-

Ecological imperialism and the Canadian mining industry

In 2013, Edward Snowden’s leak of documents pertaining to the inner workings of National Security Agency (NSA) sparked international revelations about the reach and unaccountability of Washington’s international surveillance apparatus. One series of documents that remain understudied, however, concern similar activities orchestrated by the Canadian government.

-

On income and wealth inequality

THE fact that income and wealth inequalities have increased quite dramatically under the neo-liberal regime is beyond dispute. The empirical work by Piketty’s team bears out the increase in income inequality. They use income tax data to infer about the share of the top 1 per cent of the population of a country in its national income.

-

Crypto bros want your 401(k)

Despite FTX’s collapse, a lawsuit linked to the exchange’s investor is trying to force regulators to allow crypto into the retirement market.

-

The fiscal requirement of a welfare state

THE post-second world war period had seen a spate of welfare state measures in the advanced capitalist countries, especially in Europe, in emulation of what the Soviet Union was effecting.

-

Recession alert: we need a new unemployment insurance system

With the Federal Reserve pushing up interest rates, we appear headed for a new recession.

-

Beating around the bush: polycrisis, overlapping emergencies, and capitalism

It is in vogue nowadays to describe the multifaceted and intertwined crises of capitalism without referring to capitalism itself. Obscure jargon of ‘overlapping emergencies’ and ‘polycrisis’ are brought up to describe the complexity of the situation, and they serve, with or without intention, to conceal the culprit, namely the totality of capitalist relations.

-

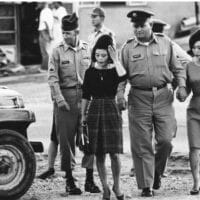

Supreme Court orders reparations for sex workers serving U.S. Military

Reminiscent of Imperial Japan’s “Comfort Women,” the organized sex trade near U.S. bases in Korea involved horrendous human rights violations.

-

Open veins of Africa bleeding heavily

The ongoing plunder of Africa’s natural resources drained by capital flight is holding it back yet again. More African nations face protracted recessions amid mounting debt distress, rubbing salt into deep wounds from the past.

-

The outflow of finance from the periphery

In the current calendar year an estimated $200 billion has already flown out of India which amounts to a third of India’s exchange reserves.

-

FTX partnership with Ukraine is latest chapter in shady Western aid saga

The demise of FTX, the fifth-biggest cryptocurrency exchange by trade volume in 2022, and the second-largest by holdings, has sent a wave of chaos through global financial markets.

-

Collapsed cryptocurrency exchange FTX had ties to Ukrainian government, WEF, and top Biden adviser

FTX had some eye-opening connections to powerful entities and individuals around the world before it all came crashing down.

-

Millions suffer as junk food industry rakes in profit

Increased consumption of ultraprocessed foods (UPFs) was associated with more than 10% of all-cause premature, preventable deaths in Brazil in 2019. That is the finding of a new peer-reviewed study in the American Journal of Preventive Medicine.

-

Developing countries need monetary financing

Developing countries have long been told to avoid borrowing from central banks (CBs) to finance government spending. Many have even legislated against CB financing of fiscal expenditure.

-

Boom and bust: The fight over Bitcoin mining in New York State

Seneca Lake’s picturesque setting belies its long history of conquest and extraction.

-

Canada prepares war bonds for Nazi-infested Ukrainian government

During the Second World War, the Canadian government appealed for Canadians to buy war bonds to fight fascism in Europe.

-

The world according to Bloomberg

The story currently being peddle by the folks at Bloomberg [ht: ja] is that the American middle-class is currently suffering, as the enormous wealth they managed to accumulate during the past few years is now dwindling. And that crisis—the end of their “once-in-a-generation wealth boom”—is what they will take into the midterm elections.

-

Prof. Richard Wolff: inflation, imperialism & worker resistance

Inflation, Imperialism & Worker Resistance

-

EU confesses ‘our prosperity was based on China & Russia’: Cheap energy, low-paid labor, big market

EU foreign-policy chief Josep Borrell confessed the West’s neoliberal economic model was “based on cheap energy coming from Russia,” “access to the big China market,” and low-paid Chinese workers. Europe has now lost that, and is thus in crisis.

-

Cashing in on carbon capture: How Big Oil will spend our money

Big Oil stands to pocket billions in taxpayer dollars by way of carbon capture, their latest climate scam. Here’s how they’ll do it.

-

Stop worshiping central banks

Preoccupied with enhancing their own ‘credibility’ and reputations, central banks (CBs) are again driving the world economy into recession, financial turmoil and debt crises.