Brazil’s first quarter GDP shows continued expansion, driven by manufacturing and private consumption. The economy grew at an annualized rate of 5.4 percent in the first quarter, and over the last four quarters it has grown 4.2 percent. The two sectors that have had the strongest recovery since the recession, minerals extraction and finance, both lost some ground in the most recent quarter, but both have still far outpaced other sectors since the recession in late 2008. Meanwhile, the sector with the slowest growth since the recession, manufacturing, saw its strongest quarter in a year and reached its pre-recession level.

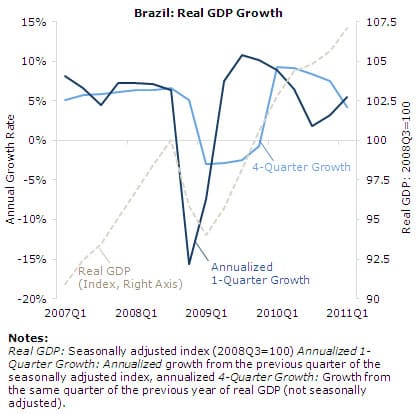

During the world financial crisis and recession, Brazil lost 6 percent of GDP in just two quarters: the last quarter of 2008 and the first quarter of 2009, which saw annualized growth of -15.7 and -7.4 percent, respectively. However, it recovered very rapidly: the next four quarters saw annualized growth rates of 7.6, 10.8, 10.2, and 8.9 percent, respectively. Growth slowed to an annualized rate of 1.8 percent in the third quarter of 2010 but has since regained momentum. Annualized quarterly growth rose to 3.2 percent in the fourth quarter and 5.4 percent in the first quarter of 2011.

The Industry and Service Sectors

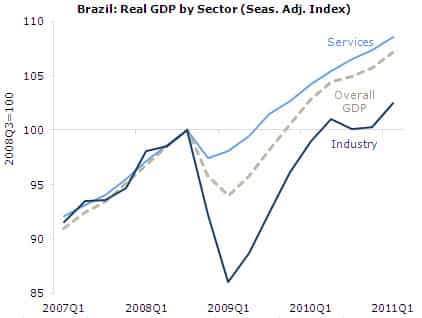

The recovery has been heavily concentrated in the service sector, in which the downturn and recovery to pre-recession levels lasted only four quarters. In the fourth quarter of 2008 the sector lost 2.6 percent of its pre-recession peak, but by the third quarter of 2009 it had regained this ground. In the first quarter of 2011, it grew at an annualized rate of 4.3 percent and has grown 4.0 percent in the last four quarters. It has now reached 8.5 percent above its pre-recession peak level. Industry has not fared as well: it shrank by 12.3 percent during the recession, during two quarters, and took four additional quarters of growth to regain its pre-recession levels. In the most recent quarter, it grew at an annualized rate of 8.9 percent, more than twice the growth recorded in the services sector, but over the last four quarters it has grown at a more modest 3.5 percent and is still only 2.4 percent above its 2008 levels.

The Service Sector

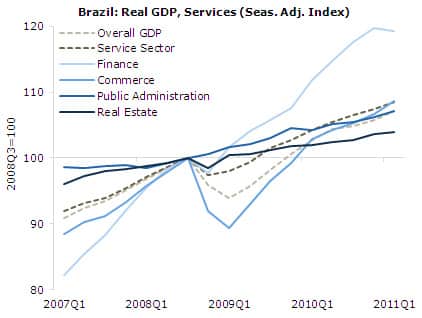

Within the service sector, financial intermediation and insurance has risen at a much faster pace than any other major area. The first quarter of 2011 saw this progress falter for the first time since the recession: it shrank at an annualized rate of 1.6 percent per year, but it is still 19.3 percent above its pre-recession levels. Over the last four quarters, it has grown 6.4 percent, and since the 2008 peak it has grown at an average rate of 7.3 percent per year. This is more than twice the growth in the overall services sector, and GDP as a whole, which have grown at average annual rates of 3.3 and 2.8 percent per year, respectively, since the 2008 peak.

The next best-performing area of the service sector has been commerce. It lost 10.6 percent of its output during the recession, more than any other area of services, but it has since recovered to 8.6 percent above its pre-recession peak, about the same level as the services sector overall. The other two major areas of the service sector, real estate and public administration, saw smaller declines during the recession and less growth thereafter. Real estate saw only one quarter of decline during the recession, in which it shrank by just 1.5 percent. Since then it has seen modest growth: it grew at an annualized rate of just 1.0 percent in the first quarter of 2011 and has grown 1.9 percent over the last four quarters. It is currently 3.9 percent above its pre-recession level. (Note that this is measured in real, inflation-adjusted terms, so the large price increases in residential real estate do not show up here.) Public administration is the only major services area that saw no decline during the recession and instead saw continued growth until 2010, when it briefly faltered (shrinking at an annualized rate of 1.5 percent in the first quarter), and continued growing. It has grown 2.8 percent over the last four quarters and grew at an annualized rate of 3.5 percent in the first quarter of 2011.

The Industrial Sector

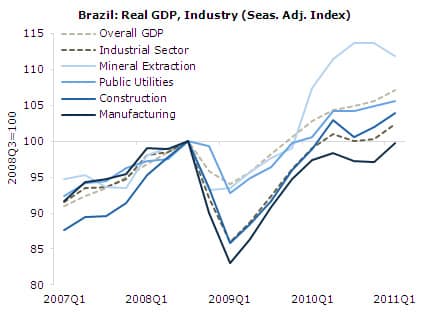

Like the service sector, the industrial sector has one area growing much more quickly than the rest: in this case, mineral extraction. It shrank less during the recession (6.8 percent), and for a shorter time (only one quarter), than any other industry. While other industries saw their recovery stagnate in 2010, mineral extraction had three very strong quarters of growth that year, growing at an annualized rate of 38.9, 15.5, and 8.6 percent in each of the first three quarters, respectively. The last quarter of 2010 was essentially flat (it shrank at an annualized rate of 0.2 percent), and the first quarter of 2011 brought a more significant decline (at an annualized rate of 5.9 percent). Nonetheless mineral extraction, currently at 12.0 percent above its pre-recession peak, has greatly outperformed the rest of the industrial sector and is the only industry to outperform the economy as a whole.

The worst-performing industry has been manufacturing, which finally recovered its pre-recession level in the first quarter of 2011. It lost 16.9 percent of its output during the recession and, like every other industry except mineral extraction, saw its recovery stagnate again in 2010. However, the first quarter of 2011 saw strong growth (11.6 percent annualized), bringing up its growth over the last four quarters to 2.4 percent.

Of the other two industries, construction has fared worse than public utilities, but both have performed worse than the overall economy. They lost 14.1 and 7.1 percent of their pre-recession activity, respectively, during the recession. After a year of recovery, both saw their progress come to a halt in mid-2010, when construction shrank again at an annualized rate of 9.0 percent and public utilities were essentially flat, with 0.1 percent annualized growth. Both sectors resumed growth, though, and are now 4.0 and 5.6 percent above their respective pre-recession peaks. Over the last four quarters, they have grown 5.2 and 4.9 percent, respectively.

GDP by Expense

The three main domestic expense categories, private consumption, government consumption, and investment, have had three very different trajectories. Private consumption suffered only lightly in the recession and has rebounded strongly. Public consumption shrank by a similar amount during the recession but has recovered much more slowly. Gross fixed capital formation fell severely during the downturn but also made a rapid recovery thereafter.

Private and public consumption both fell for just one quarter during the downturn, by 1.9 and 3.4 percent respectively. Public consumption regained this ground within one quarter of recovery, and private consumption followed one quarter thereafter. Since that point, however, private spending has grown twice as quickly as public spending: an average of 6.5 percent per year compared to 3.2 percent. The data from the most recent quarter appears to buck this trend, with public spending growing at an annualized rate of 3.4 percent, compared to 2.6 percent for private consumption. Still, private consumption has grown to 13.7 percent above its pre-recession peak, and public consumption has only reached 5.8 percent above its own peak. Gross fixed capital formation shrank by almost one quarter (23.8 percent) from the third quarter of 2008 to the first quarter of 2009. Since that trough, however, it has grown at an average rate of over 18 percent per year, recovering to its pre-recession level by the second quarter of 2010. Its growth has slowed some in recent quarters, and in the first quarter of 2011 it grew at an annualized rate of 4.9 percent per year, but over the last four quarters it has still grown by 8.8 percent.

Meanwhile, the trade deficit continues to grow. Imports fell in the first quarter of 2011, at an annualized rate of 6.3 percent, but exports fell by nearly twice as much: an annualized rate of 12.2 percent. Exports only reached their pre-recession levels in the fourth quarter of 2010, but with the negative growth so far in 2011, they have dropped back down to 0.7 percent below their 2008 levels. Imports, which shrank by roughly a quarter (24.9 percent) during the recession, regained their pre-recession levels by the first quarter of 2010 and reached 20.9 percent above those levels by the end of 2010. The first quarter of 2011 saw them decline again, but they are still at 18.9 percent above their pre-recession peak.

This is the first time in more than 10 years that Brazil has seen sustained trade deficits, although they are modest, at 0.7 percent of GDP for the first quarter of 2011. This is down from the first quarter of 2010, when it was 1.1 percent of GDP.

Exports fell from 15.9 percent of GDP in the fourth quarter of 2008 to 9.8 percent one year later, their lowest level since 2000. They recovered to 11.4 percent of GDP in the fourth quarter of 2010 and 11.2 percent in the latest quarter. Imports also fell during 2009, but not as far: from 15.7 percent of GDP in the fourth quarter of 2008 to 10.5 percent one year later. They rebounded to 12.9 percent by the third quarter of 2010, but have since slipped to 11.9 percent.

Overall, the sustained trade deficit and the relatively weak performance of manufacturing as well as the industrial sector (outside of mineral extraction) is very likely the result of the appreciation of the Brazilian real over the last several years. In real terms, the currency remains at levels comparable to those under the Real Plan, before the devaluation of 1998. We can expect these trends in manufacturing, the industrial sector, and the trade deficit to continue so long as currency remains at these high levels or appreciates further.

Rebecca Ray is a Research Associate at the Center for Economic and Policy Research in Washington, D.C. This article was first published by CEPR on 27 June 2011 under a Creative Commons license.

var idcomments_acct = ‘c90a61ed51fd7b64001f1361a7a71191’;

var idcomments_post_id;

var idcomments_post_url;