The UN Conference on Trade and Development (UNCTAD) has warned in its annual trade and development report released on October 3rd that the methods used by the wealthy nations to fend off inflation, such as skyrocketing interest rates, would actually wear on the developing and poorest of nations through a distressing global recession.

Moves to swell interest rates by major central banks, like The Bank of England and The US Federal Reserve, in response to rising prices were dubbed an “imprudent gamble” that the UN body said would need a “course correction” to avoid stacking up debt, health emergencies, and the prevailing climate crisis on developing nations as a result of the pandemic and the war in Ukraine.

The Central Bank of Turkey raised the estimates for consumer prices to 60.4% by the end of the year 2022. Furthermore, amid the highest inflation rate hitting Sweden since 1991 of 9.0 recorded in August, the central bank of Sweden announced in September an interest rate hike of 1 percentage point, the biggest since 1993.

Central Banks worldwide have been battling against high inflation rates, as factors such as rising energy prices and Covid residual imbalances have been pressing the economies with no signs of relief in the short-term.

The report further challenged the idea of a monetary shock being required by central bankers, by stating that the shock of inflation was fueled by the ballooning of prices for energy, food, and friction in global trade as opposed to excess demand for goods and services.

Even the steps taken to counteract the inflationary consequences, which included windfall taxes and anti-trust measures, could have still taken place without the need to put poorer countries at the forefront and as a shield.

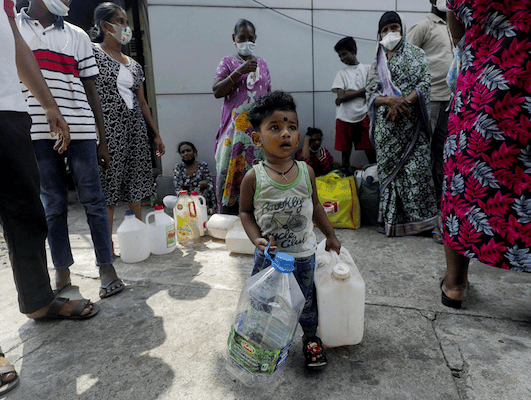

Approximately $3.6 trillion of future income for developing countries, excluding China, is anticipated to face a cut as interest rate increases from the Federal Reserve, per the UN body’s statement. Countries such as Zambia, Suriname, and Sri Lanka that were already exhibiting a hefty debt weight are now among those suffering the most of the inflation, and those like Pakistan are being hit with bigger threats of economic instability due to climate shocks.

Richard Kozul-Wright, the head of the team that authored the report, said:

The real problem facing policymakers is not an inflation crisis caused by too much money chasing too few goods but a distributional crisis with too many firms paying too high dividends, too many people struggling from pay cheque to pay cheque and too many governments surviving from bond payment to bond payment.

The dollar value against other currencies showed a rapid rise as it exerted pressure on developing nations on pricing imported goods and the cost of servicing debts.

Rebeca Grynspan, the secretary-general of UNCTAD, said: “There’s still time to step back from the edge of recession,” said,

We have the tools to calm inflation and support all vulnerable groups. This is a matter of policy choices and political will. But the current course of action is hurting the most vulnerable, especially in developing countries, and risks tipping the world into a global recession.