-

Developing countries need monetary financing

Developing countries have long been told to avoid borrowing from central banks (CBs) to finance government spending. Many have even legislated against CB financing of fiscal expenditure.

-

Stop worshiping central banks

Preoccupied with enhancing their own ‘credibility’ and reputations, central banks (CBs) are again driving the world economy into recession, financial turmoil and debt crises.

-

Central bank myths drag down world economy

The dogmatic obsession with and focus on fighting inflation in rich countries are pushing the world economy into recession, with many dire consequences, especially for poorer countries. This phobia is due to myths shared by most central bankers.

-

Ideology and dogma ensure policy disaster

Central banks (CBs) around the world–led by the U.S. Fed, European Central Bank and Bank of England–are raising interest rates, ostensibly to check inflation. The ensuing race to the bottom is hastening world economic recession.

-

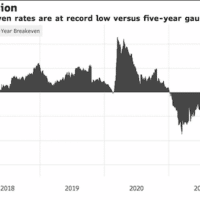

Inflation targeting farce: High costs, moot benefits

Sep 20, 2022 (IPS). Policymakers have become obsessed with achieving low inflation. Many central banks adopt inflation targeting (IT) monetary policy (MP) frameworks in various ways. Some have mandates to keep inflation at 2% over the medium term. Many believe this ensures sustained long-term prosperity.

-

Africa struggles with neo-colonialism

After a quarter century of economic stagnation, African economic recovery early in the 21st century was under great pressure even before the pandemic, due to new trade arrangements, falling commodity prices and severe environmental stress.

-

1980s’ redux? New context, old threats

As rich countries raise interest rates in double-edged efforts to address inflation, developing countries are struggling to cope with slowdowns, inflation, higher interest rates and other costs, plus growing debt distress.

-

How NOT to win friends and influence people

After four years of Trump’s ‘America first’ isolationism, U.S. President Joe Biden announced “America is back”. His White House has since tried to find allies against China and Russia.

-

Stagflation: From tragedy to farce

SYDNEY and KUALA LUMPUR. Half a century after the 1970s’ stagflation, economies are slowing, even contracting, as prices rise again. Thus, the World Bank warns, “Surging energy and food prices heighten the risk of a prolonged period of global stagflation reminiscent of the 1970s.”

-

Neo-colonial currency enables French exploitation

SYDNEY and KUALA LUMPUR. Colonial-style currency board arrangements have enabled continuing imperialist exploitation decades after the end of formal colonial rule. Such neo-colonial monetary systems persist despite modest reforms.

-

Africa taken for ‘neo-colonial’ ride

SYDNEY and KUALA LUMPUR. Like so many others, Africans have long been misled. Alleged progress under imperialism has long been used to legitimize exploitation. Meanwhile, Western colonial powers have been replaced by neo-colonial governments and international institutions serving their interests.

-

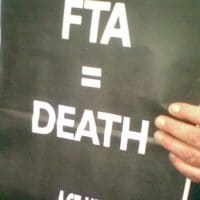

Weaponizing Free Trade Agreements

Long seen as means to seek advantage on the pretext of providing mutual benefit, free trade agreements may increasingly become economic weapons in the new Cold War, disrupting earlier globalization.

-

SWIFT dollar decline

SYDNEY and KUALA LUMPUR: U.S.-led sanctions are inadvertently undermining the dollar’s post-Second World War dominance. The growing number of countries threatened by U.S. and allied actions is forcing victims and potential targets to respond pro-actively.

-

Fighting inflation excuse for class warfare

SYDNEY and KUALA LUMPUR. A class war is being waged in the name of fighting inflation. All too many central bankers are raising interest rates at the expense of working people’s families, supposedly to check price increases.

-

When saviours are the problem

SYDNEY and KUALA LUMPUR: Central bank policies have often worsened economic crises instead of resolving them. By raising interest rates in response to inflation, they often exacerbate, rather than mitigate business cycles and inflation.

-

Sri Lankan economic crisis inflicted by self-serving elite

SYDNEY and KUALA LUMPUR: Once deemed a basic human needs success story, Sri Lanka (SL) is now in its worst economic crisis since independence in 1948. Nonetheless, SL’s ‘moment of truth’ now offers lessons for other developing countries.

-

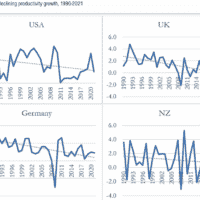

Financialization at heart of economic malaise

COVID-19 has exposed major long-term economic vulnerabilities. This malaise–including declining productivity growth–can be traced to the greater influence of finance in the real economy.

-

Climate change: Adapt for the future, not the past

Funding for developing countries to address global warming is grossly inadequate. Very little finance is for adaptation to climate change, the urgent need of countries most adversely affected. Also, adaptation needs to be forward-looking rather than only addressing accumulated problems.

-

Profiting from the carbon offset distraction

Carbon offset markets allow the rich to emit as financial intermediaries profit. By fostering the fiction that others can be paid to cut greenhouse gases (GHGs) instead, it undermines efforts to do so.

-

Climate injustice at Glasgow COP-out

Former Irish President Mary Robinson observed, “People will see this as a historically shameful dereliction of duty,… nowhere near enough to avoid climate disaster.”