, if we want to move on towards ecological transition, production and distribution of energy must be under our control. By dismantling nuclear or electric power stations, the State would be controlling the energy sector and could transform it into a public service. In the case of banking, there could be a similar process: to confront major banks like HSBC, Barclays, DB or Santander, you would have to confront the dominant banking sector, while at the same time developing ethical banking. These are jobs for a government supported by its people. A social and solidarity-based economy is very important and we must get to grips with it urgently, but not at the expense of the institutional fight for structural change.

Original Spanish version: http://www.cadtm.org/Para-mantener-una-linea-de-cambios

Translated from the French by Vicki Briault with Christine Pagnoulle

Footnotes

|1| Eric Toussaint was a member of the Integral Auditing Commission for Public Credit of Ecuador (CAIC) set up in 2007 by President Rafael Correa (see http://www.cadtm.org/Video-The-Ecuador-debt-audit-a and http://www.cadtm.org/From-Dashed-Hopes-to-Success-in). The same year, he advised the minister of Finance and the president of Ecuador about founding a Bank of the South (http://www.cadtm.org/The-Bank-of-the-South-a-review-of). In 2008, the Paraguayan president Fernando Lugo called upon his experience to launch a debt audit in his country ( See: http://www.cadtm.org/Paraguay-The-Belgian-who-met-with). In 2008, he also advised the Venezuelan minister of economic Development and Planification (http://www.cadtm.org/Respuestas-del-Sur-a-la-Crisis-de In Spanish only)