Statement by James K. Galbraith, Lloyd M. Bentsen, jr., Chair in Government/Business Relations, Lyndon B. Johnson School of Public Affairs, The University of Texas at Austin and Senior Scholar, Levy Economics Institute, before the Committee on Financial Services, U.S. House of Representatives, Hearings on the Conduct of Monetary Policy, February 26, 2009.

Mr. Chairman and Members of the Committee, it is again a privilege to appear today at these hearings, which as a member of the staff I worked on from their inception in 1975. In 1930, John Maynard Keynes wrote, “The world has been slow to realize that we are living this year in the shadow of one of the greatest economic catastrophes of modern history.” That catastrophe was the Great Crash of 1929, the collapse of money values, the destruction of the banking system. The questions before us today are: is the crisis we are living through similar? And if so, are we taking adequate steps to deal with it? I believe the answers are substantially yes, and substantially no.

This statement covers six areas very briefly:

- Why the baseline forecast is too optimistic, and why the recovery bill was too small.

- Why low interest rates will have limited effectiveness going forward.

- Why the banking plan will not work.

- Why Social Security and Medicare are not part of the problem, but of the solution.

- How to keep people in their homes, and

- Why our long-term infrastructure and energy needs should be addressed now.

1. The Baseline Forecast Is Too Optimistic and the Recovery Bill Was Too Small

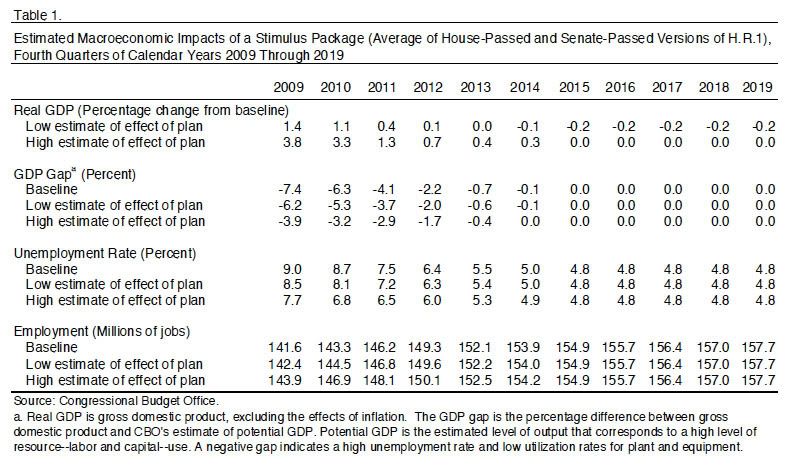

In early February the CBO baseline projected a “GDP gap” averaging about six percent over the next three years (Table One). They also expect a recovery beginning late this year and a return to normal by 2015. That was the baseline: the forecast even if the ARRA had not passed.

The baseline rests on a mechanical assumption: that there is a “natural rate of unemployment” of exactly 4.80 percent. The assumption is that labor-market adjustments will return us to this rate over time. By labor-market adjustment, economists usually mean a fall in real wages, sufficient to make workers more attractive to employers.

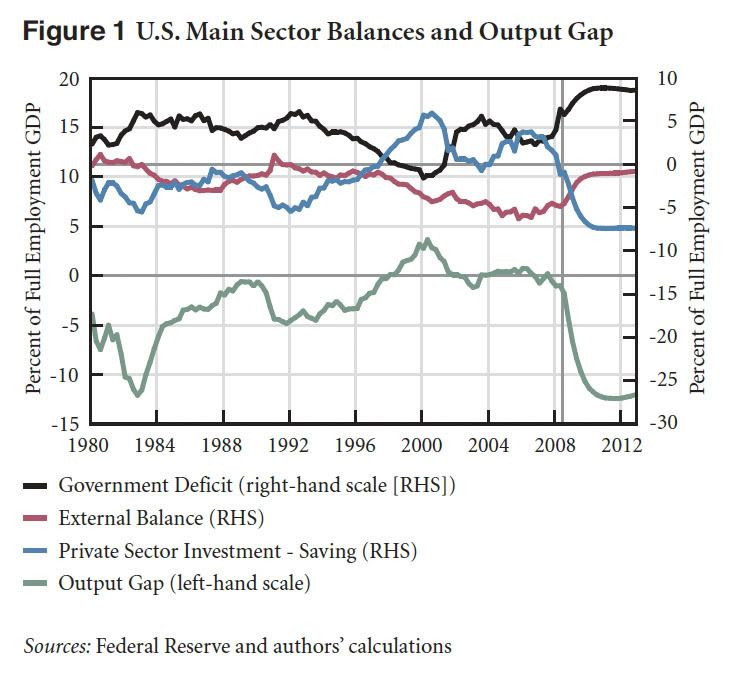

This assumption is unfounded. No fall of wages will restore employment. Employment does not depend materially on wage rates, but on the prospect for sales and profits. And these require credit. Flow-of-funds data for December show that the fall-off in new borrowing is the greatest in 40 years. The Levy Institute’s accounting-based macro model, based mainly on the rate at which households are liquidating their debts, now suggests that the GDP gap will be as much as 12 percent of GDP, with no recovery in sight. This is shown in Figure One. This gap is compatible with unemployment rates near ten percent, indefinitely.

The ARRA should add between 2 and 3 percent to total demand, per year for two years. With normal multipliers (about 1.5 for spending) the total boost to GDP might be between 3 and 5 percent. This would be enough to turn a baseline recession averaging 6 percent into something quite mild. But if the true collapse is twice as bad, the stimulus was too small. And the multipliers are probably overstated, because in a deep crisis liquidity preference grows stronger. A 12 percent GDP gap might require a stimulus of, say, 10 percent including automatic stabilizers to cope with it. The bill as enacted was far short of that.

Chairman Bernanke, in his speech at London in January, said “the global economy will recover.” He did not say how he knows. And the truth is, this is merely a statement of faith. In present conditions the most dangerous position is that of the unfounded optimist. Those who use this position to defend a program of inaction, or of little action, or to defend a program of action that is geared to a forecast of automatic recovery, might possibly turn out to be right. There might be a deliverance. But to rely on that possibility in the design of policy is surely unwise, for at least two reasons.

First, we know that bad news has been outrunning the forecasts for months. Professional economists, working with the normal models, failed to predict the crisis. In many important cases, including high officials, they actively denied it could happen. Chairman Bernanke was typical: through July of 2007, he argued that the Federal Reserve Board’s predominant concern was inflation; thus the Federal Reserve was unable to give Congress a foretaste of a crisis that was to erupt within days. And as the crisis has unfolded, events have repeatedly come in worse than expected or caught us by surprise. This should tell us something.

Second, we know that the origins of the crisis lie in a breakdown of the banking and financial system, following a breakdown in the regulation of mortgage originations, in underwriting, and in credit default swaps. This is something we have not seen in our lifetimes. We know that the actions already taken in response — the TARP, the nationalization of the commercial paper market and the swap agreements with the ECB and other central banks — are unprecedented. We know that these measures have, at best, only averted a deeper catastrophe. And we know that the baseline forecast, which is a mechanical procedure based on statistical relationships between non-financial variables, for the most part, takes none of this into account.

We therefore have no basis for confidence in the baseline forecasts, and we should prepare ourselves, as Churchill said to Parliament at the time of Dunkirk, “for hard and heavy tidings.”

2. Monetary Policy Alone Cannot Restore Growth and Employment

Chairman Bernanke deserves respect for his forceful interventions since the crisis broke. A failure, last October, to nationalize the commercial paper market would have been disastrous. Increasing deposit insurance limits warded off a run on the banks. The extension of currency swap agreements to Europe and elsewhere helped stabilize global markets temporarily, though there is a grave question, as to whether those swaps can be unwound.

I also supported this Committee’s version of the TARP, despite its limitations. At that time, a collapse of the payments system in the last months of a dying presidency was to be avoided at all costs. And the most unworkable idea in TARP, the outright repurchase of bad assets at inflated prices, was abandoned in favor of a step — the purchase of preferred equity in banks — that was possibly unnecessary but not the worst that might have happened.

Despite the fact that these steps were able to ward off complete disaster, monetary policy today has little power to restore growth. In the Depression they called it “pushing on a string.” With interest rates already at zero, there is little more the Federal Reserve can do. Chairman Bernanke’s London speech grasps at a number of straws, including “policy communication” and the reduction of long-term interest rates. But the former is a weak reed and the latter is of very doubtful effect in a liquidity trap. If rate cuts do not lead to new borrowing — as they have not — then their effect is actually counterproductive, since they reduce the interest income flowing to the elderly and others who hold the national debt, or (what is the same thing, economically) cash and cash-equivalents in the banks.

The phrase “quantitative easing” — or in Chairman Bernanke’s formulation, “credit easing” — is often heard these days. What does it mean? Not much, in my view. Can it be relied on to produce a return to economic growth? No. Credit easing, at its heart is about liquidity — a problem monetary policy can deal with. But the problems of the economy go far beyond liquidity. Chairman Bernanke’s discussion of “heterogeneous effects” — the supposed differences between lending to banks, to the commercial paper market or elsewhere, strikes me as a keen example of wishful thinking. It is unlikely that the Federal Reserve can, merely by making judicious distinctions, materially reduce the perception of risk in these markets and therefore the credit spreads that are strangling them today.

The deeper problem obviously lies in the lack of demand for output, in the collapse of confidence, in the grim prospects for profit, and in the absence of collateral to support new loans. These problems will require much more work — work to persuade the public and the business community that effective, long-range, sustained, visible action is underway. The Federal Reserve is not the agency that can persuade the world of this.

Thus, in this situation the main responsibility for pulling the ox from the ditch is not Chairman Bernanke’s. Let me turn next to the question of whether Secretary Geithner’s plan to restart the “flow of credit” can take up the slack.

3. The Bank Plan Will Not Work

The scale of the ARRA was predicated on the baseline and also on the idea that lending by the banking sector can be made to return to normal. That is, it assumed, implicitly, that Secretary Geithner’s plan for the banks will succeed. So we must ask, will it?

The bank plan appears to turn on a metaphor. Credit is “blocked” or “frozen.” It must be made to “flow again.” Take a plunger to the toxic assets, a blowtorch to the pipes, it’s said, and credit will flow. This will make the recession essentially normal, validating the baseline forecast. Add the stimulus to a normalization of credit, and the crisis will end. That’s the thinking, so far as I can tell, of the Treasury department in this new administration.

But common sense begins by noting that the metaphor is wrong. Credit is not a flow. It is not something that can be forced downstream by clearing a pipe. Credit is a contract. It requires a borrower as well as a lender, a customer as well as a bank.

The borrower must meet two conditions. One is creditworthiness, meaning a secure income and, usually in the case of a private individual, a house with equity in it. Asset prices therefore matter. With a chronic oversupply of houses, prices fall. Collateral disappears, and even if borrowers were willing many of them would not qualify for loans.

The other condition is a willingness to borrow, motivated by the “animal spirits” of business enthusiasm or just the desire for more worldly goods. In a slump such optimism is scarce. Even if people have collateral, they want cash. And it is precisely because they want cash that they will not deplete their reserves by plunking down, say, a down-payment on a new car.

The “credit-flow” metaphor implies that people came flocking to the auto showrooms last November and were turned away because there were no loans to be had. This is not true. What happened was that people stopped coming in. And they stopped coming in because, suddenly, they felt poor, uncertain and afraid.

In this situation, stuffing the banks with money will not change their behavior. Banks are not money-lenders. Banks are money-creators. They do that by making loans. And the bank chiefs have made it very clear, in testimony here and elsewhere: they will not return to ordinary commercial, industrial and residential lending until they can see a reasonable way to make money at it. If given the chance, they may go off on another bender in commodities or some other quick way to repair losses. More likely, they will hunker down, invest in Treasuries and prime corporate bonds, and rebuild capital for the long-term, as they did from 1989 to 1994. Only this time, with the yield curve as flat as it is and the insolvencies as deep as they are, it could take a decade or longer.

Seen in this light, the latest version of the plan to remove bad assets from the banks’ balance sheets is a costly exercise in futility. It will protect incumbent management, for a time. It will keep the equity values above zero, for the benefit of those who did not sell their shares when they were high and those who now speculate on a public rescue. It will do this at the expense of driving public debt, as a share of GDP, to very high levels. But there is no reason to believe that the “flow of lending” will be restored, nor that banks which long ago abandoned prudent and ordinary lending practices will now somehow return to them, chastened by events. Why should they change behavior, if their losses are in effect guaranteed by the Treasury Department?

The Treasury plan, if put in place as described, would have a perverse effect on the distribution of wealth. To guarantee bad assets at rates above their market value is simply a transfer to those who hold those assets. It would enable them to convert those assets, sooner or later, to cash. The plan would thus preserve the wealth of bank insiders and financial investors, while failing to prevent the collapse of the wealth of almost everyone else. I cannot believe that the American public will tolerate this, for very long.

There is an argument, made by those who would suspend mark-to-market accounting, that the true value of the mortgage-backed securities has been depressed by fire-sale conditions, and that a guarantee would help to restore confidence and would be validated, in changing economic conditions, by improved performance of the loans. This is something that does, in fact, sometimes happen: good loans go bad in bad times, but become good again when conditions improve. But it is not an appropriate argument for the current case.

Why not? Because the sub-prime securities that are at the bottom of this problem were, and are, in very large measure, corrupt, abusive and even fraudulent from the very beginning. They should never have been issued, and they should never have been securitized, and the ratings agencies engaged in fraud, on the face of it, by giving them AAA ratings in certain configurations, without actually inspecting the loans. No private buyer, with responsibility to do due diligence on these loans, will ever purchase them simply because due diligence is going to reveal the truth. So far as we know, the loans, almost uniformly, lack documentation or show prima facie evidence of fraud or misrepresentation. The ratings agency Fitch so determined, when it reviewed just a small sample of loan files in 2007: there was fraud or misrepresentation in practically every file. The default rates on these loans will be very high no matter what happens. It is only a matter of time. Therefore, there is no reason to think that the Treasury’s guarantees, at any price above the market price, are likely ever to be made into a profitable investment by changing economic conditions.

Finally, one has to worry about the long-term consequences of issuing new public debt just to wash away the sins of the banks. Those in the larger world who have, in the past, trusted the transparency, efficiency and accountability of the U.S. financial system — and have therefore been willing to treat the US as a haven of financial safety and stability — are bound to take note. It can’t be good for the long-term reputation of the government, and therefore for the long-term stability of the dollar. Moreover, while there is no reason to treat these asset exchanges as new public spending, it is certain that adding ten or twenty percent of GDP to the public debt (fruitlessly) will complicate the political problems associated with the effective fiscal expansion measures that getting out of the crisis may require. In short, the Treasury plan will not achieve its stated goals, and meanwhile risks both triggering inflation and obstructing growth.

If we are in a true collapse of finance, our models will not serve and our big banks will not serve either. You will have to replace them both. Since several very big banks are deeply troubled, there is in my view no viable alternative to placing them in receivership, insuring their deposits, replacing their management, doing a clean audit, isolating the bad assets. Since these banks were clearly too large, in my view they should be broken up, and either sold in parts or relaunched as multiple mid-sized institutions with fresh capitalization and leadership.

And meanwhile, how do we keep the economy running? There should be a public bank to provide the loans to businesses — small, medium and large — sufficient to keep them running through the crisis. This was the function, in the Depression, of the Reconstruction Finance Corporation. While the need for this today is very clear in the automotive sector, as time goes on a much larger part of American industry and commerce will face similar problems and similar needs. The resulting forced liquidation of the productive sector is a distinct possibility, and is not in our national interest.

4. Social Security and Medicare Are Not the Problem

A repeated theme from certain quarters holds that the financial meltdown is only a side-show, that the real “super sub-prime crisis” is in the federal budget, and that the most urgent need today is “entitlement reform,” which is code for cutting Social Security and Medicare, in the guise of saving those programs. Some of this was heard earlier this week at the White House meeting on “fiscal responsibility.”

These arguments are both mistaken and dangerous.

By long-standing political convention Social Security and Medicare are attached to designated funding streams — portions of the payroll tax. It was the original intent that Social Security benefits would be largely matched by these taxes, but this was never true for Medicare, and as the aging population grows and lives longer it has become contentious for Social Security as well. Thus we have frightening estimates of “unfunded liabilities” running to the scores of trillions of dollars over long or infinite time horizons, with dire warnings that these will drive the entire government of the United States into bankruptcy, whatever that means.

These arguments are testimony to the power of accounting to cloud men’s minds, and not much else. Let me make some obvious points.

First, a transfer program reassigns claims to output. It neither creates nor destroys production. What comes from somewhere, goes somewhere else. Thus Social Security liabilities to the government are matched by assets in the hands of the aged and those who will become aged — that is to say, in the hands of citizens of the country. From the standpoint of the country, the two sides of the balance sheet necessarily balance. Talk about “unfunded liabilities” without discussing the corresponding assets is intrinsically misleading: the liabilities in question are owed to citizens of the United States, and represent to them a very modest degree of income security and as well as access to medical care in old age.

There is no operational reason why the country cannot transfer income to its elderly, as a group, as much or as little as it wishes. The supposed inter-temporal aspect of this transfer is meaningless, for two reasons. First, the goods and services actually provided to the elderly at any point in time are always produced only shortly before they are used. Second, the workers on whom the liabilities supposedly fall today, are the same people who accrue the assets that they will enjoy later. It is true that Social Security’s real burden will rise as the population ages: from about 4.5 percent to about 6.5 percent of GDP over the century ahead. There is no reason to be afraid of this, it is simply the mechanical consequence of the fact that there will be more old people to care for. Those people would exist, and would be cared for to some degree, without Social Security. But the process would be much more erratic, much less fair, and subject to the neglect and petty cruelties of private financial relations.

The only issue posed by a deficiency of payroll taxes, now or later, is whether the funds devoted to Social Security and Medicare might be described as coming, in part, from other sources: from the wealthy, or from bondholders. So what if they are? There is no reason in principle why income or estate taxes (as the late Commissioner Robert Ball suggested), or a financial transfer tax, could not be assigned to cover Social Security and Medicare costs. The Social Security compromise of 1983, which raised payroll taxes on my generation, plainly envisaged that the obligations to cover my generation’s retirement would come, in due course, from somewhere else. That is what “paying back the Trust Fund” is all about.

Part of the worry about “entitlements” relates to borrowing, and thus to future deficits. Are these “unfunded liabilities” so large as to threaten the creditworthiness of the government? Clearly this is not the case. Despite immense efforts by the gloom-and-doom chorus on this question, the government of the United States is today funding itself, long term, for less than it did in the 1950s. Solvency was not a question then and is not a question now. This also suggests that the long-term deficit projections for the government as a whole, though much discussed at the fiscal responsibility summit, are not a worry for the financial markets, either.

The preoccupation with Social-Security-and-Medicare is actively dangerous to the prospects for economic recovery. Why? Because it raises concern and anxieties among today’s working population, who have been told repeatedly that these programs will not be present for them when they will need them. The rational individual response, in that case, is to save more and spend less. I don’t think this effect is very large, right now, but it is a risk. There are cases in the world (notably in China) of distressed populations over-saving obsessively, to try to provide for security that could be provided much more cheaply by social insurance.

More immediately, our elderly population is under a tremendous squeeze, from the stock market collapse, from falling house prices and from falling interest rates. It has already lost, through these channels, a major part of its wealth. The economist Mark Zandi told the House Democratic Caucus in December that this alone could subtract around $200 billion per year from total spending, and the situation is worse now than it was then.

Talk about the supposed need to cut back on Social Security and Medicare thus gets in the way of the discussion we should be having. This is over how to use these programs to get us out of the hole we are in. Each them could be powerful and useful. To wit:

- a permanent increase in Social Security benefits would help offset the losses that the elderly population, as a group, is suffering on its equity investments and its cash holdings. A thirty percent increase in Social Security benefits would not repair individual losses, but it would keep the elderly out of poverty as a group, and relieve severe difficulties in many individual cases.

- a payroll tax holiday would powerfully ease the financial situation of America’s working families, giving them roughly an 8.3 percent pay increase and their employers a comparable reduction in the cost of keeping them on the job. Many mortgages would be paid, and many cars purchased, that otherwise would default or go unsold.

- a reduction in the age of eligibility for Medicare would be a powerful response to the industrial crisis, permitting many older workers who would like to retire but who cannot afford to lose health insurance to do so. This would relieve health burdens from private industry, while not infringing on the employer-insurance systems still in effect for the prime-age workforce. Note that transferring workers from private health care to Medicare in this age bracket has no real economic cost: the same health care is provided to the same people. In fact, the reduction in private insurance claims and bookkeeping constitutes a real saving.

These measures are among the most promising available at this moment. Congress should be prepared to use them if and when it becomes clear that the present policies are insufficient. And the historical linkage between Social Security and Medicare benefits and the payroll tax should then be broken. Social Security and Medicare obligations should be treated, henceforward, as simply the bonded obligations of the government — like net interest, backed by the full faith and credit — thus making explicit what is obvious to any careful observer, which is that these programs cannot go “bankrupt” anymore than the government of the United States can go bankrupt, which it cannot.

And of course the United States Government has not gone bankrupt, in more than two centuries of continuous operations and through much bigger deficits and greater trials than we are experiencing just now.

5. Keep People in Their Homes

The housing crisis is at the root of our difficulties, for since the Tax Reform Act of 1986 our economy has been strongly biased toward collateralizing lending with homes. This model, which built up a structure of debt over a very long period of time, has now collapsed. It has collapsed, moreover, in ways that not only have destroyed the market for sub-prime securities, but that also have compromised secondary markets for prime mortgages.

There is no way for public policy to stabilize housing prices as such in the near term. House prices are private contracts for idiosyncratic goods, and cannot be controlled. Therefore, policy must focus on the proximate problem, which is chronic excess supply. The only way to do that, short of buying up surplus homes and knocking them down, is to find a means to stop the wave of evictions, vacancies, trash-outs and forced sales that is overwhelming the system.

In economic terms the problem is simple: how to align, in a way that is fair and sustainable, the payments people are required to make on their houses with their actual capacity to pay? But there is a corollary which is not so simple: how to do so in ways that do not encourage irresponsible behavior on the part of homeowners who are not in trouble?

The administration’s plan of action in the housing sphere is a bright spot on the policy horizon. It meets, so far as I can tell, the tests of fairness and sustainability reasonably well. But it does so only for a limited class of borrowers, who are not too deeply underwater already on their homes. It will provide a measure of relief, but it will not, so far as I can tell, either stop the wave of foreclosures or prevent a continued decline in prices.

There are, I think, two basic alternatives that might work. One would be to declare a comprehensive moratorium on new foreclosures, and then to turn over the entire portfolio of troubled mortgages to an entity like the depression-era Home Owners Loan Corporation for triage and renegotiation on a case-by-case basis. The advantage of this approach is that, if done on a large enough scale, it would work. An HOLC could distinguish honest from fraudulent borrowers, fit legitimate homeowners into appropriate work-out categories, and manage or dispose of the properties of the rest. Meanwhile people would enjoy a presumptive right to stay in their homes. The difficulty is that this would take a long time and a lot of money and manpower, and the system would still be prone to manipulation, at least to some degree.

An alternative, suggested by Warren Mosler, is to allow the ordinary foreclosure process to work. But, after foreclosure, owner-occupied properties would be bought at the lower of the appraisal price or mortgage balance by a new federal entity, and the previous owner allowed to stay in the house for a fair market rent, with the option of repurchasing the home at a fair appraisal value later on. This would have the advantage of protecting against moral hazard, while at the same time preserving occupancy, to the maximum extent possible.

6. The Long Term Starts Now: Infrastructure, Energy and the Dollar

Finally, though these remarks depart from the realm of monetary policy in a strict sense, it is important to make them briefly.

First, no recovery program will work unless crude oil imports in the upswing are effectively curtailed. Failure to do this simply leaves the power to set oil prices in the hands of speculative markets and the swing producers — Saudi Arabia and possibly Russia. This is the channel that poses the most serious inflation risks going forward.

Second, a growing economy down the road will need new focal points for public and private investment. Infrastructure and energy are clearly the great challenges ahead: infrastructure because this vital contributor to efficiency and competitiveness has been severely neglected for decades, and energy because of the danger of climate change. The correct approach to infrastructure remains a National Infrastructure Fund — a permanent facility that can provide funds to state and local governments and to regional authorities independently of market conditions, while serving as a source of standards and providing a measure of oversight.

Third, energy conservation and the production of sustainable energy are areas with potential for great gains; since the United States is the world’s greatest per capita greenhouse gas emitter we have the capacity to make the largest improvements. But there is also the potential here for economic gains: if we do this job right, we can develop new industries which will set standards for efficient and sustainable energy production and use, and reduce our trade deficits, over time, both by curbing imports and by exporting these new products to the world. These new industries will help sustain the international position of the dollar in the long run.

For the time being, the world crisis has revealed the relative strength of the dollar and the structural weakness of the euro and of other major currencies. This situation, which has surprised many, removes the concern that the dollar will lose its reserve status — at least for the moment. But it awakens an equally serious danger, which is that instability between world currencies could produce a cumulative spiral of global economic collapse. This is an important danger, for which we are ill-prepared. There needs to be a new attention to the financial architecture, both to achieve a coordinated fiscal expansion and to admit the serious possibility of an even larger crisis, preparing for the moment when major reforms may be required.

The time to start work on all of these issues is now. Let’s face it. We are not in a temporary economic lull, an ordinary recession, from which we will emerge to return to business-as-usual. We are at the beginning of a long, profound, painful process of change. Of irreversible change. For better or for worse. We need to start thinking and acting accordingly.

Thank you very much for your time and attention.

Table One. CBO’s Baseline Forecasts, February 11, 2009, from a letter from Douglas Elmendorf, Director, to Senator Judd Gregg.

Figure One. The Output Gap: Levy Institute Strategic Analysis, December 2008.

The statement (in PDF) is available at the Web site of the House Committee on Financial Services: <house.gov/apps/list/hearing/financialsvcs_dem/galbraith022609.pdf>.