-

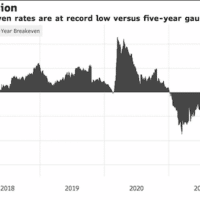

Inflation phobia hastens recessions, debt crises

SYDNEY and KUALA LUMPUR, Sep 27, 2022 (IPS)—Inflation phobia among central banks (CBs) is dragging economies into recession and debt crises. Their dogmatic beliefs prevent them from doing right. Instead, they take their cues from Washington: the U.S. Fed, Treasury and Bretton Woods institutions (BWIs). Costly recessions Both BWIs—the International Monetary Fund (IMF) and World […]

-

1980s’ redux? New context, old threats

As rich countries raise interest rates in double-edged efforts to address inflation, developing countries are struggling to cope with slowdowns, inflation, higher interest rates and other costs, plus growing debt distress.

-

A “lost decade” for developing countries?

Developed countries use 3.5% of their income to pay interest on their debt, while developing ones must use 14%, which complicates their situation.

-

Why Coinbase’s balance sheet has massively inflated

Coinbase recently filed its interim financial report. It makes pretty grim reading. A quarterly net loss of over $1bn, net cash drain of £4.6bn in 6 months, fair value losses of over 600k…

-

Stagflation: From tragedy to farce

SYDNEY and KUALA LUMPUR. Half a century after the 1970s’ stagflation, economies are slowing, even contracting, as prices rise again. Thus, the World Bank warns, “Surging energy and food prices heighten the risk of a prolonged period of global stagflation reminiscent of the 1970s.”

-

Economics and the law of the hammer

As yours truly has reported repeatedly during the last couple of years, university students all over the world are increasingly beginning to question if the kind of economics they are taught–mainstream economics–really is of any value. Some have even started to question if economics is a science.

-

USA: World’s largest producer of oil AND its largest oil consumer

According to an analysis by Elements Newsletter based on the BP Statistical Review of World Energy 2022, roughly 43% of the world’s oil production came from just three countries in 2021 — the US, Saudi Arabia, and the Russian Federation. Together, these three countries produced more oil than the rest of the top 10 combined.

-

Real debt trap: Sri Lanka owes vast majority to West, not China

Sri Lanka owes 81% of its external debt to US and European financial institutions and Western allies Japan and India. China owns just 10%. But Washington blames imaginary “Chinese debt traps” for the nation’s crisis, as it considers a 17th IMF structural adjustment program.

-

Cryptocurrencies must die

Bitcoin had gone from around USD 4,000 to USD 64,000, a sixteen fold increase, in 20 months. Other cryptocurrencies had even more ridiculous price increases in the same time period – Ethereum had a 50 fold increase, Solana 500 times, and LUNA had a 1,000 times increase. Now, these cryptocurrencies are crashing down.

-

The inhumanity of capitalism

For over two years now, the world has been facing a pandemic the like of which has not been seen for a century, and which has already taken 15 million lives according to the WHO, without being anywhere near an end.

-

2005-22′: The crisis of western capitalism behind the left and far right radicalism

It is simply impossible to understand what is going on now in the world if we don’t take into consideration the crisis the globally dominant Western capitalism has been facing since 2008.

-

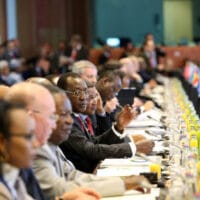

African leaders opting for nonalignment amidst tensions in Europe

In addition to today’s fuel and energy crises, food insecurity has been a major issue for a number of reasons and, with the current Russian-Ukrainian war, a global food crisis and hunger is a real risk. Unfortunately, this may pave the way for a kind of food diplomacy and food wars.

-

Beyond Eurocentrism

If you really want decolonisation, go beyond cultural criticism to the deep structural insights of economist Samir Amin.

-

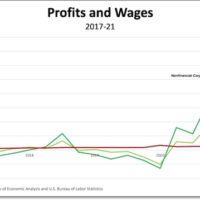

Inflation and the case of the missing profits

Everyone knows that inflation in the United States is increasing. Anyone who has read the news, or for that matter has gone shopping lately. Prices are rising at the fastest rate in decades. The Consumer Price Index rose 8.6 percent in March, which is the highest rate of increase since December 1981 (when it was 8.9 percent).

-

Ukraine and the Global economic war: barbarism or civilisation?

DOES the Ukraine war and the action of the U.S., EU, and the UK spell the end of the dollar as the world’s reserve currency? Even if the peace talks between Russia and Ukraine reach a 15-point peace plan, as Financial Times has reported, the fallout for the dollar still remains.

-

Financialization at heart of economic malaise

COVID-19 has exposed major long-term economic vulnerabilities. This malaise–including declining productivity growth–can be traced to the greater influence of finance in the real economy.

-

An unimaginable contrast

Much has been written about the immense increase in economic inequality that has occurred of late and various startling figures have been provided by bodies like Oxfam, which has just come out with a report titled ‘Inequality Kills.’

-

The Left has culture, but the World still belongs to the banks: The Sixth Newsletter (2022)

Dear friends, Greetings from the desk of the Tricontinental: Institute for Social Research. ‘[T]here is great intellectual poverty on the part of the right wing’, Héctor Béjar says in our latest dossier, A Map of Latin America’s Present: An Interview with Héctor Béjar (February 2022). ‘There is a lack of right-wing intellectuals everywhere’. Béjar speaks […]

-

There is no Nobel Prize in economics

Let’s debunk a myth. There is no “Nobel Prize in Economics”. On Nov 27, 1895, when Alfred Nobel signed his will, he left five prizes in alphabetical order to: chemistry, literature, peace, physics, and physiology or medicine. The Nobel Prize in Economics is declared after the Panchapandavas above.

-

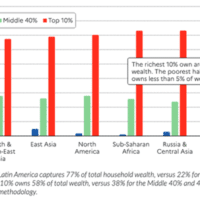

World inequality

The world has become more unequal in income and wealth in the last 40 years. That’s according to the World Inequality Report 2022.