UPDATE: To drive me absolutely crazy, what I was worried about happening happened. Just as I wrote about their lack of major action, they took major action an hour later. I will be writing Part 5 about all the developments tomorrow. Still, I think there’s a lot of useful analysis of the last week and a half here. —Nathan Tankus. (Click here to see the entire series on “The Federal Reserve’s Coronavirus crisis actions, explained.”)

This is part 4 of my ongoing coverage of the Federal Reserve’s Coronavirus actions. You can read Part 1 here, Part 2 here and Part 3 here. You can also read an “aside” I wrote pointing to the big unanswered questions of the Federal Reserve response here. I’ve delayed writing about the new announcements from the Federal Reserve for a while, in the hopes that big announcements were forthcoming. But this is not the case. We’re still at least a week away from the Main Street Lending Program and it’s impossible to know how quickly the municipal bond buying program will come. It is very disappointing how much Fed responses have slowed down. They seem to believe that there is breathing room now that financial markets don’t seem to be seizing up. But you don’t stop treating patients when the cardiac arrest is over. It’s the time between the most acute phases of the health crisis that are critical and where necessary reforms are the most possible.

March 31st

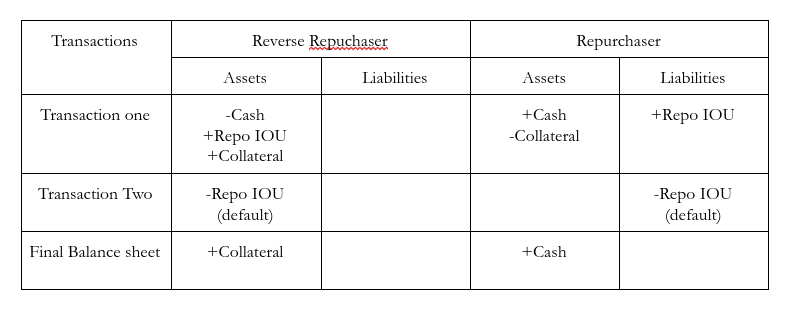

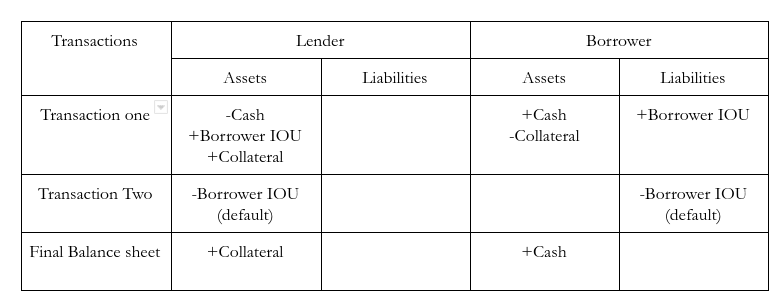

Ten days after the last central bank swap line announcement (see Part 3), the Federal Reserve followed up with an announcement of another facility meant to help a lower tier of central banks. In this facility the Federal Reserve would make a standing offer to temporarily purchase U.S. treasury securities from central banks (and supranational monetary institutions) and sell them back to them the following day. This is known as a repurchase or “repo” agreement. I want to do a quick, simple accounting exercise to illustrate what a “repo” agreement fundamentally is. For the purposes of this example I’m ignoring money creation and more complex forms of credit- the counterparties are simply dealing in “cash”.

When you look closely at these two examples, you’ll notice that they are identical. There is no transactional difference between pledging collateral for a loan and entering a repurchase agreement. The difference between the two is instead legal- you get to keep the collateral almost no matter what in the case of a repo agreement whereas other creditors may also have a strong claim to at least a chunk of the collateral. Thus, in the simplest terms, we can say that the Federal Reserve is providing a standing offer for central banks around the world to borrow dollars by pledging treasury securities as collateral.

Why are they doing this? One reason is clearly that the global shortage of dollars has led central banks to try to dump their holdings of treasuries, which has contributed to the malfunctioning of those markets. This “FIMA” (Foreign & International Monetary Authorities) Repo Facility keeps treasury securities off of private markets. Second is that easing the global dollar shortage is in the U.S. interest. Global instability is not particularly helpful for the U.S. You may wonder why our largest banks weren’t simply able to absorb treasuries onto their balance sheets. We’ll deal with this question during the next announcement.

As Professor Gabor says, FIMA creates a two tiered system. Those in the lower tiers get to pawn their treasury securities (which means they better hope they have enough treasury securities) while those in the top tiers can simply pledge their domestically receivable IOUs to get dollars. Those on the bottom tiers (like Iran) can’t get access to dollars at all because they lack an account with the Federal Reserve all together.

this matters because the new FIMA repo facility creates a two-tier hierarchy of central banks:

1. Swap$ central banks, Fed treats as peers

2. Repo$ central banks, Fed treats as private commercial banks, who can borrow against their Treasurieshttps://t.co/wk388KY7GX— Daniela Gabor (@DanielaGabor) March 31, 2020

This move, while helpful, will not be enough. It also illustrates that there’s a global geopolitical struggle over the U.S. dollar and the Fed is conducting foreign policy. Should the Federal Reserve have sole discretion over foreign policy? What are the negative consequences of the Fed conducting its own, “independent” dollar diplomacy? I hope to tackle this question in future posts.

April 1st

April 1st’s announcement points to one answer for why liquidity in the Treasury Securities market has been so poor- bank balance sheets have not been able to expand to purchase them from non-banks looking to unload them. Why not? Because they count against leverage-based capital requirements. As I (and co-authors) say in our forthcoming report entitled “Monetary Policy for a Green New Deal”:

Leverage based capital requirements impose a strict maximum ratio between net worth and assets that doesn’t weight the assets by any criteria. As is commonly remarked upon, this means treating treasury securities as having the same level of uncertainty embedded in them as private IOUs. The concern policymakers have with leverage based capital requirements is that an attempt to set them so high that they meaningfully curtail the rate of asset growth would lead banks to take on riskier assets than is desirable in order to preserve a certain rate of return. Overly strict leverage-based capital requirements also discourage market-making activities that involve expanding one’s balance sheet substantially on low-risk transactions and inventory accumulations

This is one of the big reasons that the Fed had to move so aggressively to purchase treasury securities. The private financial system was not able to act like a dealer- absorb inventories of assets in buyers markets that they then sold in sellers markets- so the Federal Reserve had to act as “dealer of first resort”. April 1st’s rule change tackles this problem by excluding treasury securities from our leverage-based capital requirement: the supplementary leverage requirement. This change is attempting to move the Fed away from that market making role by ensuring that private actors absorb treasuries as needed. In addition, the rule also excluded settlement balances held in accounts at the Federal Reserve from the supplementary leverage requirement. This is important for slightly different reasons. The Fed doesn’t have to worry about banks not accepting settlement balances in payment. Instead, the worry is that Federal Reserve actions which increase the banking system’s level of settlement balances will force them to reduce other activities.

In this way, Federal Reserve lending to and purchases from non-bank entities could actually reduce bank lending by taking up balance sheet space and moving financial institutions closer to the asset ceiling set by supplementary leverage ratios. Excluding balances held at the central bank prevents this phenomenon. Other central banks have done this kind of thing in normal times. This is another change that is bound to lead to the question “if it’s good enough for a crisis, why isn’t it always good enough?” Leverage ratios that exclude government guaranteed assets, unlimited intraday liquidity and a freely open discount window is a radically different policy suite that should be considered in “normal” times. Unlike now, normal times may require stricter asset-based financial regulations, but that is a feature not a bug.

April 6th

The first announcement of April 6th was a simple one- the implementation of a provision of the CARES Act Congress recently passed. As called for in the legislation, bank regulators lowered the “community bank leverage ratio”, which is an alternative simple leverage ratio provided to banks with less than 10 billion dollars in assets. They lowered the leverage ratio to 8% of total assets, which must rise to 8.5% during 2021 and 9% again in 2022. This is meant to prevent lending cuts to businesses and households. I’m sure it will have some positive effect. It’s also interesting that they are clearly trying to implement this countercyclically, though a more useful analytical framework would have been to set triggers for positive events (such as x% falls in the unemployment rate) rather than assume recovery over the next year or two.

The second announcement of the day was far more interesting. They announced that they are going to create a facility to lend to banks where forgivable loans created and guaranteed by the Small Business Association because of the CARES Act are pledged as collateral. Why is this necessary? It appears to be because these loans are still taking up balance sheet space for banks and thus preventing other forms of lending, despite being government guaranteed. It also seems to be because of difficulties in funding markets generally. It does make one wonder why these loans were done through the Small Business Association in the first place. If they were going to do this, why not have the Fed set up a facility from the beginning and have the Treasury put up equity to facilitate the loans being forgiven? If these loans were made on a no-recourse basis, like Money Market Mutual Fund Liquidity Facility loans, the lender would have no threat of loss this way either. The one possibility I can think of is that lawmakers didn’t realize how administratively difficult these loans would be and now the Fed is stepping into the breach. It is also curious that they are announcing a distinct facility for this and that it isn’t simply a part of the Term Asset Backed Loan Facility. Presumably that’s because these loans will be pre-securitization.

April 7th

This announcement follows a pattern of a series of announcements I’ve discussed before, and one I didn’t on April 3rd. I’m not speaking about that announcement because it’s not really distinct from previous announcements. Regulators continue to “encourage” financial institutions to “work with” debtors. They continue to provide “incentives” to be lenient with borrowers. Unfortunately, the CARES act legislation didn’t really beef up the regulatory response on these issues. Tuesday’s interagency statement contains the disappointing details.

There is a “forbearance” program for federally backed mortgages. The CARES act makes it official that modified loans don’t have to be categorized as “Troubled Debt Restructurings” and don’t have the associated negative regulatory consequences. Those who provide loan modifications to borrowers will “not be criticized”. The most significant part of this latest announcement is that modified loans would still be eligible collateral for borrowing directly from Federal Reserve banks (referred to as “discount window” borrowing). This is overall a small improvement over the previous regulatory guidance. We unfortunately remain in the same position I described last Thursday:

What we do know is that the Federal Reserve is not using its regulatory powers to compel banks to cancel mortgage and other debt payments during the Coronavirus shutdown. While, as we discussed in Part 2, they have said that “loan modifications” will not count as “Troubled Debt Restructurings”, banks still have full discretion to decide whether they’ll waive mortgage payments. This shouldn’t be the case. As Skanda Amarnath argued earlier this afternoon, financial regulators should be informally discussing with banks about the need for them to declare suspensions and holidays. When necessary, they should also threaten them with negative regulatory treatment, up to and including raising capital requirements, in order to compel them to declare such suspensions and holidays.

April 8th

Yesterday’s announcement is relatively minor when it comes to understanding the crisis we’re experiencing and the Federal Reserve’’s response but it is very important to the larger political economy of finance in the United States. In order to facilitate Wells Fargo’s participation in the forthcoming Federal Reserve “Main Street Lending Program” and the Small Business Administration “Paycheck Protection Program”, the restrictions on Wells Fargo’s growth will be modified. Wells Fargo can grow as necessary to make loans under either of these programs. This is notable because Wells Fargo had growth restrictions applied to it by regulators because of its repeated criminal activity in a multitude of areas. It is extremely concerning that they believe we need criminal actors to make these loans. It is also strange that these programs don’t waive the application of capital and liquidity requirements to assets acquired (and liabilities incurred) in the process of participating in these programs. Costing balance sheet space and liquidity for participation doesn’t really make sense.

Announcements like this, as well as the entire structure of the Main Street Lending Program and the Small Business Association’s “Paycheck Protection Program” point to the real problem with a lack of public infrastructure in the United States. A network of public financial institutions (even if they were simply post offices doing payment processing and managing customer bank accounts) would be able administer these kinds of programs, (especially programs with forgivable loans) far more effectively and uniformly than the patchwork attempt by these federal regulatory institutions to supervise private financial institutions making these loans. This alternative infrastructure could also help the public from avoiding reliance on these serially criminal financial institutions. How could we possibly trust an institution with “widespread compliance and operational breakdowns that resulted in harm to consumers”? More than even certain “too big to jail” comments during the Obama administration, this action cements the necessity of even criminal large institutions to implement public policy.

Conclusion

Overall, it has been a quiet couple of weeks at the Federal Reserve. The most notable announcement was the FIMA Repo facility, which is still less significant than any of their central bank swap line announcements. The most interesting one was excluding treasury securities from supplementary leverage requirements, which is an issue so boring that it was the main topic of debate among monetary policy experts from 2015 to early 2016. It is not exactly earth shaking or of world historical importance. No one is going to excitedly write home about lowering the community bank leverage ratio. Even the Wells Fargo announcement provides the chance to relitigate the 2008 crisis. It doesn’t invoke the drama of the Federal Reserve’s first two weeks of responses to the Coronavirus depression. The Fed’s relative inaction is very concerning. We badly need Municipal support and the Main Street Lending Program is shaping up to be a key part of their crisis response. We need faster responses and we certainly can’t afford another week of small-time announcements.