-

BRICS plans ‘multi-currency system’ to challenge U.S. dollar dominance: Understanding Russia’s proposal

The BRICS Cross-Border Payment Initiative (BCBPI) will use national currencies, instead of the U.S. dollar. Russia’s finance ministry and central bank released a report detailing plans to transform the international monetary and financial system.

-

World Bank enables private capture of profits, public resources

The World Bank insists private finance is needed for economic recovery and the Sustainable Development Goals but does little to ensure profit-hungry commercial finance serves the public interest.

-

Pitfalls of export-led growth

THE wisdom of pursuing a strategy of export-led growth has been discussed among development economists for at least half a century, ever since the so-called East Asian “miracle” started to be contrasted with the comparatively sluggish growth experience of countries like India that were pursuing, in the World Bank’s language, an “inward looking” development strategy.

-

How the International Monetary Fund continues to shrink the poorer Nations: The Forty-Third Newsletter (2023)

At Tricontinental: Institute for Social Research, we continue to monitor the IMF’s impact on developing economies, including in our new dossier, How the International Monetary Fund Is Squeezing Pakistan (October 2023).

-

The urgent need to repudiate debt

It is now time to react concerning the issue of debt cancellations and repudiations.

-

The impending world recession

The IMF managing director Kristalina Georgieva has now openly admitted that the year 2023 will witness the slowing down of the world economy to a point where as much as one-third of it will see an actual contraction in gross domestic product.

-

Twenty-two years of austerity in Timor-Leste: The IMF and rebuilding the neoliberal state from scratch

Timor-Leste was proclaimed by the Revolutionary Front for an Independent East Timor (FRETILIN) as a sovereign state on November 28, 1975.

-

Inflation phobia hastens recessions, debt crises

SYDNEY and KUALA LUMPUR, Sep 27, 2022 (IPS)—Inflation phobia among central banks (CBs) is dragging economies into recession and debt crises. Their dogmatic beliefs prevent them from doing right. Instead, they take their cues from Washington: the U.S. Fed, Treasury and Bretton Woods institutions (BWIs). Costly recessions Both BWIs—the International Monetary Fund (IMF) and World […]

-

Real debt trap: Sri Lanka owes vast majority to West, not China

Sri Lanka owes 81% of its external debt to US and European financial institutions and Western allies Japan and India. China owns just 10%. But Washington blames imaginary “Chinese debt traps” for the nation’s crisis, as it considers a 17th IMF structural adjustment program.

-

Cost of the Ukraine War felt in Africa, Global South

While international news headlines remain largely focused on the war in Ukraine, little attention is given to the horrific consequences of the war which are felt in many regions around the world. Even when these repercussions are discussed, disproportionate coverage is allocated to European countries, like Germany and Austria, due to their heavy reliance on Russian energy sources.

-

Rhetoric, meet reality: how to green the Belt and Road Initiative

After much talk, concrete frameworks and guidelines are finally arriving, and the stage is set for China to improve its green credentials on the Belt and Road.

-

Privatised health services worsen pandemic

Decades of public health cuts have quietly taken a huge human toll, now even more pronounced with the pandemic. Austerity programmes, by the International Monetary Fund (IMF) and World Bank, have forced countries to cut public spending, including health provisioning.

-

IMF, World Bank must support developing countries’ recovery

The COVID-19 pandemic continues to take an unprecedented human and economic toll, wiping away years of modest and uneven progress towards the Sustainable Development Goals (SDGs).

-

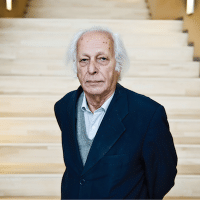

Interpreting contemporary imperialism: lessons from Samir Amin

Samir Amin’s life and work left behind many important legacies, which can continue to enrich us if only we recognise them adequately. He brought an indefatigable ‘optimism of the will’ to complex processes of political, social and economic change, involving an energy that was not deterred at all by the ‘pessimism of the intellect’ that his razor-sharp mind could generate.

-

Climate and environmental crisis: Sorcerer’s apprentices at the World Bank and the IMF

In December 2020, on the occasion of the fifth anniversary of the signature of the Paris Agreement on Climate, the UN General Secretary sounded the alarm because the situation has fundamentally worsened. In this article we analyze what the World Bank and the IMF have done in connection with the environmental crisis and climate change.