-

The New Postcolonial Economics with Fadhel Kaboub

In this episode, we speak with Fadhel Kaboub (@fadhelkaboub), associate professor of economics at Denison University and President of the Global Institute for Sustainable Prosperity. Fadhel outlines a new critical approach to postcolonial political economy, arguing that re-gaining financial sovereignty is a crucial next step for postcolonial nations hoping to achieve social, economic, and environmental justice.

-

No migration without economic exploitation

Why are thousands of Central Americans fleeing violence and economic devastation and flocking to the United States? Because of the American dream? Because the streets are paved in gold?

-

‘Corbynomics’ as fair and caring socialism

Karl Polanyi’s reciprocal, redistributive substantive-socialism; ‘Corbynomics’ as fair and caring socialism.

-

Confronting Cinema’s Fascist Unconscious with Maxximilian Seijo

In this episode, Money on the Left cohost Maxximilian Seijo (@maxseijo) expands upon the argument made in his video essay, “Inglorious Basterds: Nazi Desire Fully Employed,” which takes a neochartalist lens to Quentin Tarantino’s Inglorious Basterds (2008).

-

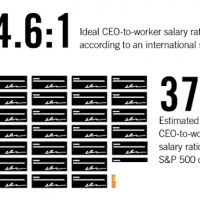

Marx ratio

First there was the Great Gatsby curve. Then there was the Proust index. Now, thanks to Neil Irwin, we have the Marx ratio.

-

Job Guarantee as Historical Struggle with David Stein

In our inaugural episode, we consider the recent resurgence of full employment politics in the United States from both a political and historical perspective with historian David Stein (@davidpstein).

-

China’s determined march towards the ecological civilization

There is no time for long introductions. The world is, possibly heading for yet another catastrophe. This one, if we, human beings will not manage to prevent it, could become our final.

-

Inequality and fairness

In a 2014 study, Sorapop Kiatpongsan and Michael Norton asked about 55,000 people around the globe, including 1,581 participants in the United States, how much money they thought corporate CEOs made compared with unskilled factory workers.

-

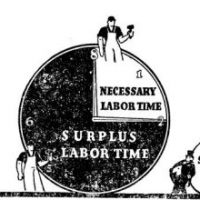

Calculating surplus value to facilitate workplace organizing

Using Marx’s critique of political economy, it’s possible for workers employed in a variety of industries to calculate the value of their work and how this value is divided between employer and employee. It becomes possible to calculate the socially necessary labor time and surplus labor time, worker wages and employer profits in their particular workplace.

-

Commoditisation and the public sphere

The commoditisation of education which makes it completely incapable of providing students with the wherewithal to engage in any active and worthwhile public discourse, has proceeded apace under the neo-liberal regime.

-

Does capitalism depend on credit?

Credit is essential for the continuation of capitalism but also a major source of its instability, writes the Marx Memorial Library.

-

Half a year on from Hurricane Maria, many Puerto Ricans lack running water and electricity

PUERTO RICANS marked six months today since the formation of Hurricane Maria, which devastated the island, causing about $100 billion (£72bn) in damage.

-

Utopia and healthcare (part 2)

The dystopia of the American healthcare system certainly invites a utopian response—a ruthless criticism as well as a vision of an alternative.

-

The political economy of space and time in Eduardo Galeano

Uruguyan novelist and historian Eduardo Galeano (1940–2015) wrote more than 40 books. Monthly Review lauded his creative non-fiction Open Veins of Latin America: Five Centuries of the Pillage of a Continent (1973[1971]) as ‘outstanding political economy … and perhaps the finest description of primitive capital accumulation since Marx’.

-

Are intersectionalism or Afro-Pessimism paths to power? (Part 3 of 3)

In parts one and two of this series I’ve talked about the fact that there are two conflicting versions of intersectionality, one employed by some honest to god leftists who reach backward across decades to ventriloquize the term into the mouths of the Cohambee comrades, of Audre Lord, even of Claudia Jones and Sojourner Truth, and how this exists alongside another, hegemonic version of intersectionality deployed by the corporate funded lawyers, media and the nonprofit sector which invented the term in the first place for reasons Cohambee or Claudia Jones would never touch.

-

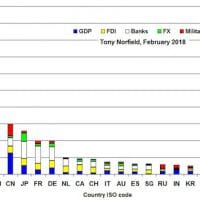

Index of power

he overall picture shows a small number of countries, led by the U.S., towering over the rest. Only 33 countries out of 180 have an index that is more than 1% of the U.S. index number! In the chart, the columns for these would look like the x-axis, so I have shown just the top 20 countries. Of those, only five are close to or above 20% of the U.S. number: the UK, China, Japan, France and Germany.

-

Value, credit and crisis: Reading Marx out of context can lead to confusion

A literalist, out-of-context reading of Marx can get one into trouble, or at the very least, leave you hopelessly confused. For help, I look to David Harvey. Perhaps the preeminent expert on Marx’s Capital in the English-speaking world, Harvey meticulously reconstructed Marx’s approach to money in his major treatise, Limits to Capital (1982).

-

Warren Buffett & imperial economics

Warren Buffett is one of the wealthiest people in the world. He is also Chairman of the Board, President and Chief Executive Officer of Berkshire Hathaway, a huge U.S. investment conglomerate. Looking at Berkshire’s investment policy reveals some important features of the economics of imperialism today and the role of money capitalists.

-

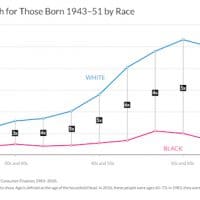

Too many whites are in denial about the extent of race-based economic inequality

A recently published paper by three Yale scholars reveals “that Americans, on average, systematically overestimate the extent to which society has progressed toward racial economic equality, driven largely by overestimates of current racial equality.”

-

Can we avoid another financial crisis?

After the Global Financial Crisis, Steve Keen achieved worldwide acclaim with his book Debunking Economics (2011). It attacked the core tenets of neoclassical economics and some of its heterodox rivals. It also revealed Hyman Minsky’s post-Keynesianism as the most promising route to a scientific revolution in economics.