Few countries can exert much power in the rest of the world. There are just five permanent members of the United Nations Security Council, the ones who can cast vetoes on important UN decisions. Or take the G7, a U.S.-led political forum of rich countries that has, well, seven members. The concentration of global power is extreme, and it rests upon the different ways a country can have influence over how the world works.

Some of these ways are obvious, for example, using military power to force another country to submit. Many are not, especially those that are linked into the system that envelops the world economy. Five dimensions of international power can be used to gauge the status of countries.[1] These show not only how the U.S. is far more prominent in the hierarchy than suggested by a simple measure of economic size, such as GDP. They also map the relative importance of other countries and throw new light on a major geopolitical issue today: the rise of China.

China rising

China was once seen mainly as an important supplier of cheap goods and a valuable dynamo for the world economy. Now the U.S. looks upon China as the biggest threat to its global interests. Every year, many hundreds of pages on this topic are published for the U.S. Congress, adding to a steady stream of material directed at U.S. policymakers from think tanks and lobby groups.[2]

In 1990, China accounted for just 2% of the world GDP. Since then, that share has doubled every decade and China will likely account for 18% in 2021.[3] This has worried the small group of countries that dominates the world’s key institutions, because quantitative changes can also bring about qualitative shifts. Will they be able to stay in charge as they had done, now that a country from outside the rich club has risen to the fore? That question is posed especially for the U.S. All those institutions–the United Nations, the IMF, the World Bank, the World Trade Organisation and others–have been shaped by it.[4] The first three also have headquarters in Washington DC or in New York.

Russia–formerly, the Soviet Union–is the traditional U.S. political enemy. Yet, it is principally a military obstacle, notwithstanding the more recent U.S. belief that it can influence Presidential elections through buying Facebook advertisements. China, by contrast, presents a much wider challenge to how the U.S. sets the rules for the world, as seen when it ignores U.S.-inspired sanctions against countries such as Iran. U.S. political rhetoric and economic measures against China picked up with President Trump, and they have continued unabated with the new Biden administration. All the international meetings held by Biden and his officials since the start of the 2021–at the G7, at NATO, in Europe and in Asia–have had a strong anti-China theme.

Measuring power

Power has many dimensions. Here are five aspects of economic and political power that are relevant for a country’s international influence.

Economic size is one measure of a country’s weight in the world, usually measured by its GDP. That GDP number is broadly related to the size of its domestic market, how many big corporations it has, and how important it is in international trade. The U.S. is the world’s biggest economy, accounting for roughly 24% of world GDP. G7 countries–the U.S., Japan, Germany, the UK, France, Italy and Canada–together account for 45% of world GDP, despite having only 10% of the world’s population. GDP counts for more than people when it comes to power and influence.[5]

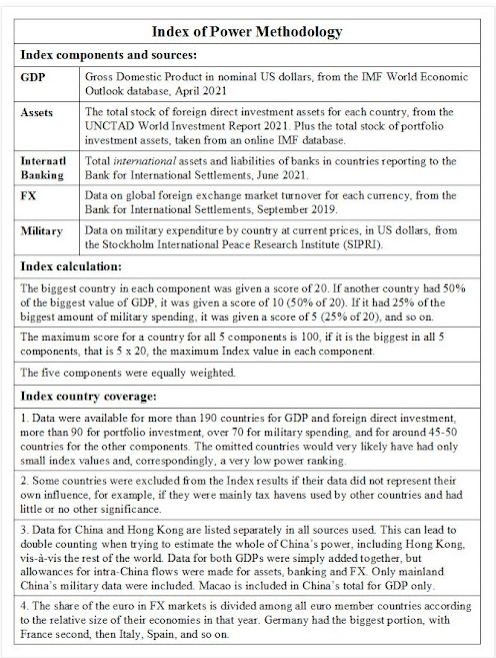

By 2020, China’s GDP was just under three-quarters of that for the U.S. Japan’s GDP was roughly a quarter the size of the US, Germany was at nearly a fifth, and the UK and France were each at roughly one-eighth. All countries have been affected by the COVID-19 pandemic, and it has had little effect on their relative positions. However, U.S. sanctions will have curbed China’s growth to some extent in recent years.

By 2020, China’s GDP was just under three-quarters of that for the U.S. Japan’s GDP was roughly a quarter the size of the US, Germany was at nearly a fifth, and the UK and France were each at roughly one-eighth. All countries have been affected by the COVID-19 pandemic, and it has had little effect on their relative positions. However, U.S. sanctions will have curbed China’s growth to some extent in recent years.

A country’s foreign assets are another important measure of power. Such assets include the ownership of companies operating in other countries, together with holdings of financial securities, such as equities and bonds, and ownership of real estate.[6] These indicate how much control it has over resources in other countries, and the size of the assets is related to the potential revenues it can gain from them.[7]

At the end of 2020, the U.S. had by far the highest stock of foreign assets, at roughly $22.7 trillion. Germany was next in line, but well below that with ‘only’ $6.3 trillion, and the Netherlands, the UK and France followed. China and Hong Kong’s foreign assets amounted to just under $5 trillion.

These asset ownership numbers, as much other published information, do not allow for the flows of finance between major countries and tax havens. Tax havens are registered as the owners of significant foreign assets in official data, yet most of their funds originally come from major country investors.[8] This should not have much effect on the top level calculations used here.[9]

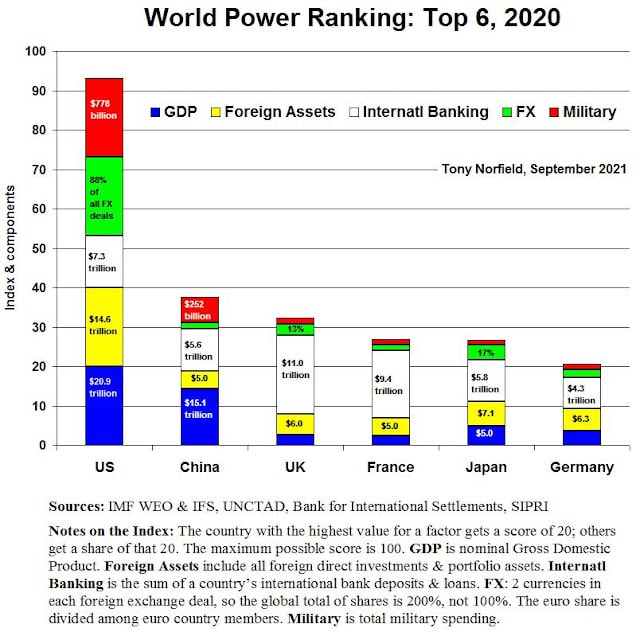

International lending and borrowing by banks is a third measure. These data show how much a country is involved in channelling funds around the world, and are also linked to how far that country is a finance hub that can profit from international dealing. London is the largest centre for international banks. While it may be a surprise that London is bigger than Wall Street on this measure, that is because much U.S. banking business is oriented towards the domestic U.S. economy, not so much internationally.

Nevertheless, Brexit has had some impact on UK international banking. With the UK outside the single market for financial services in the EU, some banks have shifted their operations from the UK and into EU centres. France has gained most ground because of this, and jumped into second place just behind the UK by the end of 2020, moving ahead of the U.S., which was in third place (see the next chart).

How much a country’s currency is used in foreign exchange (FX) deals for trade and investment is another aspect of its economic status in the world. Directly or indirectly, this also adds to its global power. This is most evident for the U.S. with the dollar, which is involved in 88% of all currency deals.

How much a country’s currency is used in foreign exchange (FX) deals for trade and investment is another aspect of its economic status in the world. Directly or indirectly, this also adds to its global power. This is most evident for the U.S. with the dollar, which is involved in 88% of all currency deals.

Most commodities and important industrial goods, including oil, metals, grains, technology, pharmaceutical and aerospace products, are priced for trade in terms of U.S. dollars. The same is true for many investment and financial deals, helped by the U.S. having the world’s largest stock and bond markets, with international private and official funds buying those securities. Even the China-led Asian Infrastructure Investment Bank conducts its business mainly in U.S. dollars.

U.S. power in this FX dimension relies on the fact that nearly all deals involving U.S. dollars must be settled through the domestic U.S. banking system. Images of drug dealers and criminals crossing borders with bags of cash may be good for the cinema, but they do not represent what really happens to international transfers of funds.

This means that if the U.S. government doesn’t like you–whether you are an individual, a company or a country–then it can try to prevent you from doing currency deals, even if you are not based in the U.S. If a bank nevertheless does deal with you in dollars, or even in another currency, then the U.S. can fine that bank and threaten to shut it out of the huge U.S. market. The U.S. government’s Treasury Department has a special agency for this purpose, appropriately named the Office of Foreign Assets Control.

Other countries with important currencies could try to exert power in the same way, but their currencies have far less international significance. For example, the euro’s share of world FX markets is just 32%,[10] with the Japanese yen half of that in third place and the UK’s pound sterling in fourth.[11] So far, China’s renminbi currency has remained very minor in terms of global trading, at around 4%.[12] This is based upon the relatively late inclusion of China in financial markets, together with many more government controls on the flow of capital than is the case for other major countries.

The amount of military spending is a simple gauge of how far a country can use force against another, or threaten to use it, and is the fifth measure of power used. The U.S. is once again in the top rank here, and it also has military bases in over 50 countries. By contrast, China has bases in just three other countries (Djibouti, Myanmar and Tajikistan).

Even if much U.S. military spending is, in reality, more of an indirect subsidy to the domestic U.S. economy and corporations, or is on equipment with inflated prices, its total spending of a huge $778bn in 2020 still gave the U.S. plenty of scope to project power. This sum was more than three times bigger than China’s and twelve times bigger than Russia’s. The U.S. lead over other major countries in military spending has increased in the past two years.

Power outcomes

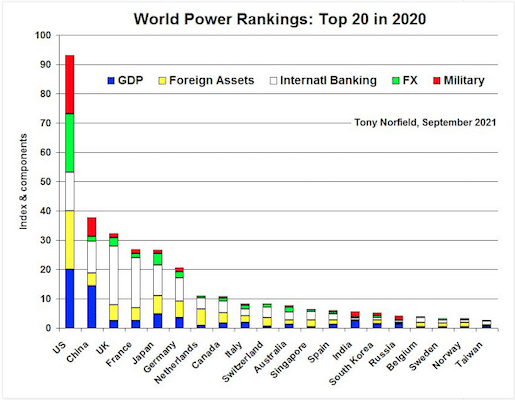

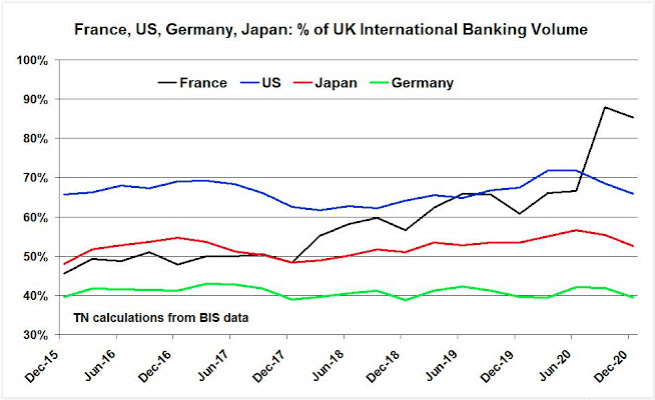

Each of the five factors has some limitations regarding its accuracy or coverage. But together they give a good summary of power and are available for a large number of countries. This measurement of global power is endorsed by how the results for the top 20 countries include the five permanent members of the UN Security Council, all of the G7, and most of the G20 countries.

A country may have a high score on one component and very little on another, but all except a few countries in the world have a negligible score on all of them. The U.S. has an index score of 93.2, with China well below in second position at 37.7. Only six other countries have an index score above 10.0. More than 150 countries score less than 1.0. This picture of the extreme hierarchy of power is a challenge to anyone who uses the term ‘international community’!

Sources & notes: See the first chart for details.

This calculation of power depends upon individual country values and does not consider the effect of alliances between countries, or factors that are not as easy to quantify, such as cultural influence. If included, these would only add to the power of the U.S. and generate a more towering image. Consider NATO, for example, which accepted that the ‘North Atlantic’ security region extended into Afghanistan, the first U.S. target after September 2001. Or consider how U.S. social media companies dominate the Internet, how the world’s youth wear baseball caps, like, backwards, and how even India’s massive film industry calls itself ‘Bollywood’.

What next?

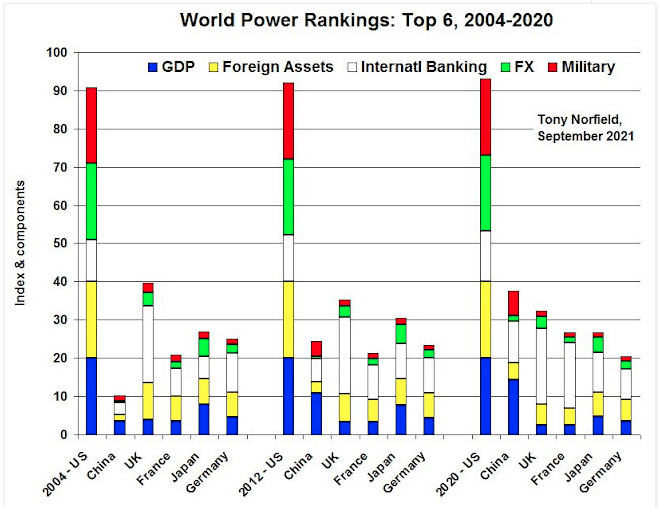

The U.S. is worried about the rise of China’s economy, although U.S. power extends much further than a simple economic measure would suggest. A look at the power index for the major countries over the past two decades shows how China has also built some non-GDP dimensions of power, notably in military spending, international banking and the ownership of foreign investment assets.

Sources & notes: See the first chart for details.

Sources & notes: See the first chart for details.

In recent years, China dislodged the UK in number two spot on this ranking of world power. The UK is the world’s fifth largest economy, but has its status boosted by its role in international banking. That reflects its position in world finance, although the form that this takes is also changing with the rise of China and other Asian countries, and the relative decline of European economies.[13] The more that international business grows outside of the traditionally dominant group of countries, the less important are the rules that they impose for how the world economy must work.

The U.S. sees the rise of China not just as unwelcome competition, especially in the technology sphere, but also as a serious future threat to its hegemonic status, one that must be dealt with today. Other countries closely linked to the U.S., and especially other Anglo members of the ‘5 Eyes’ spying network (UK, Australia, Canada, New Zealand) are in a similar position, because they have been an integral part of a system that has dominated the world since 1945. That is why the rise of China inevitably becomes a geopolitical issue.

Some countries in Europe, particularly Germany, have a different perspective. Politically they are pro-U.S., and they are also economically cautious about China. But they would also like to have an alternative to relying solely upon the U.S., or U.S. permission, whether that is for technology, for energy, or for other vital supplies. They are right to be concerned that the U.S. is inclined to unilateral policy moves that can go against European interests. That remains true under Biden, although his administration stepped back from its former hard stance against the completion of the Nord Stream 2 gas pipeline from Russia.

Not surprisingly, China has responded to the U.S. policies over the past decade, and the risk that as a result of these policies it could be pushed to the edges of a world economy controlled by hostile countries.[14] A key part of its response has been to press ahead with the massive trade and investment programme begun in 2013: the ‘Belt and Road Initiative’. This involves more than 130 countries, mainly in Asia, Europe and Africa, but also extending into Latin America. Faced with U.S. sanctions and political manoeuvres, China is building up a network over which the U.S. and its allied powers have far less control.

These developments will foment divisions in the world that every country will have to deal with. In the next few years, we will live in interesting times as the established powers led by the U.S. fight to maintain their domination.

Notes:

[1] This article updates my analysis of September 2019, where I showed that the Index of Power had put China in #2 position. See here. The Index calculation here adds a country’s foreign portfolio assets to its direct investment assets, to get a better measure of its total foreign assets. (Previously, I only counted FDI, but I have since found good data on portfolio assets.) It also makes some adjustments to eliminate possible double counting of intra-China relations between China and Hong Kong, which are treated as separate countries in all official data. See the Appendix to the article for more details.

[2] For example, the U.S.-China Economic and Security Review Commission has issued annual reports since 2000. Its December 2020 report was nearly 600 pages: https://www.uscc.gov/annual-report/2020-annual-report-congress

[3] Sources for GDP and other data used are given in the Appendix to this article. The U.S. share of the world economy has fallen from 30% in 1990 to 24% in 2021.

[4] The former institutions, or its predecessor, the GATT for the WTO, emerged from the post-1945 political realignment led by the U.S. The President of the World Bank is almost always a U.S. citizen, while the Managing Director of the IMF is always a European. The WTO has had a more diverse list of Directors General. Decisions by each institution are rarely passed if the U.S. disagrees, a result helped in the case of the IMF by a voting allocation that always enables the U.S. to block any IMF action.

[5] GDP numbers can be calculated in various ways. Here, the nominal value of GDP in a single currency is used to compare countries.

[6] In standard official statistics, ownership of 10% or more of a company in another country is considered foreign direct investment. Ownership of less than 10% of the company’s equity is considered a foreign portfolio investment, as are holdings of foreign debt securities. These are all added together here to give the measure of a country’s total foreign assets.

[7] Large corporations, usually from rich countries, can also profit from their commercial domination of producers in other countries via so-called supply chains, for example, Apple’s relationship with its suppliers, or western fashion companies getting their products made in Asian countries. However, these relationships are difficult, if not impossible, to measure.

[8] One study shows, for example, how a nationality-based measure could greatly increase the registered U.S. and other major country holdings of bonds and equities in particular countries. These holdings are under-estimated by the usual residency-based measures in official data, as the residency can also be a tax haven. See pages 44 and 48, especially, of: https://bfi.uchicago.edu/wp-content/uploads/BFI_WP_2019118_Revised.pdf

[9] This is because the data I use measure total outflows from a country, which should include the funds first sent to tax havens before being resent elsewhere. However, the ‘round tripping’ of funds to escape tax would not be counted properly. For example, if U.S. investors sent funds to a company registered in the Cayman Islands for the purpose of investing back in U.S. assets, that first flow would appear as a foreign asset of the U.S. when it is not.

[10] The euro’s share of global FX markets is divided up among the 19 euro country members according to their relative GDPs. Germany has the biggest share of that, followed by France, Italy and Spain.

[11] Note that the total shares of all currencies add to 200% because there are two currencies in each foreign exchange deal.

[12] Less surprisingly, the separate Chinese currency of Hong Kong also has only a small role in world FX trading. Its currency value is tied very tightly to the U.S. dollar’s.

[13] See Tony Norfield, The City: London and the Global Power of Finance, Chapter 9 and the Afterword to the paperback edition, Verso, 2017.

[14] For a discussion of these topics, see my articles ‘Racism & Imperial Anxiety: U.S. vs Huawei’, 16 April 2019, here, and ‘China and U.S. Power’, 14 July 2020, here, each one on EconomicsofImperialism.blogspot.com.