Donald Trump’s decision to impose import tariffs—on solar panels and washing machines now, and perhaps on steel and aluminum down the line—has once again opened up the war concerning international trade.

It’s not a trade war per se (although Trump’s free-trade opponents have invoked that specter, that the governments of other countries may retaliate with their import duties against U.S.-made products), but a battle over theories of international trade. And those different theories are related to—as they inform and are informed by—different utopian visions.

In one sense, Trump and his supporters are right. Capitalist free trade has destroyed cities, regions, livelihoods, and industries. The international trade deals the United States has signed in recent decades have been rigged for the wealthy and have cheated workers. They are replete with marketing scams, hustles, and shady deals, to the advantage of large corporations and a small group of individuals at the top.

But Trump, like all right-wing populists, as I explained recently, offers a utopian vision that looks backward, conjuring up and then offering a return to a time that is conceived to be better. For Trump, that time is the 1950s, when a much larger share of U.S. workers was employed in manufacturing and American industry successfully competed against businesses in other countries. The turn to import tariffs is a way of invoking that nostalgia, the selective vision of a utopia that was exceptional, in terms of both U.S. and world history, and that conveniently conceals or overlooks many other aspects of that lost time, such as worker exploitation, Jim Crow racism, and widespread patriarchy inside and outside households.

It should come as no surprise that mainstream economists, today and in a tradition that goes back to Adam Smith and David Ricardo, oppose Trump’s tariffs and hold firmly to the gospel of free international trade. Once again, Gregory Mankiw has stepped forward to articulate the neoclassical view (buttressed by classical antecedents) that everyone benefits from free international trade:

Ricardo used England and Portugal as an example. Even if Portugal was better than England at producing both wine and cloth, if Portugal had a larger advantage in wine production, Portugal should export wine and import cloth. Both nations would end up better off.

The same principle applies to people. Given his athletic prowess, Roger Federer may be able to mow his lawn faster than anyone else. But that does not mean he should mow his own lawn. The advantage he has playing tennis is far greater than he has mowing lawns. So, according to Ricardo (and common sense), Mr. Federer should hire a lawn service and spend more time on the court.

That’s the basis of neoclassical utopianism—the gains from trade: when international trade is unregulated, and every country specializes according to its comparative advantage, more commodities can be produced at a lower cost and as a result average living standards around the world are improved.

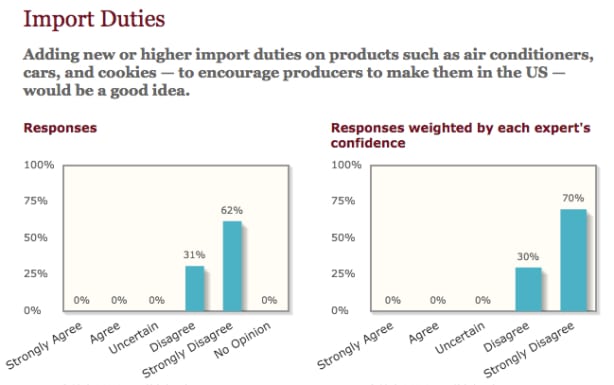

Like Mankiw, most mainstream economists, who are the only ones represented in the IGM Economic Experts panel, oppose import tariffs (as seen in the chart above) and celebrate the utopianism of free international trade.

That’s true even among mainstream economists who have argued that, in reality, the causes and consequences of international trade may not coincide with the rosy picture produced within the usual textbook versions of neoclassical economic theory.

For example, Paul Krugman was awarded the Nobel Prize in economics for his work demonstrating that the relative advantages most neoclassical economists take as given are in fact products of history. Thus, it is possible for countries to enhance their trade advantages (through creating internal economies of scale) by regulating international trade. But Krugman was also quick to belittle “a steady drumbeat of warnings about the threat that low-wage imports pose to U.S. living standards” and, then, in his first New York Times column, to denounce the critics of the World Trade Organization.

A few years later Paul Samuelson, widely recognized as the dean of modern mainstream economics, published an article in the Journal of Economic Perspectives in which he challenged the presumed universal benefits of free trade. It is quite possible, Samuelson argued, that if enough higher-paying jobs were lost by American workers to outsourcing, then the gains from the cheaper prices may not compensate for the losses in U.S. purchasing power. In other words, the low wages at the big-box stores do not necessarily make up for their bargain prices. And then Samuelson was immediately taken to task by other mainstream economists, most notably Jagdish Bhagwati (along with his coauthors, Arvind Panagariya and T.N. Srinivasan [pdf]), who argued that “that outsourcing is fundamentally just a trade phenomenon [and] leads to gains from trade.”

Finally, Dani Rodrick, the mainstream economist who has been most critical of the role his colleagues have played as “cheerleaders” for capitalist globalization, still defends the standard models of international trade:

It has long been an unspoken rule of public engagement for economists that they should champion trade and not dwell too much on the fine print. This has produced a curious situation. The standard models of trade with which economists work typically yield sharp distributional effects: income losses by certain groups of producers or worker categories are the flip side of the “gains from trade.” And economists have long known that market failures – including poorly functioning labor markets, credit market imperfections, knowledge or environmental externalities, and monopolies – can interfere with reaping those gains.

But Rodrick, like Krugman, Samuelson, and other mainstream economists who have identified problems with the story told by Mankiw, Bhagwati, and other free-traders—who have “consistently minimized distributional concerns” and “overstated the magnitude of aggregate gains from trade deals”—still holds to the neoclassical utopianism that, with “all of the necessary distinctions and caveats,” more international trade can and should be promoted. Thus, as Rodrick argued just last week,

If our economic rules empower corporations and financial interests excessively, then the correct response is to rewrite those rules — at home as well as abroad. If trade agreements serve mainly to reshuffle income to capital and corporations, the answer is to rebalance them to make them friendlier to labor and society at large.

The goal is to make sure everyone, not just “corporations and financial interests,” benefits from international trade.

But recent criticisms of trade deals from within mainstream economics still don’t include the possibility that capitalism itself, with or without free international trade and multinational trade agreements, however the rules are written, privileges one class over another. Capital gains at the expense of workers because it is able to extract a surplus for literally doing nothing. That kind of social theft occurs—both when international trade is regulated and controlled and when it is allowed to operate free of any such interventions.

That’s why Karl Marx ironically came out in support of free trade in his famous speech to the Democratic Association of Brussels at its public meeting of 9 January 1848:

If the free-traders cannot understand how one nation can grow rich at the expense of another, we need not wonder, since these same gentlemen also refuse to understand how within one country one class can enrich itself at the expense of another.

Do not imagine, gentlemen, that in criticizing freedom of trade we have the least intention of defending the system of protection.

One may declare oneself an enemy of the constitutional regime without declaring oneself a friend of the ancient regime.

Moreover, the protectionist system is nothing but a means of establishing large-scale industry in any given country, that is to say, of making it dependent upon the world market, and from the moment that dependence upon the world market is established, there is already more or less dependence upon free trade. Besides this, the protective system helps to develop free trade competition within a country. Hence we see that in countries where the bourgeoisie is beginning to make itself felt as a class, in Germany for example, it makes great efforts to obtain protective duties. They serve the bourgeoisie as weapons against feudalism and absolute government, as a means for the concentration of its own powers and for the realization of free trade within the same country.

But, in general, the protective system of our day is conservative, while the free trade system is destructive. It breaks up old nationalities and pushes the antagonism of the proletariat and the bourgeoisie to the extreme point. In a word, the free trade system hastens the social revolution. It is in this revolutionary sense alone, gentlemen, that I vote in favor of free trade.

That’s because Marx’s critique of political economy embodied a utopian horizon radically different from the utopianism of classical and neoclassical economics. He sought to transform economic and social institutions in order to eliminate capitalist exploitation. And if free trade was the quickest way of getting to the point when workers revolted and changed the system, then he would vote against protectionism and in favor of free trade.

As it turns out, as Friedrich Engels explained forty years later, both protectionism and free trade serve, in different ways, to produce more capitalist producers and thus to produce more wage-laborers. In our own time, Trump’s protective tariffs may do that in the United States, just as free trade has accomplished that in other countries that have increased their exports to the United States.

But neither protectionism nor free trade can succeed in undoing the “elephant curve” of global inequality, which in recent decades has shifted the fortunes of workers in the United States and Western Europe and those in “emerging” countries and still left all of them falling further and further behind the top 1 percent in their own countries and globally.

Reversing that trend is a goal, a utopian horizon, worth fighting for.