-

A wealth tax: because that’s where the money is

The bank robber Willie Sutton, when asked by a reporter why he robbed banks, is reputed to have answered, “Because that’s where the money is.” Which brings us to a wealth tax.

-

The empire, Trump and intra-ruling class conflict

Over the past few months President Trump has unilaterally by Tweet and telephone begun to dismantle the U.S. military’s involvement in the Middle East. The irony is amazing, because in a general overarching narrative sense, this is what the marginalized antiwar movement has been trying to do for decades.(1) Prof. Harry Targ, in his important […]

-

Apartheid in the global governance system

In my research I have argued that rising global inequality is driven in large part by power imbalances in the global economy, in that rich countries have disproportionate influence when it comes to setting the rules of international trade and finance.

-

Another look at the Federal Reserve’s panic in September 2019 and solutions to the crisis

You may recall that from 17 September 2019, the United States Federal Reserve injected massive amounts of liquidity into banks due to a quite abnormal situation on the repo market.(1) The repo market designates a mechanism used by banks to obtain short-term financing. They sell securities they hold in repurchase agreements (repo).

-

The U.S. armed and funded extremists in Syria

The US armed and funded extremists in Syria to overthrow the Syrian government and the media cheered. Those same extremists then attacked the Kurds on Turkey’s behalf to the horror of the same media. Now what?

-

The IMF does not fight financial fires but douses them with gasoline

On 13 October, Moreno had to promise to withdraw Decree 833. Pressure from the streets, from the United Nations, and from the Ecuadorian Episcopal Conference forced him to the table, where a televised discussion was held. The indigenous leaders won the ‘debate’–they were much more prepared and far more humane than the president and his clumsy ministers.

-

Ireland is a racket (for foreign capital)

For 60 years Ireland has based its economy on attracting in foreign direct investment. And what’s has it got to show for it? One of the highest per capita national debts in the world and one of the highest rent regimes in the world.

-

Impeachment watch

In their crusade to get Trump and distract from their own corruption, the Democrats have moved on from Russiagate to an impeachment inquiry over “Ukrainegate.”

-

A green Earth with peace and room for us all

Draft Globalization programme submitted by the National Board of the Red-Green Alliance/Enhedslisten, Denmark, to the party’s next Annual Congress on 5 – 6 October. It is a programmatic text about global development.

-

iPhone workers today are 25 times more exploited than textile workers in 19th Century England

A recent report by the International Labour Organisation shows that the total global labour force is now measured at 3.5 billion workers. This is the largest size of the global labour force in recorded history. Talk of the demise of workers is utterly premature when confronted with the weight of this data.

-

Education Dept says Middle East Studies program has to advance the security interests of the United States in order to receive further funding

The U.S. Department of Education has determined the Duke-University of North Carolina Consortium for Middle East Studies misused Title VI funds and they’re requiring the program to provide a revised list of activities that will use these funds over the coming year.

-

Marx on taxation

“Marx on tax” is seen as an “empty box” by David Harvey in his latest book on Capital, but Marx and Engels had plenty to say about tax. Their tax theorizing is no anachronistic curiosity but perfectly applicable to the income and wealth inequalities of our own era.

-

Top 1% up $21 Trillion. Bottom 50% down $900 Billion.

The insights of this new data series are many, but for this post here I want to highlight a single eye-popping statistic. Between 1989 and 2018, the top 1 percent increased its total net worth by $21 trillion. The bottom 50 percent actually saw its net worth decrease by $900 billion over the same period.

-

Outsourcing exploitation: global labor-value chains

Through their control over supply chains, multinationals based in the global north exploit workers in the global south.

-

Lula: “U.S. hand” on everything that’s happened in Brazil

In an interview with Bob Fernandes, on TVE Bahia, former president Luiz Inácio Lula da Silva said that the U.S. government “created the Lava Jato investigation to take our oil.”

-

Time is running out

Richard Reeves is right about one thing: time is crucial to capitalism’s legitimacy. The premise and promise of capitalism are that the future will be better than the present. And “if capitalism loses its lease on the future, it is in trouble.”

-

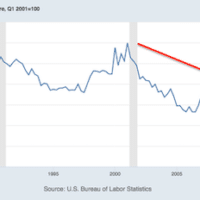

CEO compensation has grown 940% since 1978

Typical worker compensation has risen only 12% during that time

-

China & World trade

Just in case you had forgotten that China is a major part of the global economy, here is a chart from the Bank of England’s Financial Stability Report.

-

The NYT’s six percent solution for student debt

Why are Democratic candidates going on about student loan debt? Why, the problem is practically solved already!

-

Imperialism in a coffee cup

Why is it that just 1p of a £2.50 cup of coffee goes to the farmer who cultivated and harvested the coffee beans?