-

Facing the left-wing challenge in the European Union

One of the central and most concrete themes that the break should cover concerns the way public indebtedness is used to justify austerity policies.

-

Living our lives inside a tragedy the size of the planet

After fifteen years in the cold, the International Monetary Fund (IMF) returned to Argentina this May. President Mauricio Macri promised to attract foreign direct investment and to make his country the ‘supermarket of the world’. Instead, Argentina’s economy went into a tailspin. The IMF entered with its shop-worn prescriptions, a recipe that it has effectively sold for the past four decades: structural adjustment.

-

Dossier 10: Argentina goes back to the IMF

For six months, Argentina has been confronted with a new economic and social crisis on a massive scale. In the context the devaluation of local currency, rising inflation, and a deep recession, Mauricio Macri’s administration struck an agreement with the IMF, marking a major shift in the country’s future. The agreements slash public spending and prioritize the repayment of debt, among other measures. This dossier examines the different dimensions of the crisis, the open disputes, and the possibilities for the immediate future.

-

Prisoner prophet: revisiting George Jackson’s analysis of systemic fascism

The rise of Donald Trump has brought talk of fascism to the forefront. While comparing U.S. Presidents to Hitler is certainly nothing new–both Obama and W. Bush were regularly characterized as such by their haters–Trump’s emergence on the national political scene comes at a very peculiar moment in U.S. history.

-

The law versus worker rights

Organizing a union is no easy task in the United States. Although organizing a union is supposed to be a protected right, businesses regularly fire union supporters knowing that they face minimal punishment even if found guilty for their actions. In fact, the rights of all workers, regardless of their interest in unionization, are being whittled down. Simply put, U.S. law doesn’t work for workers.

-

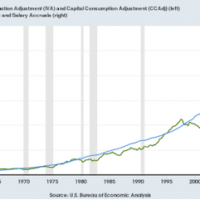

Never have corporate profits outgrown employee compensation so clearly and for so long

Those aren’t my words. The quotation that forms the title of this post is from a recent Federal Reserve Bank of St. Louis blog post.

-

Corporate concentration, intellectual property rights, and U.S. public policy

Dominant corporations have dramatically increased their market power in the U.S. over the last decades, allowing them to boost their profits and, by extension, political power. And, although rarely acknowledged by the media, this trend owes much to the way public policy has promoted corporate intellectual property rights at the public expense.

-

Yes, ExxonMobil and Chevron are still distorting climate science

If you look at headlines from the last year, ExxonMobil, Chevron and other major fossil fuel companies have seemingly turned a new page on climate change.

-

Sciences of inequality

Last month, Philip Alston, the United Nations Special Rapporteur on extreme poverty and human rights (whose important work I have written about before), issued a tweet about the new poverty and healthcare numbers in the United States along with a challenge to the administration of Donald Trump (which in June decided to voluntarily remove itself from membership in the United Nations Human Rights Council after Alston issued a report on his 2017 mission to the United States).

-

The U.S. medical system: healthy profits at people’s expense

The health-care industry overtook the retail sector as the nation’s largest employer in December, giving local economies and their workers a stake in the industry’s growth. Health jobs surpassed manufacturing jobs in 2008.

-

Brazil: left unites in support of Haddad as candidate works to woo voters

The Democratic Labor Party, which got 12.5 percent of the vote, confirmed its support for Workers’ Party candidate Fernando Haddad.

-

Puerto Rico governor calls for ‘elimination’ of Venezuela’s government

GOVERNOR of Puerto Rico Ricardo Rossello has called for the “elimination” of Venezuelan President Nicolas Maduro and announced that a summit of opposition leaders will be held on the occupied U.S. island later this month.

-

U.S. Nobel winner, who sold his medal to meet medical bills, dies

Leon Lederman had to auction his Nobel medal for physics to meet sky-high healthcare costs.

-

Market meltdown

Grace Blakeley dissects the failure of finance capital and calls for radical measures to take it back under democratic control.

-

Socialism is about workers, not wealth funds

The Social Wealth Fund plan is insidious in the sense that it has the capacity to redirect vast amounts of energy and resources toward a goal presented as “socialist” when in reality it is fundamentally incompatible with socialism. We must bring the discussion out into the open to prevent such seductive ideas from compromising the basic vision and integrity of socialism.

-

U.S. public school teachers: declining pay, growing militancy

Strikes continue to be an effective way for teachers to improve their living and working (and by extension student learning) conditions. And, polls show that a strong majority of parents continue to support them. Popular support for teacher strikes remains strong The education pollster PDK recently asked adults what they thought about teacher salaries and […]

-

Why clubbing employment and work in India is misleading

This lack of distinction explains the decline in women’s workforce participation rates. The decline reflects a shift from paid to unpaid work.

-

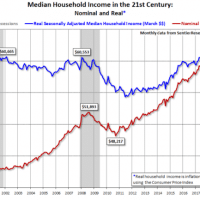

The 21st Century has been hard on U.S. households

The 21st Century has not been a good one for most working people in the United States. In fact, for most of this century, real median household income has been below its starting value in January 2000.

-

The optimism of a victor

Finding a formula to describe Fidel is no easy task.

-

The oldest profession

In the second installment of our subseries Rebel Women, Madeleine Johansson gives her thoughts on the topic of ongoing debate, sex work, and how we on the left should relate to it.