-

The United States and the Bretton Woods Twins

With President Donald Trump and his team launching an aggressive attack on international institutions and threatening to pull out from many of them, there has been speculation about whether they would adopt the same strategy with respect to the Bretton Woods institutions.

-

Trump 2.0: An inflection point for global capitalism?

“This is a new form that inter-imperialist relations have taken. It is not the old form of inter-imperialist rivalry that precipitated world wars.”

-

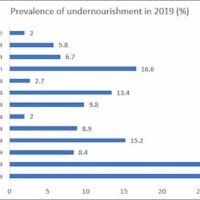

A food crisis not of their making

The crisis in low, middle-income nations is driven by speculation, falling purchasing power and depreciating currencies.

-

Capital flight from emerging markets

Financial markets in the so-called ‘emerging economies’ are in turmoil. At the end of May 2022, the Financial Times reported that the return delivered by emerging market (EM) sovereign bonds was around minus 15 per cent for 2022, the worst since 1994.

-

Why are global wheat prices rising so much?

The global food crisis has now grown to such proportions that everyone is talking about it (even though world leaders are doing relatively little about it).

-

How emerging markets hurt poor countries

Financial globalization was supposed to spur development. Instead, it transfers money to the global North and exacerbates existing inequalities.

-

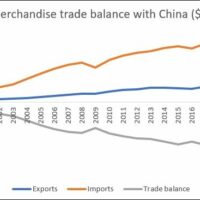

What has the Trade “War” between the United States and China achieved?

On July 6, 2018, U.S. President Donald Trump unilaterally imposed a 25 per cent tariff on Chinese imports of around $34 billion, and further tariffs in 2018 and 2019—claiming that trade between U.S. and China had been unfairly skewed in China’s favour and needed to be rebalanced.

-

Is public investment holding up global capitalism’s dynamism?

Capitalism is supposed to be all about economic growth, through the dynamism that is created by competition. This growth is meant to be driven by investment (or accumulation) which, in turn, is used to justify the shares of national income that are delivered to private profits, to the owners of capital.

-

Hunger, again

The world has been preoccupied with the COVID-19 pandemic, and this has also affected policymakers everywhere. There is much more recognition today of the terrible effects of underfunding public health over decades and how this affects the resilience of economies and societies.

-

Changing the speculative game

January proved to be an unusual month in the U.S. equity market. The shares of GameStop, a brick-and-mortar retailer of gaming consoles and video games, had in the course of that month risen by close to 2000 per cent.

-

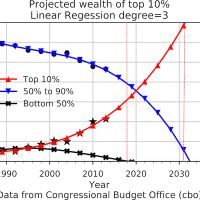

Prepare for a surge in Global inequality

The evidence clearly is that the Covid-crisis has upended the fiscal conservatism that has been the hallmark of the neoliberal era since the 1980s.

-

Bilateral swaps in China’s global presence

China’s use of yuan-denominated central bank swaps, while enhancing its influence, is a source of support for developing countries in an unequal international order.

-

Growing divergence between China and ‘Developing Asia’

The past year has brought into sharp relief the significant differences between China and the rest of the world.

-

It’s all work and no pay for most women in India

The NSSO’s time use survey reveals striking facts about how men and women in India spend their time very differently, with women hugely burdened by unpaid work

-

COVID-19 adds new dimensions to U.S.-China trade war

The Trump regime is ratcheting up its protectionist rhetoric vis-à-vis China. If this leads to new sanctions, it would worsen the COVID-induced trade crisis rather than help the U.S.

-

Growth figures underscore economic crisis amidst COVID

Early evidence on the intensity and drivers of the COVID-induced crisis in the U.S. and Europe suggests that the official response may lengthen the recession and delay recovery

-

A niggardly response to an extraordinary crisis

In a show of solidarity, some of India’s opposition leaders have declared the much-delayed relief package (titled Pradhan Mantri Garib Kalyan Yojana) announced by Finance Minister Nirmala Sitharaman on March 26 to mitigate the effects of the Coronavirus pandemic on the poor as a welcome “first step”.

-

No escape from low growth

Discussions on the state of the world economy centre around the likely negative impact of the novel coronavirus epidemic and the potential positive effect of the truce reflected in the “phase 1” trade deal between China and India.

-

End of the free trade myth

“Is that a big deal?”, some may ask. It is to those who have pushed for achieving the far-reaching liberalisation of trade in an unequal global order, first under the General Agreement on Tariffs and Trade (GATT), and then under the auspices of the agreements that established the WTO and defined and expanded its remit.

-

A rate cut that failed to please

On 31 July, the United States Federal Reserve System (U.S. Fed) announced its decision to cut its benchmark short-term interest rate by one quarter of a percentage point to a target range between 2% and 2.25%. It also announced that it would put an end to its policy of selling chunks of its holdings of securities, so as to unwind its bloated balance sheet.