-

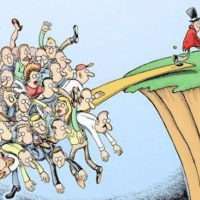

Inequality worsens Planetary heating

The accumulation of still growing greenhouse gas emissions in an increasingly unequal world is accelerating planetary heating. This is worsening inequalities, both nationally and internationally.

-

Another Nobel for Anglocentric Neoliberal Institutional Economics

New institutional economics has received another so-called Nobel prize, ostensibly for again claiming that good institutions and democratic governance ensure growth, development, equity & democracy.

-

More poverty for the poor

Many low-income countries (LICs) continue to slip further behind the rest of the world. Meanwhile, people in extreme poverty have been increasing again after decades of decline.

-

Government debt is symptom, not cause

Developing country governments are being blamed for irresponsibly borrowing too much. The resulting debt stress has blocked investments and growth in this unequal and unfair world economic order.

-

Rich nation hypocrisy accelerating global heating

Addressing climate change requires a comprehensive, equitable, and pragmatic approach that prioritizes substantial emissions reductions and supports vulnerable populations most affected by global heating.

-

World Bank enables private capture of profits, public resources

The World Bank insists private finance is needed for economic recovery and the Sustainable Development Goals but does little to ensure profit-hungry commercial finance serves the public interest.

-

IPEF: New Cold War weapon backfires

U.S. President Joe Biden’s Indo-Pacific Framework for Prosperity (IPEF) is the economic arm of his administration’s Indo-Pacific Strategy, aimed at countering China’s influence in the region.

-

Debt-pushing as financial inclusion

Ajay Banga was anointed World Bank president for promoting financial inclusion. Thanks to its success and interest rate hikes, more poor people are drowning in debt as consumer prices rise.

-

World Bank climate finance plan little help, unfair

The World Bank plans to use public funds to subsidize private finance, ostensibly to mobilize much more capital to address the climate crisis. But the new plan is not the solution it purports to be.

-

Government health financing for all, not insurance

To achieve universal health coverage, all people need access to public healthcare. This should be an entitlement for all, regardless of means, requiring adequate long term sustainable financing.

-

Open veins of Africa bleeding heavily

The ongoing plunder of Africa’s natural resources drained by capital flight is holding it back yet again. More African nations face protracted recessions amid mounting debt distress, rubbing salt into deep wounds from the past.

-

Rich nations doubly responsible for greenhouse gas emissions

Natural flows do not respect national boundaries. The atmosphere and oceans cross international borders with little difficulty, as greenhouse gases (GHGs) and other fluids, including pollutants, easily traverse frontiers.

-

Limits to growth: Inconvenient truth of our times

Ahead of the first United Nations environmental summit in Stockholm in 1972, a group of scientists prepared The Limits to Growth report for the Club of Rome. It showed planet Earth’s finite natural resources cannot support ever-growing human consumption.

-

Developing countries need monetary financing

Developing countries have long been told to avoid borrowing from central banks (CBs) to finance government spending. Many have even legislated against CB financing of fiscal expenditure.

-

Stop worshiping central banks

Preoccupied with enhancing their own ‘credibility’ and reputations, central banks (CBs) are again driving the world economy into recession, financial turmoil and debt crises.

-

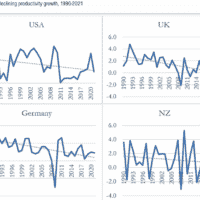

Central bank myths drag down world economy

The dogmatic obsession with and focus on fighting inflation in rich countries are pushing the world economy into recession, with many dire consequences, especially for poorer countries. This phobia is due to myths shared by most central bankers.

-

Ideology and dogma ensure policy disaster

Central banks (CBs) around the world–led by the U.S. Fed, European Central Bank and Bank of England–are raising interest rates, ostensibly to check inflation. The ensuing race to the bottom is hastening world economic recession.

-

Inflation targeting farce: High costs, moot benefits

Sep 20, 2022 (IPS). Policymakers have become obsessed with achieving low inflation. Many central banks adopt inflation targeting (IT) monetary policy (MP) frameworks in various ways. Some have mandates to keep inflation at 2% over the medium term. Many believe this ensures sustained long-term prosperity.

-

Africa struggles with neo-colonialism

After a quarter century of economic stagnation, African economic recovery early in the 21st century was under great pressure even before the pandemic, due to new trade arrangements, falling commodity prices and severe environmental stress.

-

1980s’ redux? New context, old threats

As rich countries raise interest rates in double-edged efforts to address inflation, developing countries are struggling to cope with slowdowns, inflation, higher interest rates and other costs, plus growing debt distress.